Understanding the Royalty Investment Model in Natural Resources

The landscape of natural resource financing has evolved dramatically over the past two decades, with royalty and streaming companies in mining emerging as a sophisticated alternative to traditional equity or debt structures. This capital-light investment approach fundamentally differs from direct mining exposure by creating perpetual revenue streams without the operational complexities that plague traditional producers.

The Capital-Light Alternative to Direct Mining Exposure

Resource companies seeking development capital face three primary financing options: bank debt arrangements, equity dilution through public offerings, or royalty and streaming agreements. Each pathway carries distinct risk profiles that significantly impact long-term shareholder returns.

Royalty structures function as percentage-based claims on gross revenue or net revenue after transportation costs, most commonly applied in precious metals contexts. Streaming agreements involve advance capital provision in exchange for predetermined metal delivery at below-market "streaming prices," typically featuring longer-term contractual commitments. Furthermore, a third category, offtake agreements, specialises in byproduct monetisation where primary commodity operators monetise secondary metals extracted during operations.

Unlike equity instruments, royalty rights cannot be diluted through subsequent capital raises, providing structural capital preservation advantages during extended commodity downturns when producers require additional financing. This permanent ownership characteristic distinguishes royalties from traditional investment vehicles and creates compound value over extended time horizons.

Institutional investors increasingly gravitate toward this asset class due to its unique risk-return characteristics. The model provides commodity price exposure while eliminating operational risk, capital expenditure requirements, and management execution dependencies that characterise direct mining investments. Moreover, AI in mining efficiency continues to enhance operational performance for underlying assets.

Risk-Return Profile Analysis Across Mining Investment Vehicles

Comparative risk assessment reveals fundamental structural differences between investment approaches in natural resources. Mining producers exhibit downside leverage during commodity price declines, where fixed operational expenses amplify losses when revenues contract. Conversely, royalty holders capture upside leverage during commodity price increases with minimal expense correlation to commodity prices.

This operational leverage inversion creates superior risk-adjusted returns over full commodity cycles. During extreme market stress, such as the April 2020 oil price negative pricing event, energy royalty companies maintained positive profitability while traditional producers experienced severe losses. The contrast demonstrates how royalty structures preserve capital during market dislocations.

Geographic and commodity diversification benefits emerge naturally through portfolio construction. Major royalty companies typically maintain exposure across multiple jurisdictions and commodity types, reducing single-asset concentration risk that affects individual mining operations. This diversification occurs without additional capital deployment or management complexity.

Long-term return on invested capital metrics favour the royalty model through its capacity to generate infinite returns following initial capital recovery. Once upfront payments are recouped through cash distributions, subsequent returns represent pure profit without ongoing capital requirements.

What Drives Superior Performance in Royalty Investments?

The Mathematics of Infinite Returns

The Mesabi Trust case study provides compelling evidence of royalty investment mathematics. Originally capitalised at approximately $33 million in 2000, the iron ore royalty trust achieved complete capital recovery within five years while maintaining distributions for over two decades. Investors who participated in the initial offering experienced dividend-adjusted returns exceeding 13x despite iron ore's modest 4% annual nominal price appreciation.

This performance demonstrates how perpetual cash generation creates mathematically infinite return on invested capital calculations once initial investment recovery occurs. The underlying economics function as revenue equals production volume multiplied by commodity price, with royalty holders capturing both growth vectors without capital deployment constraints.

The iron ore commodity itself underperformed monetary inflation during this period. With U.S. money supply expansion averaging 7.4-7.5% annually, iron ore's 4% nominal appreciation represented negative 3.5% real returns. Yet the royalty structure generated substantial positive returns through operational efficiency and zero ongoing capital requirements.

Cleveland-Cliffs, operating the same Peter Mitchell mine in Minnesota, destroyed shareholder capital over the identical time period despite owning the underlying deposit. This controlled comparison isolates the business model advantages inherent to royalty structures versus direct ownership models.

