The complex interplay between global economic development and energy consumption continues to drive sustained petroleum demand growth, with current projections indicating 5-10 years of oil demand growth across emerging economies despite accelerating electrification initiatives. Understanding these fundamental economic drivers becomes essential for investors navigating the intricate intersection of energy transition policies and persistent fossil fuel requirements across multiple sectors.

Recent analytical frameworks suggest that oil markets face a distinctive phase where traditional demand destruction narratives meet resilient consumption growth, particularly in emerging economies where infrastructure development and middle-class expansion drive energy-intensive activities. This dynamic creates investment opportunities and risks that differ markedly from previous energy transition models, particularly when considering how US economy tariffs might influence global trade patterns.

What Economic Fundamentals Drive Oil Demand Growth Through 2035?

Emerging Market Consumption Patterns and GDP Correlation

Global oil consumption patterns reveal significant regional divergence, with current demand baseline reaching 105 million barrels per day through November 2025, marking a year-over-year increase of 460,000 barrels per day according to J.P. Morgan Commodities Research. This growth trajectory supports projections for sustained expansion from current levels to approximately 108 million barrels per day by 2032.

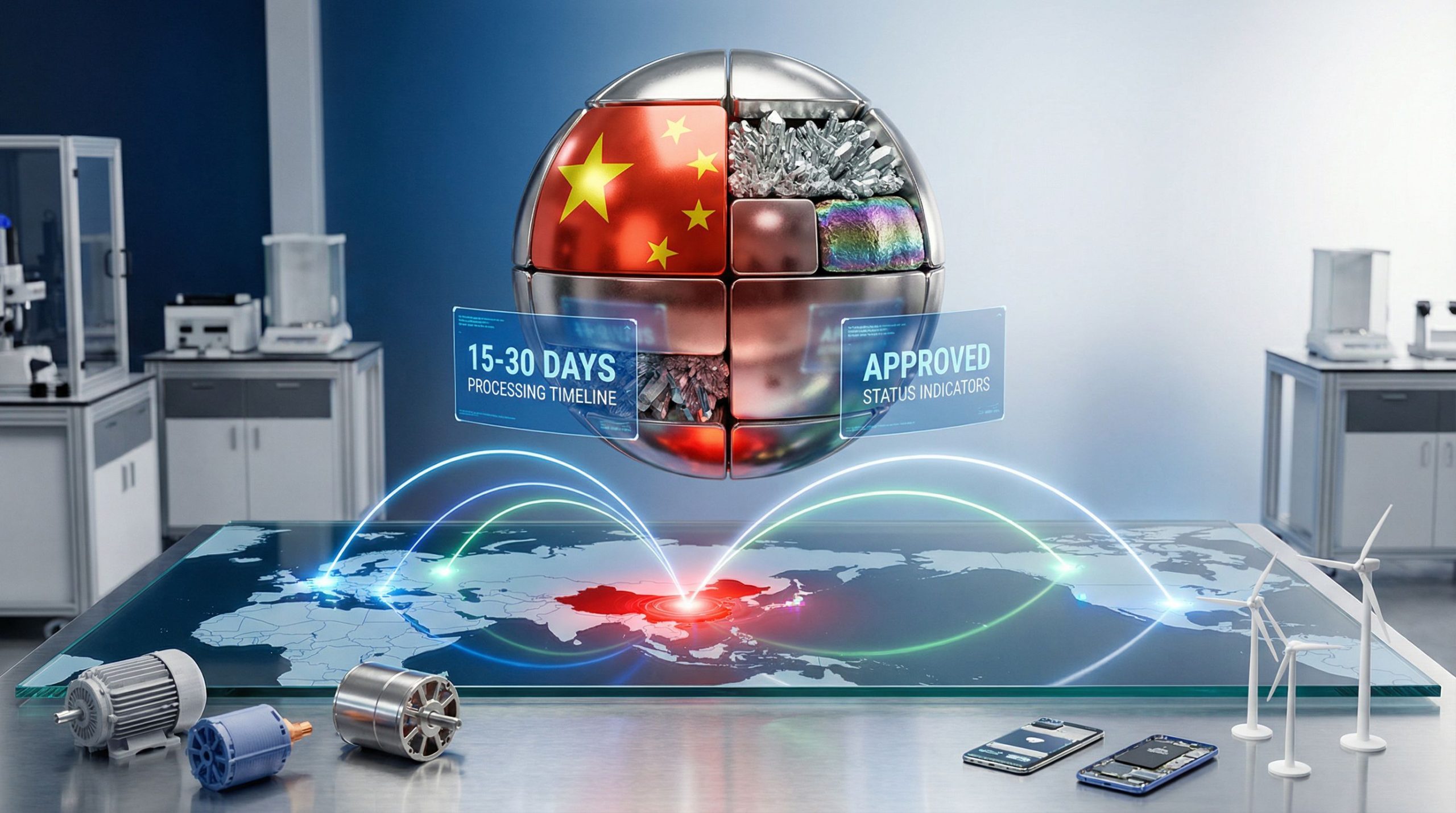

Chinese transportation indicators demonstrate the complexity of emerging market demand dynamics. Cargo volumes increased 4% year-over-year through November 2025, while trucking and cargo loading strengthened after brief October slowdowns. These metrics illustrate how developing economies maintain robust fossil fuel consumption even amid policy pressures toward electrification.

The relationship between economic development and energy consumption varies significantly across regions. While mature economies show declining oil intensity per unit of GDP growth, emerging markets continue exhibiting positive correlation between economic expansion and petroleum product consumption, particularly in industrial and transportation sectors.

Key demand growth indicators through November 2025:

• Global oil demand: 105 million barrels per day (460,000 bpd year-over-year increase)

• Chinese cargo volumes: +4% year-over-year growth

• Year-to-date demand growth: 0.85 million barrels per day

• Projected growth target: 0.9 million barrels per day annually

Source: J.P. Morgan Commodities Research, November 14, 2025

Industrial Sector Dependencies Beyond Transportation

Manufacturing and industrial processes represent demand segments with limited substitution alternatives compared to passenger transportation. Recent port activity increases at Los Angeles and strengthening cargo operations demonstrate sustained industrial fuel requirements that resist electrification pressures.

