Revolutionary Capital Architecture in European Critical Minerals

The global transition toward battery technology and renewable energy infrastructure has created unprecedented demand for sophisticated financing mechanisms that can support large-scale critical minerals development. Traditional mining project finance models, historically dependent on commodity price volatility and single-revenue streams, face structural limitations when attempting to capitalise projects exceeding €2 billion in scope. Furthermore, the emergence of integrated energy-minerals facilities represents a fundamental shift in how institutional capital approaches resource extraction, combining geothermal energy generation with lithium production to create diversified cash flow profiles that attract infrastructure-grade financing terms.

This evolution in project finance architecture reflects broader geopolitical imperatives surrounding supply chain independence, particularly within European Union member states seeking to reduce dependence on Chinese lithium processing and establish domestic battery manufacturing capabilities. Consequently, the convergence of sovereign strategic objectives with commercial project viability has enabled the development of multi-tier capital structures that distribute risk across governmental, multilateral, and private sector participants while maintaining bankable project economics.

Multi-Institutional Risk Distribution Framework

The Vulcan Energy lithium project financing represents a paradigm shift in critical minerals project capitalisation through its sophisticated risk layering across multiple institutional categories. The €2.2 billion financing package demonstrates how strategic mineral projects can access capital pools traditionally reserved for renewable energy and infrastructure development by restructuring operational risk profiles and revenue diversification.

Sovereign and Multilateral Capital Integration

The financing architecture incorporates substantial governmental backing through multiple channels:

• German federal grants: €204 million in direct government funding reducing project capital requirements

• KfW Raw Materials Fund equity investment: €150 million securing 14% ownership stake in Vulcan Energie Ressourcen

• European Investment Bank participation: Institutional lending at supranational development finance rates

• Export Credit Agency consortium: Five-nation ECA participation distributing political risk across allied economies

This governmental participation serves multiple strategic functions beyond traditional project finance. Moreover, sovereign capital provides patient investment horizons extending beyond typical commercial equity requirements, while multilateral development bank participation establishes institutional credibility that facilitates commercial bank syndication at favourable terms.

Commercial Syndicate Architecture

The €1.18 billion senior debt facility operates through a 13-institution syndicate comprising the European Investment Bank, five Export Credit Agencies, and seven commercial banking institutions. This structure distributes individual institutional exposure while creating shared covenant frameworks that reduce administrative complexity compared to bilateral lending arrangements.

Commercial bank participation benefits from the institutional precedent established by EIB involvement, allowing commercial lenders to apply infrastructure-grade terms rather than traditional mining venture finance spreads. In addition, the syndicated structure typically operates with individual commitments ranging from €50-200 million per institution, maintaining diversified exposure across European and international banking networks.

Integrated Energy-Minerals Production Economics

The Vulcan Energy lithium project financing fundamentally restructures traditional lithium extraction economics by integrating renewable energy generation as a co-primary revenue source. This creates multiple cash flow streams that reduce commodity price exposure while enhancing overall project resilience through direct lithium extraction technology innovation.

Dual Revenue Stream Optimisation

The Lionheart project creates three distinct revenue categories operating from shared infrastructure:

| Revenue Component | Annual Capacity | Strategic Function |

|---|---|---|

| Lithium Hydroxide Monohydrate | 24,000 tonnes | Primary commodity production |

| Renewable Power Generation | 275 GWh | Grid revenue and local industrial supply |

| Thermal Energy Output | 560 GWh | Industrial heat contracts and district heating |

| Combined Energy Production | 835 GWh | Integrated revenue diversification |

This integrated approach addresses fundamental weaknesses in traditional lithium extraction projects, which typically face concentrated commodity price risk and single-product market exposure. Furthermore, by structuring lithium production within an energy facility framework, the project captures waste heat monetisation opportunities while providing renewable energy services to local industrial consumers and grid operators.

Technology Integration Through VULSORB Direct Lithium Extraction

The project utilises proprietary VULSORB Adsorption-type Direct Lithium Extraction technology, which enables simultaneous geothermal energy extraction and lithium brine processing from Upper Rhine Valley geothermal reservoirs. This technological integration provides several economic advantages:

• Shared infrastructure costs: Geothermal wells and surface facilities serve both energy and lithium extraction functions

• Thermal efficiency optimisation: Heat extraction supports both power generation and lithium processing requirements

• Reduced processing costs: Direct extraction eliminates traditional evaporation pond requirements and associated land use costs

• Environmental performance: Net-negative carbon emissions profile enhances ESG investment attraction

The 30-year operational lifespan reflects geothermal resource sustainability rather than traditional mining depletion models, enabling infrastructure-style debt amortisation periods typically unavailable for conventional mineral extraction projects.