Production Volume Expansion Without Capital Exposure

Reserve growth patterns consistently favour royalty holders through exploration success and production technique improvements. The Mesabi Trust example illustrates this phenomenon clearly: despite 25 years of cumulative production totalling approximately 100 million tons, current reserve estimates increased from the original 500 million tons to approximately 800 million tons.

This reserve expansion occurred without royalty holder capital contribution for exploration, development, or production optimisation. Mining companies invest substantial capital in reserve replacement and expansion activities, while royalty holders benefit from successful outcomes without bearing exploration risk or dry-hole costs.

Technology improvements in extraction techniques, processing efficiency, and ore body assessment frequently extend mine lives beyond initial projections. As reserve estimates expand arithmetically (Total Reserves ÷ Annual Production = Mine Life Years), the present value of future cash flows increases proportionally without additional capital deployment.

Byproduct value capture represents another dimension of volume expansion. Mining operations often extract multiple metals from complex ore bodies, with operators prioritising primary commodities while viewing secondary metals as byproducts. Royalty and streaming companies in mining can monetise these byproduct streams through specialised agreements, creating additional revenue without corresponding capital requirements.

Market Structure and Competitive Dynamics

Tier-One Assets vs. Development-Stage Opportunities

Industry consolidation activity has accelerated significantly, with Gold Royalty Corp executing aggressive acquisition strategies to achieve scale advantages. Recent mergers and acquisitions include activity involving Triple Flag Precious Metals, Elemental Altus, EMX, and various mid-tier participants seeking competitive positioning.

Established players including Franco-Nevada, Wheaton Precious Metals, and Royal Gold maintain substantial advantages through in-house geology teams, established operator relationships, and superior financing access. These capabilities enable selective deal evaluation and superior life-of-mine agreement terms compared to newer market entrants.

Scale advantages manifest through several channels:

- Enhanced due diligence capabilities through dedicated technical teams

- Established relationships providing preferential deal flow access

- Lower cost-of-capital enabling competitive pricing in negotiations

- Portfolio diversification reducing single-asset dependency

Smaller competitors face structural disadvantages, often accepting marginal deals to establish market presence. These transactions frequently include buyback clauses allowing operators to repurchase royalty interests when projects achieve profitability, stranding smaller companies' investment returns precisely when economics become favourable.

Industry Consolidation Trends and Market Evolution

Competitive dynamics reflect bifurcation between tier-one operators and emerging participants. Randy Weaton of Wheaton Precious Metals management reportedly emphasised that mega-cap selectivity represents strategic strength rather than growth limitation. Large-cap companies can reject suboptimal transactions while smaller competitors must execute marginal deals to achieve scale.

Tether's strategic investments in royalty companies (Altus Metals, Elemental Altus, Metalla Royalty, and Gold Royalty Corp) signals institutional recognition of the asset class. While individual capital deployments remain modest relative to Tether's overall financial position, the strategy suggests macro-level validation of royalty investment characteristics.

ESG considerations increasingly restrict traditional bank financing for mining projects, enhancing royalty and streaming attractiveness as alternative capital sources. Environmental, social, and governance lending policies create structural tailwinds for royalty financing compared to conventional debt arrangements. This trend is particularly relevant given the broader mining industry evolution towards sustainable practices.

New entrant challenges include limited deal sourcing capabilities, higher financing costs, and acceptance of inferior contract terms. Market positioning strategies require either rapid scale achievement through acquisitions or specialisation in specific geographic or commodity niches.

How Do Royalty Companies Navigate Commodity Cycles?

Downside Protection During Market Stress

Extreme commodity volatility events demonstrate royalty structure resilience. During April 2020, WTI Crude Oil contracts traded at negative prices due to storage constraints and demand collapse. While oil producers experienced catastrophic losses and many suspended operations entirely, energy royalty companies maintained positive quarterly profitability.

This performance differential highlights fundamental structural advantages. Oil producers faced fixed operational expenses regardless of commodity prices, creating severe downside leverage when revenues collapsed. Royalty holders, claiming percentage-based revenue shares without operational expense burdens, preserved positive cash generation even during unprecedented market stress.

