The convergence of macroeconomic uncertainty, supply chain vulnerabilities, and technological disruption has created unprecedented conditions in global commodity markets. Traditional precious metals trading systems, built on fractional reserve principles, now face mounting pressure from institutional demand shifts, geopolitical realignments, and infrastructure failures. A silver squeeze scenario becomes increasingly probable as these dynamics intensify, particularly when paper claims vastly exceed physical inventory availability.

Modern commodity exchanges operate on sophisticated derivative structures where most contracts settle financially rather than through physical delivery. This system works effectively during stable periods but reveals structural weaknesses when confidence erodes and market participants demand actual possession of underlying assets. Recent infrastructure disruptions have highlighted these vulnerabilities, creating opportunities for informed investors to understand emerging market conditions.

Market Mechanics Behind Precious Metals Trading Systems

The foundation of contemporary silver markets rests on complex financial instruments where paper contracts represent claims on physical metal stored in approved vaults. Exchange operators maintain this system through standardised contracts that can be settled through cash payments or rolled into future delivery periods. The Chicago Mercantile Exchange (CME) and London Bullion Market Association (LBMA) serve as primary venues for these transactions, facilitating billions of dollars in daily trading volume.

Historical data from CME COMEX operations shows that fewer than 2% of precious metals futures contracts result in physical metal delivery. The remaining 98% undergo cash settlement or contract rollover, allowing the system to function with relatively modest physical inventory relative to outstanding paper obligations. This fractional reserve structure enables liquidity and price discovery but creates potential stress points during periods of elevated physical demand.

Understanding Rehypothecation in Commodity Markets

Rehypothecation allows financial institutions to use client assets as collateral for their own borrowing activities. In precious metals markets, this mechanism enables multiple claims against the same physical ounce, effectively expanding the apparent supply beyond actual vault holdings. Regulatory frameworks permit this practice within specified limits, though the exact ratios vary between jurisdictions and exchange operators.

The process operates through a chain of custodial relationships where vault operators, clearing members, and financial institutions create layered claims on physical inventory. Each participant in this chain may pledge the same underlying metal as collateral for separate transactions, creating a multiplier effect that increases paper claims relative to physical holdings. This system functions smoothly during normal market conditions but becomes problematic when multiple parties simultaneously demand physical delivery.

Fractional Reserve Dynamics in Precious Metals

Commodity markets employ fractional reserve principles similar to traditional banking systems, where total claims exceed immediately available assets. This structure provides market efficiency and liquidity benefits but introduces systemic risks during confidence breakdowns. Unlike bank deposits backed by government insurance, precious metals investors face direct exposure to custodial and counterparty risks inherent in these arrangements.

Market stability depends on predictable patterns where most contracts settle financially rather than requiring physical metal transfer. Disruptions to this pattern, whether from technical failures, regulatory changes, or demand shifts, can trigger rapid adjustments in spot premiums, delivery timeframes, and futures pricing relationships. Understanding these mechanics helps investors recognise early warning signals of potential market stress.

Catalysts for Silver Market Disruptions

Multiple converging factors can trigger significant disruptions in silver trading systems. Industrial demand growth, particularly from solar panel manufacturing and electric vehicle production, creates sustained upward pressure on physical supply. The solar industry alone accounts for approximately 10% of global silver demand, with photovoltaic applications growing 8-12% annually according to U.S. Geological Survey data.

Electronics manufacturing represents the largest industrial silver consumption category, utilising approximately 268 million ounces in 2022 according to The Silver Institute's World Silver Survey. This demand remains relatively inelastic due to silver's unique electrical conductivity properties, creating baseline consumption levels that persist regardless of price movements. Electric vehicles contain approximately 25-35 grams of silver per unit, primarily in electrical switches and contacts, adding incremental demand pressure as EV adoption accelerates.

Monetary Policy and Currency Debasement Pressures

Central bank monetary policies significantly influence precious metals demand through multiple transmission mechanisms. Quantitative easing programmes and currency debasement concerns drive institutional and retail investors toward hard asset allocations as inflation hedges. Recent Federal Reserve M1 and M2 money supply expansions have created conditions favourable to precious metals appreciation, particularly among investors seeking portfolio diversification beyond traditional financial assets.