Strategic Industrial Partnership Architecture

Strategic investor participation extends beyond traditional project finance equity provision, incorporating operational expertise and market integration that reduces project execution risks while aligning industrial stakeholders with long-term project success. Consequently, this approach reflects broader mining innovation trends that emphasise collaborative risk-sharing models.

Integrated Contractor-Investor Model

HOCHTIEF's €169 million investment demonstrates innovative risk alignment between engineering-procurement-construction (EPC) providers and project ownership. The investment structure includes:

• €39 million direct Phase One project entity investment

• €130 million cornerstone share subscription in Vulcan parent company

• EPC contract execution with fixed-price construction commitments

This dual role creates aligned incentives where the primary construction contractor bears direct equity risk from project performance. Furthermore, it incentivises cost-effective execution and schedule adherence rather than traditional change order optimisation. The structure reduces construction risk for debt providers while ensuring contractor commitment to operational success.

Technology Partner Integration

Siemens Financial Services participation as part of the €133 million strategic investor consortium provides both capital and technology expertise integration. This partnership structure typically includes:

• Equipment supply agreements at preferential commercial terms

• Technology transfer commitments for operational optimisation

• Performance guarantee support reducing operational risk during commissioning phases

• Long-term maintenance contracts ensuring equipment availability throughout operational life

Market-Secured Revenue Through Forward Contracting

The project's 10-year offtake agreements with European battery manufacturers provide revenue certainty that enables debt financing at infrastructure-level terms rather than commodity-exposed venture finance rates typically applied to mining projects. However, this approach aligns with broader critical minerals strategy developments across European supply chains.

Demand Security Architecture

Full production offtake coverage (24,000 tonnes LHM annually) eliminates market demand risk during the critical first decade of operations, when debt service requirements reach maximum levels. The agreements provide sufficient lithium supply for approximately 500,000 EV batteries annually, representing material supply contributions to European battery manufacturing expansion.

Contract structures typically incorporate:

• Fixed-price components providing revenue certainty for debt covenant compliance

• Volume guarantees ensuring full production absorption regardless of market conditions

• Quality specifications aligned with VULSORB technology output characteristics

• Delivery logistics integration with European battery manufacturing facilities

Supply Chain Strategic Integration

European battery manufacturer offtake relationships address broader EU strategic objectives regarding supply chain independence from Chinese lithium processing dominance. The contracts support European battery manufacturing competitiveness by providing domestic lithium supply at transparent pricing, reducing input cost volatility compared to international commodity market sourcing.

The 2028 commercial production timeline positions supply availability during projected European EV market expansion. Consequently, this timing aligns with when battery manufacturing capacity is expected to exceed current lithium supply arrangements within European economic zones.

Governmental Policy Support Framework

European Union critical minerals policy initiatives provide regulatory support mechanisms that reduce traditional mining project development risks while accelerating permitting processes through strategic project designation frameworks. This reflects the importance of energy transition security in contemporary policy frameworks.

Regulatory Fast-Track Mechanisms

Critical minerals project designation under EU strategic autonomy initiatives provides several development advantages:

• Permitting acceleration through dedicated regulatory review processes

• Environmental assessment streamlining for projects meeting renewable energy integration criteria

• Infrastructure development support including grid connection facilitation and transportation logistics

• Potential additional financing mechanisms through EU strategic investment programmes

National Strategic Resource Classification

German federal grant allocation (€204 million) reflects national strategic minerals policy recognising lithium as critical to automotive industry competitiveness and energy transition objectives. Government financial support typically correlates with:

• Economic impact assessments demonstrating job creation and industrial value-added contributions

• Supply chain security benefits reducing import dependence on non-EU lithium sources

• Technology development leadership in European direct lithium extraction capabilities

• Regional development outcomes in Upper Rhine Valley economic zones

Comparative Analysis With Traditional Mining Finance

Traditional lithium mining projects typically require 18-24 month construction periods with single-commodity revenue exposure, creating concentrated risk profiles that limit debt financing availability and increase required equity returns. In contrast, the Vulcan Energy lithium project financing extends construction timelines to approximately 2.5 years but creates immediate revenue generation from energy operations alongside lithium production ramp-up.