Revenue stability mechanisms built into royalty structures include:

- Percentage-based revenue claims independent of operator cost structures

- Multiple revenue stream diversification (oil + gas + lease payments + easement fees)

- Byproduct monetisation providing commodity diversification

- Zero correlation between royalty expenses and commodity price volatility

Comparative analysis between producer and royalty performance during market downturns reveals consistent patterns. Producers' earnings availability to shareholders often represents only 25% of reported earnings due to reinvestment requirements, while royalty and streaming companies in mining typically distribute 90% of earnings to shareholders through dividends.

Inflation Hedge Characteristics and Currency Debasement

Long-term purchasing power preservation through commodity exposure positions royalties as inflation hedges during currency debasement cycles. The debasement trade reflects growing recognition of purchasing power erosion in major fiat currencies, with fiscal deficits requiring monetary accommodation through money supply expansion.

Gold price correlation analysis demonstrates this dynamic. Gold has appreciated approximately 7-8% annually since 1971, matching U.S. money supply expansion rates over equivalent periods. This correlation suggests gold functions as an inverse dollar purchasing power measure rather than merely a commodity investment. Indeed, many investors consider a gold inflation hedge essential for portfolio protection.

Multi-commodity exposure through diversified royalty portfolios provides broader inflation protection than single-asset strategies. Portfolio companies like Franco-Nevada maintain exposure across precious metals, base metals, and energy commodities, capturing inflation vectors across different sectors of the economy.

Real returns versus nominal returns analysis reveals commodity performance inadequacy over extended periods. Most commodities, excluding gold, silver, and uranium, demonstrate negative real returns over multi-decade timeframes as producer incentives drive supply expansion and technological improvements reduce extraction costs.

Valuation Frameworks for Royalty Investment Analysis

Discounting Future Cash Flows in Royalty Valuations

Appropriate discount rate selection for royalty valuations requires consideration of gold price performance as the baseline hurdle rate. Given gold's 7-8% historical annual appreciation since 1971, this rate provides a realistic discount rate for precious metals royalty valuations rather than traditional risk-free rates.

Mine life assumptions must incorporate reserve growth potential rather than static reserve estimates. The Mesabi Trust example demonstrates consistent upward reserve revisions despite ongoing production, suggesting conservative initial estimates typically understate actual mine longevity.

Key valuation inputs include:

- Commodity price forecasting: Long-term trend analysis versus cyclical positioning

- Production volume projections: Current output plus reserve expansion potential

- Mine life extensions: Technology improvements and exploration success probability

- Byproduct value: Secondary commodity monetisation opportunities

Net present value calculations for development-stage royalties require probability-weighted scenarios reflecting project execution risk, permitting timelines, and operator capability assessment. Pre-production assets carry higher discount rates but offer superior upside potential when projects achieve commercial production.

Growth Trajectory Assessment Across Market Capitalisations

Wheaton Precious Metals exemplifies how mega-cap royalty companies maintain substantial growth potential despite their size. Production guidance anticipates reaching approximately 1 million gold equivalent ounces annually by decade-end, representing 40-50% growth from current production levels.

This growth trajectory typically associates with small-cap companies yet emerges from a $20+ billion market capitalisation entity. The performance contradicts conventional wisdom suggesting large-cap royalty companies are "ex-growth" and demonstrates how production scaling occurs through contract portfolio maturation rather than capital deployment.

Franco-Nevada's strategic positioning illustrates development-stage growth potential. Approximately 75% of contract portfolio remains in pre-production phase, with many agreements structured around projects requiring $4,000-5,000 gold pricing for economic viability. Current gold prices exceeding these thresholds position substantial production growth through the 2030s, aligning with positive gold price forecast expectations.

Market capitalisation efficiency comparisons reveal superior capital productivity in royalty models. Traditional mining companies require continuous capital expenditure for sustaining production and reserve replacement, while royalty and streaming companies in mining achieve production growth through operator capital deployment without corresponding balance sheet expansion.

