Current Market Position and Strategic Advantages

Pilbara Minerals has emerged as a standout performer in the Australian lithium sector, with shares climbing dramatically from multi-year lows of A$1.14 in June 2024 to A$3.43 as of November 2025. This 200% surge represents one of the most significant recoveries among ASX 200 lithium producers, transforming what appeared to be a struggling mining operation into a compelling investment proposition.

The company's inclusion in the S&P/ASX 200 Index provides institutional credibility and ensures consistent fund flows from index-tracking investments. While the 9.5% gain over 12 months may appear modest compared to the dramatic recovery from June lows, this performance occurred during a challenging period for lithium markets globally.

Balance Sheet Fortress in Volatile Markets

Perhaps the most compelling aspect of Pilbara Minerals' investment case lies in its exceptional financial position. With over A$1 billion in cash reserves, the company maintains one of the strongest balance sheets in the Australian lithium sector. This cash position provides several strategic advantages:

- Operational flexibility during market downturns

- Capacity for strategic acquisitions or expansion projects

- Ability to maintain production regardless of short-term price volatility

- No immediate financing concerns for planned developments

This financial strength becomes particularly valuable in the cyclical lithium industry, where companies with weaker balance sheets often struggle to maintain operations during price downturns. The substantial cash reserves position Pilbara to capitalise on growth opportunities while competitors may be forced to curtail operations or seek external financing.

Operational Excellence Drives Financial Recovery

Q1 FY2026 Results Demonstrate Turnaround

The company's latest quarterly performance validates the investment thesis supporting its share price recovery. Revenue surged 30% to A$251 million in Q1 FY2026, driven by both increased production volumes and improved pricing realisation.

| Performance Metric | Q4 FY2025 | Q1 FY2026 | Quarterly Change |

|---|---|---|---|

| Revenue | A$193 million | A$251 million | +30% |

| Spodumene Production | 127,000 tonnes | 224,800 tonnes | +77% |

| Average Realised Price | Baseline | +20% | Improvement |

| Mining Costs | Baseline | -13% | Reduction |

The 224,800 tonnes of spodumene production in Q1 FY2026 represents not just a 2% quarter-on-quarter increase, but a dramatic 77% improvement from the previous quarter's 127,000 tonnes. This production surge demonstrates the company's ability to rapidly scale operations when market conditions improve.

Cost Control Mastery

Investment analysts have particularly highlighted Pilbara's exceptional cost control during this operational expansion. Mining costs fell 13% while production volumes increased substantially, creating significant operational leverage. This achievement indicates:

- Improved economies of scale across processing facilities

- Enhanced operational efficiency through better resource utilisation

- Successful cost management during production ramp-up phases

- Competitive positioning for sustained profitability

The combination of 20% higher average realised prices and 13% lower mining costs created what analysts describe as a major boost in operating profit margins, demonstrating management's ability to optimise both revenue and cost structures simultaneously.

Understanding the Investment Risks

Lithium Price Volatility Impact

Despite recent recovery, lithium markets remain inherently cyclical and volatile. The 38% price recovery from late June 2025 lows, while encouraging, must be viewed within the context of the commodity's dramatic price swings over recent years.

Historical analysis reveals that spodumene prices can fluctuate dramatically based on:

- Electric vehicle adoption rates in major markets

- Battery technology developments affecting lithium intensity

- Global supply additions from new mining projects

- Inventory management across the supply chain

- Macroeconomic conditions influencing industrial demand

Furthermore, the company's financial performance remains closely correlated with these price movements, despite operational improvements. Investors must acknowledge that even the strongest operational performance cannot fully insulate returns from commodity price volatility, particularly when considering the global lithium outlook.

Market Cyclicality Concerns

Recent financial history demonstrates the sector's cyclical nature. The company experienced a 39% revenue decline in FY2025 and recorded net losses of approximately A$196 million during challenging market conditions. While current performance shows dramatic improvement, investors should consider whether this recovery represents sustainable growth or cyclical rebound.

Important Consideration: The lithium industry's boom-bust cycles can create significant volatility in earnings and cash flows, regardless of individual company operational performance.

Competitive Landscape Evolution

The global lithium supply landscape continues evolving rapidly, with new hard rock and brine projects advancing toward production. Western Australia's geographic advantages for Asian markets provide some competitive protection, but emerging supply sources may pressure long-term pricing power.

Key competitive factors include:

- Production cost advantages relative to global peers

- Processing capability and value-add opportunities

- Logistics infrastructure and proximity to end markets

- Resource quality and mine life considerations

Global Market Dynamics and Future Demand

Electric Vehicle Market Momentum

The electric vehicle revolution continues driving fundamental lithium demand growth. While adoption rates vary across regions, the long-term trajectory remains strongly positive. Key markets including China, Europe, and North America continue implementing supportive policies and infrastructure development that should sustain demand growth through 2027 and beyond.