Currency debasement manifests through purchasing power erosion, prompting wealth preservation strategies that include precious metals accumulation. This dynamic becomes particularly pronounced during periods of elevated inflation or currency instability, when investors seek assets with intrinsic value and limited counterparty risk. Historical precedent shows gold as inflation hedge performing well during monetary transitions and currency reset periods, though specific performance varies based on broader economic conditions.

Geopolitical Shifts and Reserve Diversification

International monetary system changes create additional pressure on precious metals markets as central banks diversify away from dollar-dominated reserves. According to CNBC, the World Gold Council reports that central banks purchased 1,037 tonnes of gold in 2022, representing the second-highest annual total on record. This trend reflects reduced confidence in traditional reserve currencies and growing preference for tangible assets with no counterparty risk.

Recent examples include Germany, India, and Hungary repatriating gold holdings from foreign vaults, signalling shifts in international monetary arrangements. Italy's leadership has also expressed intentions to maintain domestic control over national gold reserves rather than European Union custody. These developments suggest broader trends toward monetary sovereignty and reduced reliance on traditional international financial systems.

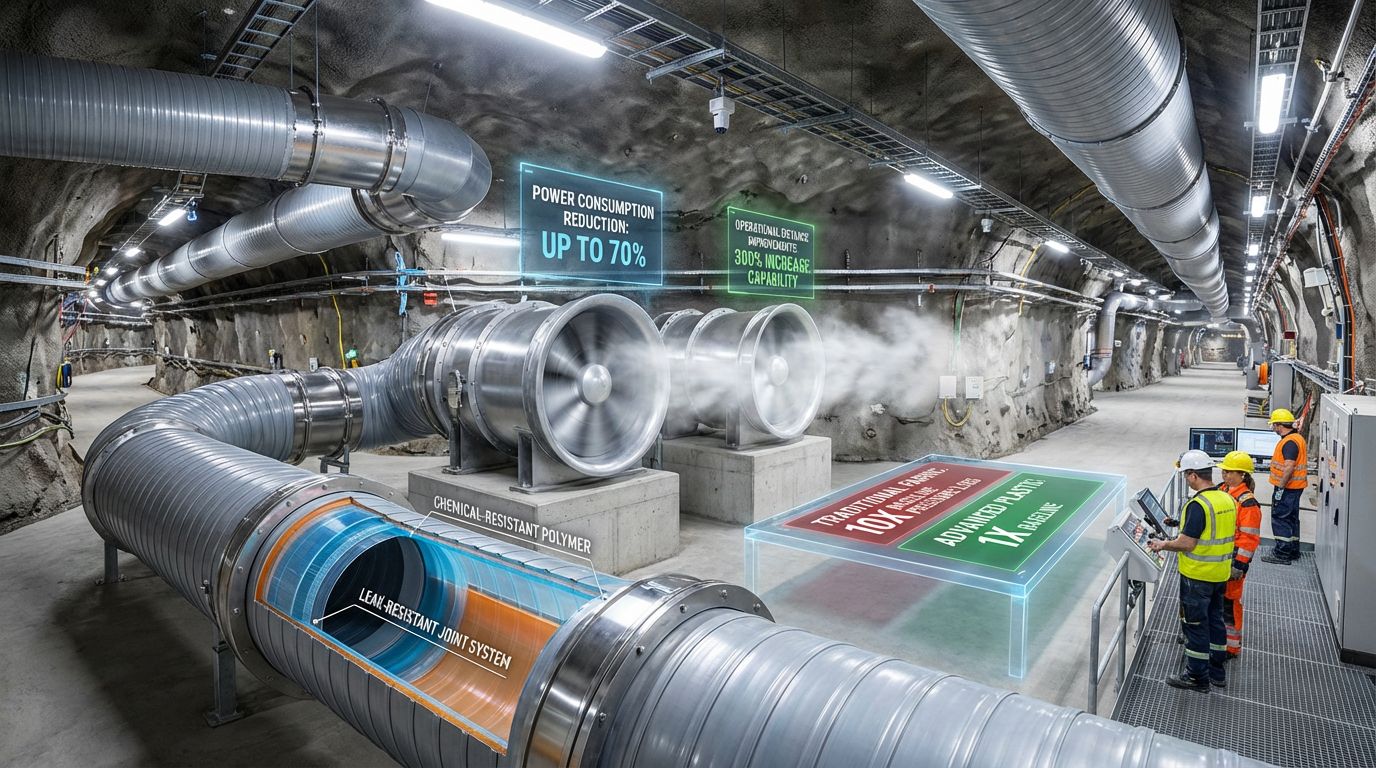

Exchange Infrastructure Vulnerabilities

Modern commodity exchanges depend on sophisticated electronic trading systems that can experience technical failures during critical market periods. Recent CME operations experienced significant disruptions affecting oil, gold, and silver futures markets during a period of elevated price volatility. The 10-hour system outage occurred when silver was approaching breakout levels, raising questions about timing and market impact.