Sector-Specific Applications Beyond Precious Metals

Energy Royalties and Land-Based Investment Strategies

Permian Basin investment strategies demonstrate comprehensive commodity exposure through land-based royalty ownership. Full-cycle monetisation includes multiple revenue streams beyond traditional oil and gas royalties:

- Lease and easement payments from drilling rights

- Sourced water sales for hydraulic fracturing operations

- Produced water processing revenue from toxic water disposal

- Pipeline easement fees for transportation infrastructure

Produced water management represents an overlooked revenue opportunity. Every barrel of oil extraction generates approximately four barrels of highly toxic produced water requiring specialised disposal. Operators pay substantial fees for produced water removal and processing, creating additional revenue streams for mineral rights holders.

This diversified revenue model provides stability during commodity price volatility. Even during weak oil and gas markets, lease payments, water sales, and processing fees continue generating cash flow, reducing dependence on commodity price performance alone.

Geographic concentration in prolific basins like the Permian creates operational synergies and infrastructure advantages. Established pipeline networks, processing facilities, and operator presence enhance long-term development potential compared to frontier exploration regions.

Base Metals and Critical Materials Expansion

Copper supply deficit implications create substantial streaming opportunities as global electrification accelerates. Infrastructure development, renewable energy deployment, and electric vehicle adoption drive structural copper demand growth exceeding current supply capacity. This trend supports copper & uranium investments across multiple jurisdictions.

Battery metals royalty development targets lithium, cobalt, and nickel exposure through streaming arrangements with diversified mining operations. These critical materials command premium pricing due to limited supply sources and growing battery manufacturing demand.

Byproduct monetisation strategies for complex ore bodies enable comprehensive value extraction. Copper mining operations frequently produce gold, silver, and molybdenum byproducts that operators deprioritise relative to primary copper production. Streaming companies can monetise these secondary commodities through specialised offtake agreements.

Industrial metals versus precious metals royalty characteristics differ in contract duration, pricing mechanisms, and market dynamics. Industrial metals typically feature shorter contract terms and greater price volatility, while precious metals provide longer-term stability and established global market liquidity.

Financial Performance Metrics and Due Diligence

Operational Efficiency Indicators

SG&A expense ratios serve as critical business model quality measures for royalty companies. Trust structures like Mesabi Trust maintain SG&A expenses below 3% of total revenues through minimal operational requirements: filing costs, audit expenses, and production verification procedures.

Corporate royalty entities typically maintain SG&A ratios below 5% of revenues when operated efficiently. Companies exceeding these thresholds may indicate management inefficiency or excessive corporate overhead inconsistent with the asset-light business model.

Comparative analysis reveals stark differences between royalty companies and traditional mining producers:

- Royalty Companies: SG&A represents <5% of revenue; no employees or operational infrastructure

- Mining Producers: Operating expenses typically 40-60% of revenue; substantial fixed cost structures

- Exploration Companies: High burn rates relative to revenue with uncertain production timelines

Trust structures versus corporate entities provide efficiency advantages through simplified governance and minimal management fees. Express trusts eliminate management compensation, employee costs, and corporate development expenses while maintaining fiduciary responsibility for shareholder distributions.

Portfolio Quality Assessment Criteria

Asset diversification across commodities and jurisdictions reduces concentration risk while maintaining growth potential. Optimal portfolio construction balances geographic exposure between tier-one mining jurisdictions (Canada, Australia, United States) and emerging markets offering higher growth potential.

Production versus development versus exploration stage balance affects risk-return profiles:

- Production Stage Assets: Immediate cash generation with established mine life

- Development Stage Projects: Near-term production growth with execution risk

- Exploration Stage Agreements: Long-term optionality with discovery risk

Counterparty risk evaluation requires assessment of operator quality, financial stability, and operational track record. Established mining companies with investment-grade credit ratings provide superior counterparty strength compared to junior operators with limited operational history.

Contract terms analysis encompasses royalty rates, buyback clauses, minimum payment guarantees, and inflation escalation provisions. Superior agreements include life-of-mine terms without buyback options, providing permanent royalty ownership through mine depletion.