Industry forecasts suggest accelerating EV penetration rates, particularly in the medium-duty and heavy-duty vehicle segments where lithium-ion batteries are increasingly viable. This broadening application base provides demand diversification beyond passenger vehicles.

Energy Storage Market Expansion

Perhaps the most significant development for lithium demand involves the rapid expansion of large-scale battery storage systems. Grid-scale energy storage deployment has shown massive growth year-to-date, according to industry analysis, driven by:

- Renewable energy integration requirements

- Grid stabilisation and frequency regulation needs

- Peak shaving and load management applications

- Industrial backup power and reliability systems

This energy storage market represents a substantial new demand source that complements traditional EV applications, potentially providing more stable industrial demand patterns compared to consumer-driven vehicle sales. However, the success of these initiatives often relies on comprehensive battery metals strategy across the supply chain.

Supply Chain Positioning Advantages

Pilbara's operations benefit from Western Australia's strategic location for Asian processing hubs. The region's established mining infrastructure, skilled workforce, and regulatory framework provide operational advantages that many emerging lithium jurisdictions cannot match.

Processing capabilities and potential value-add opportunities through downstream integration could further enhance margins and customer relationships. The company's proximity to major lithium processing facilities in China provides logistical efficiency that reduces transportation costs and delivery times.

Expert Analysis and Market Forecasts

Analyst Recommendations and Price Targets

Investment professionals have taken note of Pilbara's operational turnaround while remaining cautious about valuation following the dramatic share price recovery. Baker Young analyst Toby Grimm describes the company as their preferred lithium exposure within the sector, citing several factors:

- Exceptional cost control demonstrated in recent quarters

- Strong balance sheet providing growth financing capability

- Operational scale competitive with global producers

- Management execution during challenging market conditions

However, despite these operational positives, Baker Young maintains a hold recommendation following the significant share price appreciation. This suggests analysts believe much of the operational improvement has been reflected in current valuations.

JPMorgan's Lithium Price Forecasts

Global investment bank JPMorgan Chase has significantly upgraded its lithium price forecasts, projecting spodumene prices of US$1,100-US$1,200 per tonne for 2026-2027. This represents a substantial increase from their prior forecast of US$800 per tonne.

Lyndon Fagan, JPMorgan's Head of Basic Materials Research, notes that after what appeared to be challenging years ahead for lithium pricing, energy storage battery shipments have provided unexpected demand support. This represents a material shift in market dynamics, with storage systems emerging as a significant driver alongside traditional electric vehicle demand.

Market Insight: Energy storage demand has transformed from a speculative future market into a current reality driving immediate lithium consumption growth.

The upgraded price forecasts reflect growing confidence in demand sustainability, particularly from the rapidly expanding energy storage sector where deployment rates have exceeded many industry expectations. This development aligns with broader Australia lithium innovations that are reshaping the global market.