Aviation sector resilience emerges as a critical factor, with global flights posting 4% year-over-year increases through November 2025 despite regional variations including U.S. flight activity reductions. This pattern suggests that certain transportation modes maintain structural dependence on liquid fuels regardless of broader electrification trends.

Petrochemical feedstock requirements create additional demand stability, as these applications face technological barriers to electrification that differ substantially from passenger vehicle or residential heating applications. Industrial processes requiring high-temperature combustion or specialised chemical inputs continue relying on petroleum-based solutions.

The sectoral analysis reveals differentiated vulnerability to demand destruction. While passenger vehicle electrification accelerates in developed markets, heavy industry, aviation, marine transportation, and chemical manufacturing maintain structural petroleum dependencies that support medium-term demand growth projections.

How Will Supply-Demand Imbalances Shape Oil Price Cycles?

Production Capacity Versus Consumption Growth Analysis

Price forecasting models combine demand projections with supply-side constraints to generate integrated market outlooks through 2050. Morningstar's updated midcycle price projection of $65 per barrel (inflation-adjusted) represents an upgrade from previous $60 forecasts, reflecting analyst expectations for tightening supply-demand dynamics during the 2025-2034 period.

Current Brent pricing at $63 per barrel in November 2025 aligns closely with projected decade-average pricing, suggesting market participants may already be pricing in expected supply constraints. This contrasts with the 2015-2024 average real Brent price of $76 per barrel, indicating analyst expectations for moderately lower real prices during the upcoming decade compared to the previous period.

The integration of demand forecasting with supply-side projections reveals potential price appreciation scenarios beyond 2035. However, oil price movements may experience significant volatility. Analysts project oil prices exceeding $100 per barrel in real terms by the 2040s, suggesting that supply constraints may dominate pricing dynamics as demand plateaus and begins declining.

Price trajectory analysis:

• Current Brent price (November 2025): $63 per barrel

• Projected midcycle price (2025-2034): $65 per barrel (real terms)

• Historical baseline (2015-2024): $76 per barrel average (real terms)

• Long-term projection (2040s): >$100 per barrel (real terms)

Source: Morningstar, "The Future of Oil to 2050" report, December 2025

Price Elasticity and Market Response Mechanisms

Market dynamics during the projected 5-10 years of oil demand growth create distinctive investment considerations compared to traditional commodity cycles. The combination of sustained demand growth through 2032 followed by plateau conditions generates pricing scenarios that differ from either pure growth or decline phases.