Strategic Positioning for the Debasement Trade

Macroeconomic Tailwinds Supporting Resource Royalties

Fiscal deficit implications across major economies create structural support for asset prices as governments require monetary accommodation through money supply expansion. Current debt-to-GDP ratios approach historically unprecedented levels, suggesting traditional fiscal consolidation approaches may prove politically unfeasible.

Central bank policy impacts on real asset valuations reflect currency purchasing power erosion through quantitative easing programmes. Asset price inflation emerges as the primary transmission mechanism for monetary policy, benefiting real assets including commodity exposure through royalty investments.

The debasement trade represents recognition that fiat currency purchasing power erosion creates systematic investment requirements beyond traditional equity and bond portfolios. Resource royalties provide passive commodity exposure without operational complexity or management execution risk.

Long-term monetary policy trends suggest persistent inflation rather than deflationary outcomes. Despite near-term disinflation possibilities through 2026-2027, structural fiscal imbalances likely require continued monetary accommodation, supporting real asset valuations over extended periods.

Portfolio Construction Using Royalty Investments

Asset allocation frameworks incorporating royalty exposure typically recommend 5-15% portfolio weights depending on investor risk tolerance and inflation hedge objectives. This allocation provides meaningful commodity exposure while maintaining portfolio diversification across asset classes.

Correlation benefits with traditional equity and bond portfolios emerge through different economic cycle performance. During periods of equity market stress and bond yield volatility, commodity royalties often provide portfolio stability through uncorrelated cash flow generation.

Risk-adjusted return optimisation through royalty diversification considers:

- Commodity price correlation: Different metals and energy products exhibit varying correlation patterns

- Geographic diversification: Political and currency risk distribution across jurisdictions

- Production stage balance: Immediate cash flow versus future growth potential

- Operator quality: Counterparty risk distribution across mining companies

Portfolio construction typically emphasises established, large-cap royalty companies for core positions while incorporating smaller, growth-oriented companies for enhanced return potential. This tiered approach balances stability with growth opportunity across market capitalisations.

Technology Integration and Digital Asset Convergence

Tokenisation Trends in Precious Metals Royalties

Institutional adoption of gold-backed digital assets accelerates through cryptocurrency platform partnerships with established royalty companies. According to McKinsey's analysis of streaming and royalties in mining, Tether's strategic investments in multiple royalty companies suggests potential integration between traditional commodity exposure and digital asset innovation.

Royalty company partnerships with cryptocurrency platforms enable physical metal access through streaming arrangements while maintaining operational separation from digital asset volatility. This structure provides commodity backing for tokenisation initiatives without direct cryptocurrency exposure.

Physical metal access through streaming arrangements offers advantages over direct metal ownership for tokenisation purposes. Streaming agreements provide regular metal delivery schedules, established quality standards, and logistical infrastructure supporting digital asset backing requirements.

Blockchain applications in royalty payment verification enhance transparency and reduce administrative costs through automated contract execution and payment distribution. Smart contracts can streamline royalty calculations, payment timing, and dispute resolution processes.

Future Evolution of Resource Finance Models

Smart contract applications in royalty agreements may automate production reporting, payment calculations, and distribution processes while reducing counterparty risk through programmatic execution. These technological improvements could enhance operational efficiency and reduce administrative expenses.

Automated production reporting systems utilising IoT sensors and blockchain verification could eliminate operator reporting discretion while providing real-time production data to royalty holders. This transparency would reduce information asymmetries and enhance investor confidence.

Digital asset backing through physical commodity streams represents convergence between traditional resource finance and cryptocurrency innovation. Understanding the royalty and streaming business model becomes increasingly important as streaming companies could provide metal delivery for cryptocurrency backing while maintaining operational independence from digital asset market volatility.

Regulatory frameworks for tokenised resource investments remain under development, requiring careful navigation of securities laws, commodity regulations, and digital asset compliance requirements. Successful implementation likely requires collaboration between royalty companies, cryptocurrency platforms, and regulatory authorities.