Technical explanations cited cooling system failures at primary data centres, with backup systems also experiencing problems. While such mechanical issues occur in complex electronic systems, the timing coincided with potential delivery stress in silver markets, leading to speculation about intentional intervention versus operational accidents. Regardless of causation, these events demonstrate infrastructure vulnerabilities that can affect price discovery and market functioning during critical periods.

Global Silver Supply Conditions and Inventory Analysis

Current silver market fundamentals reveal structural supply deficits and declining global inventories across major trading centres. Mine production data from the U.S. Geological Survey indicates global silver output of approximately 850 million ounces annually, with Mexico (180 million oz), Peru (120 million oz), and China (~110 million oz) serving as primary producers. This production faces sustained industrial demand of over 1 billion ounces according to Silver Institute data, creating persistent annual deficits.

CME COMEX warehouse inventory reports show declining registered silver stocks, though specific percentage changes require regular monitoring through official exchange publications. Weekly inventory data provides early warning signals of potential supply tightness, particularly when combined with futures market backwardation and elevated spot premiums over paper prices.

Regional Inventory Status and Delivery Conditions

London Bullion Market Association (LBMA) operations have experienced extended delivery timeframes during recent periods of elevated physical demand. While the LBMA does not publish detailed inventory breakdowns, market participants report delivery delays extending from typical few-day periods to several weeks during stress conditions. These delays indicate physical supply constraints that affect pricing relationships between spot and futures markets.

Shanghai Gold Exchange represents Asia's primary precious metals trading venue, with weekly vault inventory reports providing transparency into regional supply conditions. Chinese silver inventories have declined significantly as domestic demand increases and export activity continues to Western markets. This geographic supply flow creates additional pressure on traditional London and New York trading centres.

| Region | Inventory Trend | Supply Indicators | Delivery Status |

|---|---|---|---|

| COMEX | Declining | Backwardation signals | Normal processing |

| LBMA | Constrained | Extended timeframes | Delayed deliveries |

| Shanghai | Reduced | Decade-low levels | Regional tightness |

Mining Production Economics and Supply Response

Silver mining economics influence long-term supply availability through production cost structures and capital investment decisions. Current mining costs vary significantly by operation, though industry averages suggest all-in sustaining costs between $12-18 per ounce for primary silver miners. These costs provide support levels for long-term price floors, while elevated prices incentivise expanded production and exploration activities.

Mining company hedging strategies affect near-term supply availability as producers sell future production at fixed prices. Forward sales and derivative hedging can reduce available spot market supply while providing producers with price certainty. Understanding these hedging patterns helps investors assess potential supply constraints and production allocation decisions.

China's Strategic Precious Metals Positioning

China has developed substantial precious metals trading infrastructure through the Shanghai Gold Exchange, creating alternatives to Western-dominated markets. This development aligns with broader Chinese initiatives to reduce dependence on dollar-denominated international trade systems and establish yuan-denominated commodity trading mechanisms.

The Belt and Road Initiative includes provisions for alternative trade settlement systems that could incorporate precious metals as reserve assets or trade settlement mechanisms. While specific implementation details remain speculative, the infrastructure development suggests preparation for monetary system changes that reduce Western exchange dominance.

Chinese silver accumulation patterns show strategic positioning ahead of potential monetary transitions. Domestic demand has increased substantially while export activity continues, creating inventory drawdowns that affect global supply availability. This strategic positioning reflects understanding of precious metals' roles during currency reset periods and international monetary system changes.

Exchange Outages and Price Discovery Disruptions

Electronic trading system failures during critical market periods can significantly impact price discovery mechanisms and market functioning. The Chicago Mercantile Exchange recently experienced extended system outages affecting multiple commodity futures markets, including oil, gold, and silver contracts. These disruptions occurred during periods of elevated volatility and potential delivery stress, raising questions about causation and market impact.