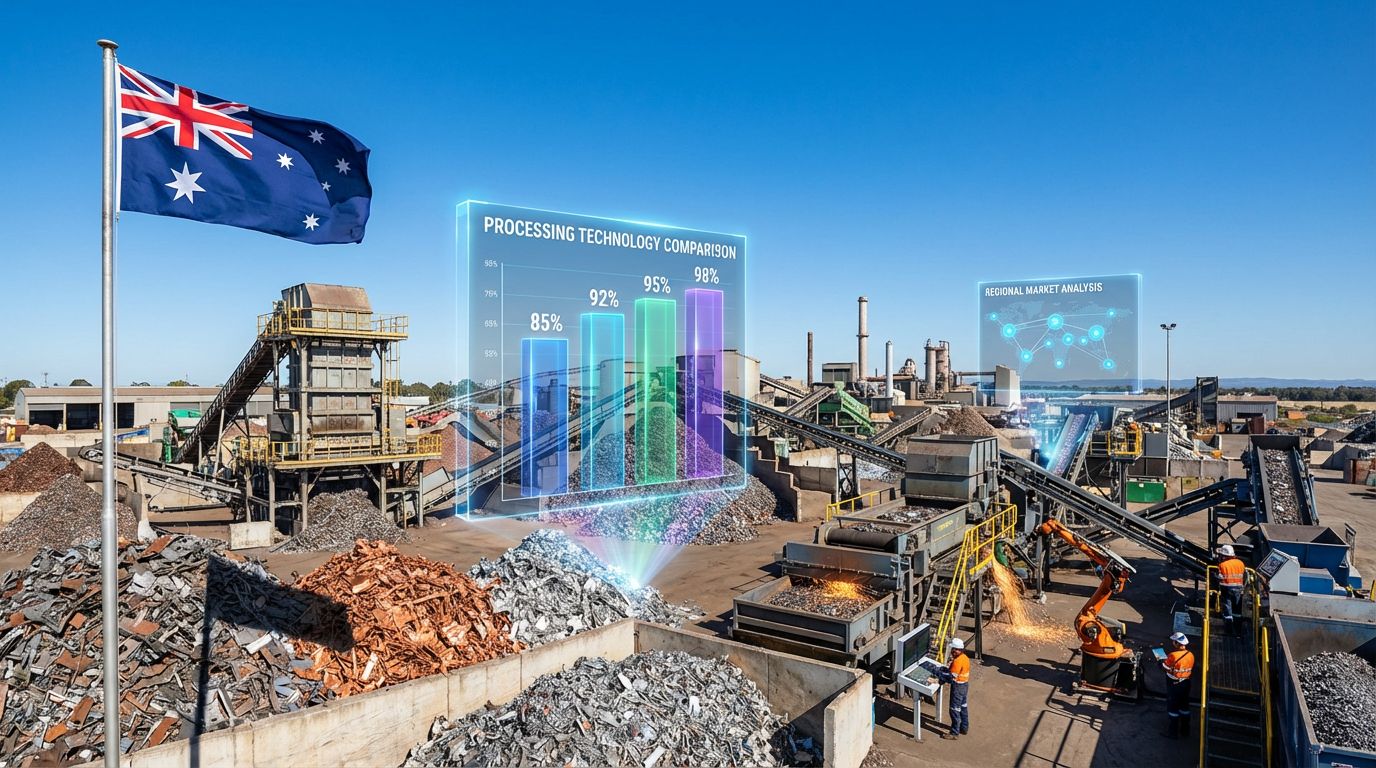

Competitive Benchmarking Analysis

Production Scale and Efficiency

Pilbara's current production run rate of approximately 900,000 tonnes per annum (based on Q1 FY2026 quarterly production annualised) positions the company among the larger lithium producers globally. This scale provides operational advantages including:

- Economies of scale in processing and logistics

- Negotiating power with customers and suppliers

- Operational flexibility to adjust production based on market conditions

- Cost absorption capability during challenging periods

Financial Stability Comparison

The company's A$1+ billion cash position provides significant financial advantages compared to many lithium sector peers. This financial strength enables:

- Sustained operations during price downturns

- Strategic investments in operational improvements

- Market share gains when competitors reduce production

- Acquisition opportunities during industry consolidation

While specific competitor financial metrics require individual analysis of ASX filings, Pilbara's balance sheet strength appears exceptional within the Australian lithium sector context. This financial positioning becomes particularly important as the industry considers new developments such as the underground lithium project initiatives.

Operational Cost Competitiveness

The 13% reduction in mining costs while expanding production demonstrates Pilbara's competitive cost structure. This operational efficiency becomes particularly important during periods of lower lithium prices when higher-cost producers may struggle to maintain profitable operations.

Cost competitiveness factors include:

- Resource grade and processing efficiency

- Infrastructure access and logistics costs

- Labour productivity and operational scale

- Energy costs and processing technology

Investment Scenario Analysis

Bull Case: Accelerated Demand Growth

The optimistic investment scenario assumes continued acceleration in both electric vehicle adoption and energy storage deployment. JPMorgan's upgraded price forecasts of US$1,100-US$1,200 per tonne for 2026-2027 provide the foundation for this scenario.

Key bull case drivers include:

- Faster EV adoption exceeding current forecasts

- Energy storage market expansion beyond anticipated levels

- Supply constraints from delayed competing projects

- Technology developments increasing lithium battery applications

Under this scenario, Pilbara's operational leverage from improved cost structure and production flexibility could generate substantial returns for shareholders. Furthermore, developments like the Thacker Pass lithium mine may face delays, providing additional market opportunities.

Base Case: Steady Market Recovery

The moderate scenario assumes lithium demand growth aligns with current industry forecasts, with steady but not spectacular market recovery. This case reflects:

- Gradual EV market penetration following established trajectories

- Energy storage growth meeting industry projections

- Balanced supply-demand dynamics preventing extreme price movements

- Operational improvements maintaining competitive positioning

This scenario supports current analyst price targets and suggests reasonable returns for investors with appropriate risk tolerance.

Bear Case: Market Oversupply Concerns

The pessimistic scenario considers potential demand disappointment or supply oversaturation. Risk factors include:

- Slower EV adoption due to infrastructure or economic constraints

- New lithium projects adding significant supply capacity

- Technology alternatives reducing lithium intensity requirements

- Economic downturn affecting industrial demand

Even under challenging scenarios, Pilbara's strong balance sheet and operational improvements provide downside protection compared to financially weaker competitors.