Disclaimer: This analysis contains forward-looking statements and projections based on current market conditions and historical performance. Commodity investments, including royalty and streaming companies in mining, carry inherent risks including commodity price volatility, operational risks, and regulatory changes. Past performance does not guarantee future results. Investors should conduct thorough due diligence and consider their risk tolerance before making investment decisions.

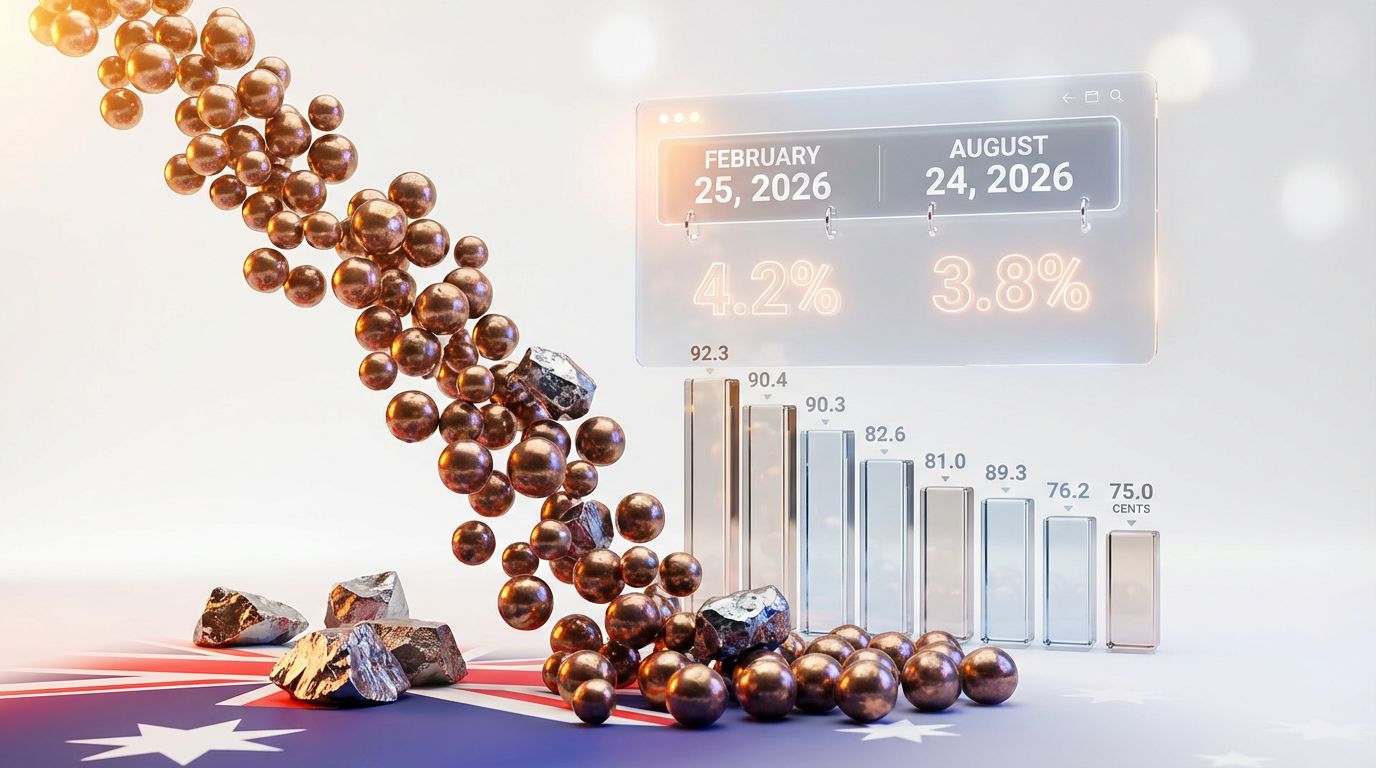

Are You Ready to Invest in the Next Major Mineral Discovery?

Discovery Alert instantly alerts investors to significant ASX mineral discoveries using its proprietary Discovery IQ model, turning complex mineral data into actionable insights. Understand why historic discoveries can generate substantial returns and begin your 30-day free trial today to position yourself ahead of the market.