Investment cycle implications emerge from this extended growth timeline. Capital allocation decisions must account for both near-term expansion opportunities and longer-term transition risks, creating complex optimisation problems for energy sector participants who must also navigate tariff impact on investments.

Real versus nominal price analysis becomes critical during inflationary periods. The inflation-adjusted nature of Morningstar's $65 midcycle price projection suggests that nominal prices may reach significantly higher levels depending on broader monetary policy conditions and currency dynamics.

"The projected price surge to over $100 per barrel (real terms) by the 2040s indicates analyst expectations for significant supply-demand imbalances during the demand plateau and early decline phase, suggesting investment opportunities in production capacity may emerge during the current growth period."

Which Economic Sectors Will Sustain Long-Term Oil Demand?

Transportation Electrification Timeline and Impact Assessment

Sectoral demand analysis reveals asymmetric exposure to electrification across different transportation modes. Furthermore, according to Wood Mackenzie's analysis, peak oil demand forecasts have been pushed back to 2032, reflecting the methodology employing a bottom-up forecast splitting oil demand into 10 distinct sectors, with each sector facing unique drivers and differential vulnerability to electrification substitution.

Aviation demonstrates particular resilience to demand destruction. Global flight activity increased 4% year-over-year through November 2025, indicating sustained jet fuel requirements despite broader transportation electrification trends. The technical challenges of battery-powered aviation for long-distance commercial flights create structural demand support for liquid fuels in this sector.

Heavy freight and cargo transportation exhibit similar characteristics. Chinese cargo loading strengthened in November 2025 with volumes rising 4% year-over-year, while increased port activity at Los Angeles suggests robust freight fuel demand. The energy density requirements for long-haul trucking and marine transportation create technical barriers to electrification that support continued petroleum product consumption.

U.S. gasoline consumption patterns provide insight into passenger vehicle demand evolution. Recent rebounds in gasoline consumption during November 2025 suggest that even in mature markets with accelerating EV adoption, conventional fuel demand maintains resilience through fleet turnover periods and regional adoption variations.

Industrial Process Dependencies and Substitution Challenges

Manufacturing processes requiring high-temperature combustion, chemical feedstocks, or specialised material inputs face limited substitution alternatives compared to transportation applications. These industrial dependencies create demand segments that resist electrification pressures and support medium-term consumption growth.

Petrochemical manufacturing represents a critical demand segment where petroleum products serve as feedstock rather than fuel, creating different economics around substitution compared to combustion applications. The chemical properties of petroleum-derived compounds make substitution technically challenging and economically disadvantageous in many applications.

Steel production, cement manufacturing, and other energy-intensive industrial processes continue exhibiting petroleum product dependencies that extend beyond simple electrification solutions. These sectors require integrated approaches combining process modification, alternative fuel development, and efficiency improvements rather than direct electric substitution.

Sectoral demand resilience factors:

• Aviation: Technical limitations of battery technology for long-distance flights

• Heavy freight: Energy density requirements for long-haul transportation

• Marine transportation: Limited infrastructure for alternative fuel systems

• Petrochemicals: Feedstock applications beyond combustion use cases

• Industrial processes: High-temperature and specialised material requirements

What Regional Variations Will Define Global Demand Patterns?

Developing Economy Consumption Drivers

Regional demand patterns demonstrate significant heterogeneity in consumption growth trajectories and substitution timelines. Chinese market indicators through November 2025 show strengthening cargo operations and trucking activity, suggesting that infrastructure development and industrial expansion continue driving petroleum product consumption despite national electrification policies.

Urbanisation processes in developing economies create sustained demand pressures through vehicle ownership expansion, industrial development, and infrastructure construction activities. These demographic and economic transitions operate on multi-decade timelines that support continued fossil fuel consumption growth even amid accelerating renewable energy deployment.

Government policy frameworks in emerging markets often prioritise economic development objectives alongside environmental goals, creating regulatory environments that support continued petroleum product consumption during transition periods. This policy balance generates different demand trajectories compared to mature economies with primarily environmental policy focus.