Capital Efficiency Advantages

The integrated model demonstrates superior capital efficiency through:

| Traditional Mining Model | Integrated Energy-Minerals Model |

|---|---|

| Single commodity revenue exposure | Three distinct revenue streams |

| Construction period without revenue | Energy revenue during lithium ramp-up |

| Mining-specific debt terms (10-12%+) | Infrastructure-grade debt terms (4-6%) |

| Shorter operational life (10-15 years) | Extended operational life (30+ years) |

| Limited investor base (mining funds) | Diversified investor attraction (infrastructure, renewable energy, mining) |

Risk Profile Transformation

Integration of renewable energy generation with lithium extraction creates fundamentally different risk characteristics compared to traditional hard-rock or brine extraction operations:

• Revenue diversification reduces commodity price sensitivity

• Operational flexibility allows energy production optimisation during lithium market downturns

• Environmental performance enhances ESG investment attraction and regulatory support

• Technology differentiation provides competitive advantages over conventional extraction methods

European Energy Security Strategic Implications

The financing structure addresses multiple European strategic vulnerabilities simultaneously, including lithium import dependence, renewable energy capacity requirements, and industrial heat supply for manufacturing competitiveness. Moreover, these developments support broader initiatives like the European CRM facility programmes in German and broader EU economic zones.

Domestic Supply Chain Development Impact

European lithium supply independence represents a critical component of EU battery manufacturing strategy, reducing dependence on Chinese lithium processing while supporting automotive industry transition toward electric vehicle production. The project contributes to broader European industrial policy objectives:

• Automotive supply chain resilience through domestic lithium hydroxide availability

• Battery manufacturing competitiveness via transparent, long-term supply contracts

• Technology development leadership in sustainable lithium extraction methodologies

• Regional economic development in traditional automotive manufacturing regions

Scalability Framework for Future Development

Success of the integrated financing model creates replication potential across other European geothermal regions with lithium-bearing brine resources. The established precedent in institutional participation, regulatory support, and market integration provides a template for similar projects in:

• Other Upper Rhine Valley locations with comparable geothermal resources

• European geothermal fields in Eastern Europe, Italy, and Iceland

• International geothermal-lithium opportunities in alliance economies (Australia, Canada, United States)

Investment Risk Assessment and Market Positioning

The VULSORB Direct Lithium Extraction technology represents both the primary technical risk and competitive differentiation factor within the project's risk profile. However, commercial-scale technology deployment at 24,000 tonnes annual capacity requires successful scaling from pilot operations to industrial production levels.

Technology Validation Through Commercial Deployment

Financing structure accommodates technology risk through several mechanisms:

• Staged capital deployment aligned with technology validation milestones

• Performance guarantees from technology development teams and strategic partners

• Insurance coverage for technology performance shortfalls during commissioning

• Alternative technology provisions enabling process modifications if required

The 2028 commercial production target provides sufficient development timeline for technology optimisation while positioning market entry during expected European lithium supply constraints. Furthermore, this timeline aligns with strategic financing arrangements from the European Investment Bank.

Competitive Market Positioning

Market entry timing addresses several competitive advantages:

• First-mover advantage in European integrated lithium-energy facilities

• Cost structure benefits from renewable energy integration and government support

• Supply chain integration with established European battery manufacturer relationships

• Environmental differentiation through net-negative carbon emissions profile

Global Lithium Market Structure Implications

Success of the Vulcan Energy lithium project financing model may accelerate similar integrated approaches in other geothermal regions globally. Consequently, this could potentially reshape lithium market structure from extraction-focused operations toward energy-integrated facilities that provide superior risk-adjusted returns for institutional capital.

European Market Independence Strategy

The project represents Europe's first major initiative toward lithium supply independence, potentially reducing Chinese processing dominance while creating alternative supply chains for Western battery manufacturers. Long-term strategic implications include:

• Supply chain diversification away from geopolitically sensitive lithium sources

• Price transparency improvement through domestic production and long-term contracting

• Technology leadership development in sustainable extraction methodologies

• Industrial competitiveness enhancement for European battery and automotive sectors