Investor Suitability Assessment

Risk Tolerance Requirements

Should you buy Pilbara Minerals shares? The answer depends significantly on individual risk tolerance and investment objectives. The stock requires investors comfortable with:

- High volatility characteristic of commodity-exposed stocks

- Cyclical earnings patterns dependent on lithium prices

- Long-term investment horizons to ride through market cycles

- Sector concentration risk from lithium market exposure

Consequently, investors must carefully evaluate their capacity to withstand significant price fluctuations while maintaining their investment thesis.

Portfolio Diversification Considerations

Pilbara Minerals should be considered within the context of overall portfolio diversification. The stock provides:

- Commodity exposure for inflation protection

- Growth sector participation in the energy transition

- Australian market exposure with global demand linkage

- Resource sector diversification beyond traditional mining

Appropriate position sizing depends on existing portfolio composition and individual risk capacity.

Investment Timeline Factors

The investment timeline significantly affects suitability assessment:

- Short-term traders may benefit from continued price volatility

- Medium-term investors (2-5 years) could capture operational leverage benefits

- Long-term investors (5+ years) may benefit from structural demand growth

- Dollar-cost averaging strategies could reduce timing risk

Key Decision Factors for Late 2025 and 2026

Upcoming Catalysts and Milestones

Several factors will influence Pilbara's investment attractiveness over the coming quarters:

Quarterly Results Monitoring:

- Q2 FY2026 results (February 2026) will indicate sustainability of current performance

- Production guidance updates and capacity expansion announcements

- Cost structure evolution as production scales

Market Development Factors:

- Lithium price trajectory and volatility patterns

- Global EV sales data and adoption rate trends

- Energy storage deployment statistics and project announcements

Macroeconomic Considerations

Broader economic factors significantly impact commodity investments:

- Interest rate environment affects growth stock valuations

- Currency fluctuations (AUD/USD) impact export pricing

- Global economic growth influences industrial demand

- Inflation expectations affect real returns

The current macroeconomic environment presents both opportunities and challenges for lithium investments, requiring careful monitoring of policy developments and economic indicators.

Company-Specific Milestones

Key developments to monitor include:

- Processing facility upgrades and efficiency improvements

- Partnership opportunities with battery manufacturers or automotive companies

- Expansion project approvals and development timelines

- Sustainability initiatives and ESG compliance progress

Investment Decision Framework

Due Diligence Requirements

Before making investment decisions, investors should conduct thorough analysis including:

Financial Analysis:

- Cash flow sustainability across different price scenarios

- Debt service capability and capital allocation priorities

- Return on invested capital and operational efficiency metrics

- Peer comparison of valuation multiples and operational performance

Operational Assessment:

- Resource base and reserve life considerations

- Production capacity and expansion potential

- Cost structure competitiveness and improvement trajectory

- Management track record and strategic execution

Strategic Entry and Exit Planning

Successful investing requires clear strategy definition:

Position Sizing:

- Risk-appropriate allocation based on portfolio size and objectives

- Gradual accumulation strategies to reduce timing risk

- Correlation analysis with existing holdings

Risk Management:

- Stop-loss levels for capital preservation

- Profit-taking targets and rebalancing triggers

- Monitoring framework for key performance indicators

Investment Disclaimer: Commodity investments carry inherent volatility and cyclical risks. Past performance does not guarantee future results. Investors should consider their individual circumstances and seek professional advice where appropriate.

The decision of whether to should you buy Pilbara Minerals shares ultimately depends on individual risk tolerance, investment timeline, and portfolio objectives. While the company demonstrates strong operational performance and financial position, lithium market volatility requires careful consideration and appropriate risk management strategies. Moreover, understanding the company's financial position and market outlook provides crucial context for investment decisions.

Current market conditions present both opportunities from recovering lithium prices and risks from potential oversupply or demand disappointment. Investors comfortable with commodity exposure and long-term investment horizons may find Pilbara's combination of operational excellence and balance sheet strength compelling, while those seeking stable income or low-volatility investments should consider alternative opportunities. For additional insights, Simply Wall St's analysis provides further perspective on the company's recent performance.

In addition, understanding whether should you buy Pilbara Minerals shares requires careful evaluation of both the company's operational improvements and the broader lithium market dynamics that will influence future performance.

Ready to Identify the Next Major Mineral Discovery?

Discovery Alert instantly alerts investors to significant ASX mineral discoveries using its proprietary Discovery IQ model, turning complex mineral data into actionable insights. Explore why historic discoveries can generate substantial returns by visiting Discovery Alert's dedicated discoveries page, showcasing exceptional market outcomes from companies like De Grey Mining and WA1 Resources.