Infrastructure development requirements in developing regions necessitate energy-intensive construction and transportation activities that rely heavily on petroleum products. Road construction, building development, and industrial facility expansion create sustained demand for diesel fuel, asphalt, and other petroleum derivatives.

Advanced Economy Demand Stabilisation Factors

Mature market consumption patterns exhibit different characteristics, with efficiency improvements and regulatory standards creating downward pressure on petroleum product demand per capita. However, recent U.S. gasoline consumption rebounds in November 2025 demonstrate that even in developed markets, demand destruction proceeds more gradually than policy targets suggest.

Modal shift trends in urban transportation create mixed demand impacts. While passenger vehicle electrification accelerates in major metropolitan areas, freight transportation, aviation connectivity, and industrial activities maintain petroleum product dependencies that support overall consumption levels.

Demographic changes in advanced economies generate complex demand implications. Aging populations may reduce personal transportation fuel consumption, while continued economic activity in freight, aviation, and industrial sectors maintains structural demand support.

Energy efficiency improvements in mature economies create declining oil intensity per unit of economic output, but absolute demand levels remain supported by continued economic growth and limited substitution alternatives in certain sectors.

How Do Macroeconomic Cycles Influence Oil Demand Forecasting?

Business Cycle Sensitivity Analysis

Oil demand growth projections through 2032 must account for macroeconomic volatility and cyclical variations that can significantly impact consumption patterns. The current trajectory showing 460,000 barrels per day year-over-year growth through November 2025 demonstrates the cyclical sensitivity of demand growth rates.

Recent demand performance indicates resilience during economic uncertainty periods. Year-to-date demand growth of 0.85 million barrels per day through November 2025, while slightly below the projected 0.9 million barrels per day target, suggests that consumption growth maintains momentum despite macroeconomic headwinds.

Economic cycle positioning becomes critical for understanding the projected 5-10 years of oil demand growth timeline. Current growth rates must be sustained through multiple business cycle phases to achieve the projected peak of 108 million barrels per day by 2032 from current levels around 105 million barrels per day.

The relationship between economic growth and oil consumption varies across development stages and economic structures. Emerging economies typically exhibit higher correlation between GDP growth and petroleum product consumption, while mature economies show declining correlation due to efficiency improvements and structural economic changes.

Monetary Policy and Energy Investment Flows

Interest rate environments significantly influence energy sector capital allocation decisions and long-term capacity development. The projected price appreciation to over $100 per barrel (real terms) by the 2040s suggests that current investment decisions during lower-price periods will determine future supply adequacy.

Currency fluctuations create additional complexity in regional demand pattern analysis. Dollar-denominated oil prices interact with local currency valuations to determine effective petroleum product costs in individual markets, influencing consumption decisions and substitution economics.

Inflation expectations affect both demand growth sustainability and price trajectory analysis. Morningstar's use of inflation-adjusted price forecasting ($65 per barrel real terms for 2025-2034) acknowledges that nominal price levels will vary significantly based on broader monetary policy conditions.

Central bank policies influence energy transition investment flows through green finance initiatives, carbon pricing mechanisms, and renewable energy subsidies. These policy tools create alternative investment opportunities that compete with petroleum sector capital allocation, whilst oil price stagnation could emerge if geopolitical tensions escalate.

What Are the Investment Implications of Extended Demand Growth?

Capital Allocation Strategies for Energy Companies

The projected 5-10 years of oil demand growth creates distinctive investment opportunities compared to traditional energy transition scenarios. Companies must balance near-term expansion opportunities against longer-term substitution risks while navigating regulatory pressures and ESG requirements.

Upstream investment decisions become particularly complex during extended growth phases. The combination of current demand growth (460,000 barrels per day year-over-year) and projected peak timing (2032) suggests approximately seven years of expansion opportunities before plateau conditions emerge.

Downstream capacity optimisation gains importance during demand growth periods with eventual plateau expectations. Refiners and distribution networks must position for both near-term throughput increases and longer-term capacity rationalisation as demand patterns evolve.

Technology investment priorities shift during extended growth phases. Companies can justify efficiency improvements, emissions reduction technologies, and operational optimisation investments over longer payback periods given sustained demand expectations through 2032.