Competitive Response and Market Evolution

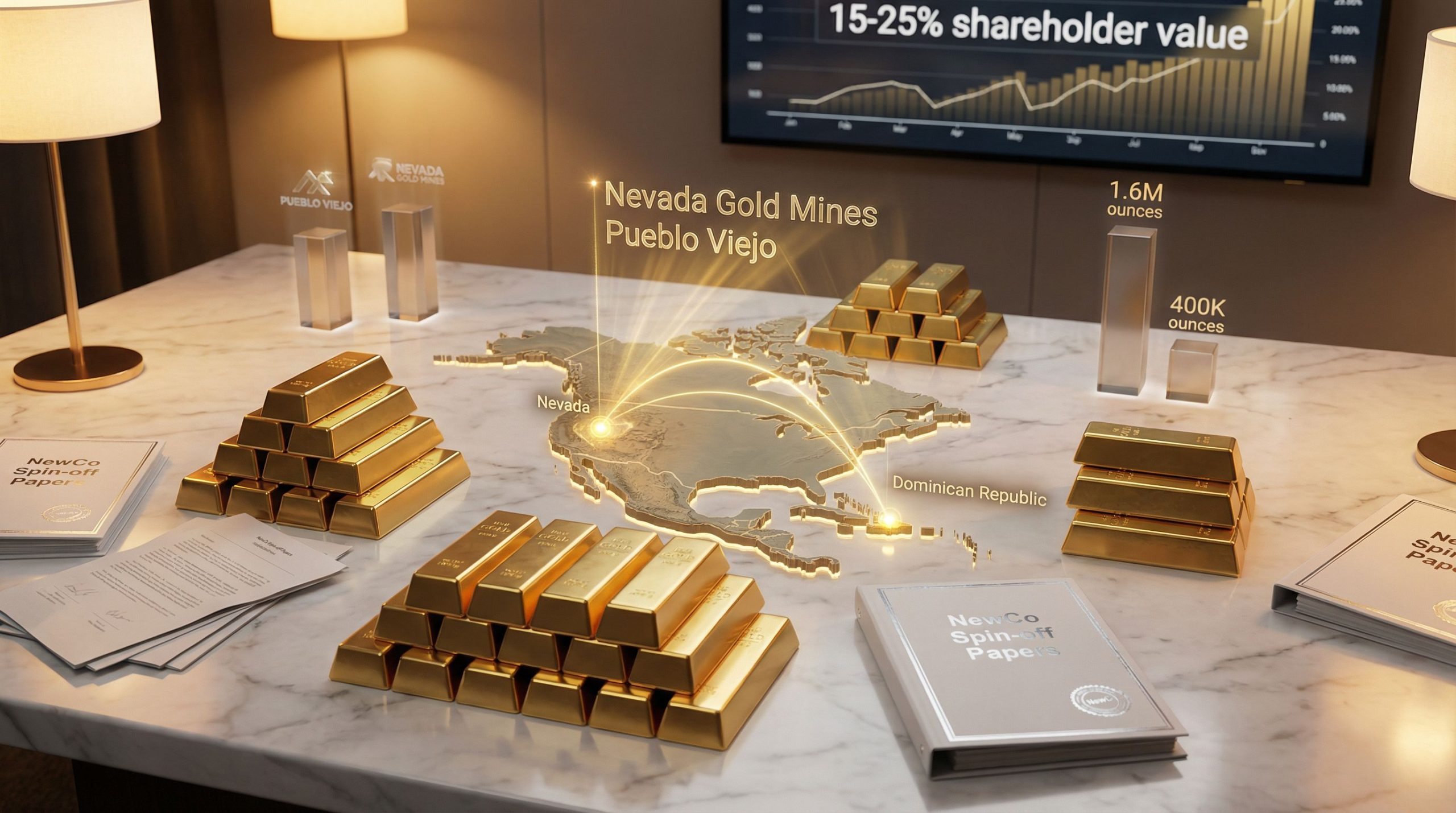

Successful deployment of the integrated model may influence global lithium market development patterns, encouraging similar energy-integrated approaches in other geothermal regions. These include the Salton Sea (United States), Clayton Valley (Nevada), and various South American lithium brine operations, as outlined in recent mining technology analysis.

Market structure evolution toward integrated energy-minerals facilities could fundamentally alter lithium industry economics by reducing commodity price volatility. In addition, this would improve environmental performance profiles that attract increasing institutional capital allocation toward sustainable resource extraction methodologies.

The information contained in this analysis is based on publicly available sources and should not be considered as investment advice. Readers should conduct independent research and consult qualified financial professionals before making investment decisions regarding critical minerals projects or related securities.

Ready to Capitalise on European Critical Minerals Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, including critical minerals projects that could benefit from innovative financing structures like those demonstrated in Europe. Begin your 30-day free trial today and position yourself ahead of the market with rapid insights into actionable trading and investment opportunities across the expanding critical minerals sector.