Market Valuation Models for Extended Growth Scenarios

Discounted cash flow models require adjustment for extended growth timelines followed by plateau and decline phases. Traditional commodity investment analysis must incorporate multiple phases with different growth, profitability, and risk characteristics over the forecast period through 2050.

Risk premium calculations become more complex during transition periods. The projected price appreciation from current $63 Brent levels to over $100 per barrel (real terms) by the 2040s suggests significant uncertainty around supply-demand balance evolution and geopolitical stability factors.

Comparative analysis with renewable energy investment returns creates portfolio optimisation challenges. Energy companies must evaluate petroleum sector investments against alternative energy opportunities while considering different risk profiles, growth trajectories, and policy support mechanisms.

The integration of ESG considerations with financial performance metrics requires sophisticated analysis during extended growth periods. Companies must demonstrate environmental responsibility while capitalising on demand growth opportunities, creating potential conflicts between short-term profitability and long-term sustainability objectives.

Investment timeline considerations:

• Near-term (2025-2030): Capitalise on sustained demand growth and capacity expansion opportunities

• Mid-term (2030-2035): Position for plateau conditions and market share consolidation

• Long-term (2035-2050): Manage decline phase and transition to alternative business models

How Will Economic Policy Shape Oil Market Evolution?

Fiscal Policy Impacts on Energy Consumption

Carbon pricing mechanisms create direct cost pressures on petroleum product consumption while generating revenue streams for alternative energy development. The effectiveness of these policies in reducing demand growth depends on price levels, coverage scope, and regional implementation coordination.

Subsidy removal timelines in major consuming countries significantly influence demand trajectory projections. Government fuel subsidies in developing economies support consumption growth, while subsidy elimination creates price elasticity effects that can moderate demand expansion rates.

Infrastructure spending priorities determine petroleum product consumption through construction activity levels and transportation system development. Government investment in conventional transportation infrastructure supports continued fuel demand, while renewable energy and electric vehicle infrastructure investment creates substitution pressures.

Tax policy influences transportation and industrial demand through vehicle purchase incentives, fuel taxation levels, and industrial energy cost structures. The coordination of fiscal policies across jurisdictions affects global consumption patterns and investment location decisions.

Trade Policy and Global Supply Chain Considerations

Regional trade agreements impact oil flow patterns and pricing mechanisms through tariff structures, transportation cost factors, and supply chain optimisation decisions. In particular, the US-China trade war demonstrates how trade policy changes can create regional price differentials that influence consumption and investment patterns.

Supply chain resilience policies following recent global disruptions emphasise energy security considerations that may support domestic petroleum production and consumption over international dependency. These policies create demand support factors that compete with environmental policy objectives.

Strategic reserve policies and market intervention capabilities provide government tools for managing price volatility and supply disruption risks. The effectiveness of these interventions influences market stability and investment decision-making processes.

International cooperation frameworks for energy stability create multilateral approaches to managing transition risks while maintaining economic stability. These frameworks balance environmental objectives with economic development needs across different regional priorities.

What Economic Scenarios Could Accelerate or Delay Peak Demand?

Accelerated Transition Scenario Analysis

Technology cost reduction curves and adoption rates create potential scenarios for faster-than-expected demand destruction in key sectors. Battery technology improvements, electric vehicle cost parity, and renewable energy deployment rates could accelerate substitution timelines beyond current projections.

Policy intervention effectiveness varies significantly across regions and sectors. Coordinated international climate policies, carbon border adjustments, and technology transfer mechanisms could create accelerated transition scenarios that bring peak demand forward from the projected 2032 timeline.

Economic incentive structures favouring alternatives include subsidies, tax preferences, and regulatory advantages for non-petroleum solutions. The scale and persistence of these incentives determine substitution rates and overall demand growth sustainability.

Market-driven efficiency improvements and substitution occur independently of policy interventions through competitive pressures, technological innovation, and consumer preference evolution. These organic transition forces may proceed faster than policy-driven changes in certain sectors.

Extended Growth Scenario Implications

Delayed electrification due to economic constraints could extend the demand growth period beyond the projected 2032 peak. Infrastructure limitations, technology costs, and financing constraints in developing economies may slow substitution rates and support continued petroleum product consumption growth.

Emerging market development pace exceeding forecasts would increase petroleum product consumption through accelerated industrialisation, urbanisation, and middle-class expansion. Economic growth rates above current projections could push peak demand timing and levels beyond current analytical frameworks.

Technology deployment challenges extending transition timelines include battery supply chain constraints, electric vehicle infrastructure limitations, and industrial process substitution complexity. Technical barriers to electrification may prove more persistent than current projections suggest.

Geopolitical factors supporting conventional energy demand include energy security considerations, resource nationalism, and international conflict impacts on energy transition investment priorities. Political instability could delay transition initiatives and extend petroleum product dependence periods.

"Scenario Planning Consideration: The projected 5-10 years of oil demand growth provides a baseline expectation, but investors should prepare for scenarios ranging from accelerated peak demand by 2028-2030 to extended growth through 2035-2037 depending on policy effectiveness, technology deployment rates, and macroeconomic conditions."

Positioning for a Decade of Measured Oil Demand Growth

Strategic Outlook for Energy Market Participants

The analytical consensus supporting 5-10 years of oil demand growth creates investment opportunities requiring sophisticated risk management approaches. Market participants must navigate the complexity of sustained near-term growth followed by plateau and decline phases while managing regulatory pressures and transition risks.

Portfolio optimisation strategies must balance conventional energy investments with alternative energy opportunities across multiple time horizons. The projected demand trajectory from 104 million barrels per day in 2024 to 108 million barrels per day by 2032, followed by decline to 96 million barrels per day by 2050, requires dynamic investment allocation approaches.

Risk management frameworks need adjustment for transition-period uncertainties. The price projection showing current $63 Brent levels evolving to $65 per barrel (real terms) through 2034, then exceeding $100 per barrel by the 2040s, indicates significant volatility potential requiring sophisticated hedging strategies.

ESG integration becomes critical during extended growth periods as companies must demonstrate environmental responsibility while capitalising on demand growth opportunities. This integration requires authentic sustainability initiatives rather than superficial compliance approaches.

Economic Indicators to Monitor

Leading indicators for demand trajectory changes include regional economic development metrics, technology adoption rates, and policy implementation effectiveness measures. Current indicators such as Chinese cargo volume growth (+4% year-over-year) and global flight activity expansion (+4% year-over-year) provide early signals of demand evolution.

Monthly demand tracking through sources like J.P. Morgan's 105 million barrels per day baseline helps identify deviation from projected growth trajectories. Year-over-year changes of 460,000 barrels per day provide trend analysis for investment timing decisions.

Technology deployment rate benchmarks, particularly in electric vehicle adoption and renewable energy capacity additions, influence substitution timeline projections. These metrics help investors anticipate acceleration or delay in peak demand timing beyond the projected 2032 baseline.

Policy implementation effectiveness across major consuming regions determines actual demand destruction rates compared to policy targets. The gap between policy announcements and implementation results significantly impacts investment strategy optimisation.

Key monitoring metrics:

• Monthly global demand levels (J.P. Morgan baseline: 105 Mmbpd)

• Regional consumption indicators (cargo volumes, flight activity, gasoline consumption)

• Technology adoption rates (EV sales, renewable capacity additions)

• Policy implementation progress (carbon pricing, subsidy elimination, infrastructure investment)

• Price trend confirmation (actual vs. projected $65 midcycle pricing)

The convergence of sustained demand growth expectations with eventual transition pressures creates a unique investment environment requiring careful timing and risk management. Success in this environment depends on accurately interpreting economic indicators while maintaining flexibility for scenario variations beyond baseline projections.

Disclaimer: The analysis presented reflects current market projections and expert opinions but involves inherent uncertainties regarding future economic conditions, technology development rates, and policy implementation effectiveness. Investment decisions should consider multiple scenarios and risk management strategies appropriate for individual circumstances and risk tolerance levels.

Ready to Navigate the Complex Energy Transition Investment Landscape?

Discovery Alert's proprietary Discovery IQ model identifies significant ASX mineral discoveries instantly, providing crucial insights into commodities that underpin both traditional energy infrastructure and renewable energy transitions. Begin your 30-day free trial today to discover actionable investment opportunities across the evolving energy sector.