Technical explanations attribute the disruptions to cooling system failures at primary data centres, with backup systems also experiencing operational problems. Modern exchange infrastructure typically includes multiple redundancy layers designed to prevent extended outages, making simultaneous failures across primary and backup systems statistically unusual though not impossible.

Derivatives Market Freeze Effects

System outages prevent trading activity and price discovery during critical market periods, potentially affecting delivery obligations and settlement procedures. When exchanges cannot process trades or update positions, market participants face uncertainty about contract status and delivery requirements. This uncertainty can influence subsequent trading behaviour and price movements once systems resume operation.

Derivatives markets depend on continuous price discovery and position management capabilities to function effectively. Extended outages disrupt these processes and can create artificial supply or demand conditions when trading resumes. Market makers and arbitrageurs require consistent access to adjust hedging positions and maintain orderly markets across related instruments.

Historical Precedents for Delivery Stress Events

March 2020 provided significant precedent for precious metals delivery stress when gold futures markets experienced extreme backwardation and elevated physical premiums. COMEX gold contracts traded at substantial discounts to London spot prices, indicating severe supply disruptions and delivery constraints. Spot premiums exceeded 3% during peak stress periods, reflecting physical market tightness that traditional futures markets could not resolve.

The 2020 crisis demonstrated how confidence breakdowns can rapidly expose structural imbalances between paper and physical markets. Central bank interventions and exchange rule modifications helped stabilise conditions, though the events highlighted underlying vulnerabilities in fractional reserve commodity systems. These precedents inform current risk assessments and investor positioning strategies.

What Causes Market Manipulation Theories?

Distinguishing between intentional market intervention and genuine technical failures requires careful analysis of timing, market conditions, and operational patterns. While cooling system failures represent plausible technical explanations, the coincidence with potential delivery stress periods raises legitimate questions about causation versus correlation.

Market participants often interpret suspicious timing as evidence of intentional intervention, though proving such allegations requires substantial evidence beyond circumstantial timing. Regulatory oversight and exchange transparency measures provide some protection against manipulation, though perfect oversight remains impossible in complex electronic markets.

Exchange operators face conflicting incentives during market stress periods, balancing orderly market functioning against potential delivery defaults that could threaten system stability. Understanding these dynamics helps investors assess risk scenarios and develop appropriate positioning strategies for various market conditions.

Investment Positioning During Market Stress Periods

Precious metals investment strategies during market disruptions require careful consideration of physical versus paper exposure, storage arrangements, and liquidity requirements. Exchange-traded funds (ETFs) like iShares Silver Trust (SLV) provide convenient exposure but introduce counterparty risks through custodial arrangements and fund management structures. Physical vault storage eliminates counterparty risk while adding storage costs and reducing liquidity flexibility.

Major silver ETFs manage substantial assets, with SLV maintaining approximately $16.2 billion in assets under management according to recent fund disclosures. These vehicles provide market liquidity and price exposure but may face redemption pressures during market stress periods when investors demand physical metal delivery rather than fund shares.

Portfolio Allocation Models for Precious Metals

Currency hedge positioning through precious metals requires understanding correlation patterns between metals prices and currency debasement metrics. Historical analysis suggests gold and silver provide effective inflation hedges during monetary expansion periods, though performance varies based on broader economic conditions and market sentiment factors.

Optimal allocation percentages depend on individual risk tolerance, investment objectives, and broader portfolio composition. Conservative approaches suggest 5-15% precious metals allocations, while more aggressive strategies may involve higher percentages based on monetary system concerns and inflation expectations. Diversification across multiple precious metals can reduce single-commodity concentration risk.

The gold-to-silver ratio insights provide tactical allocation guidance, with historical ranges suggesting optimal switching points between metals. Current ratios above long-term averages may favour silver positioning, while ratios below historical norms could indicate gold preference. This ratio analysis supplements fundamental supply-demand considerations in allocation decisions.

Physical Ownership Versus Paper Claims

Direct physical ownership eliminates counterparty risk but requires secure storage arrangements and insurance coverage. Allocated storage accounts provide specific metal ownership with individual identification, while unallocated accounts represent general claims against pooled inventory. Understanding these distinctions helps investors assess true ownership rights and potential risks during market stress periods.

Storage costs typically range from 0.5-2% annually depending on vault location, security level, and insurance coverage. These costs must be weighed against counterparty elimination benefits and potential liquidity differences between physical and paper positions. Geographic diversification across multiple storage locations can reduce concentration risk from political or operational disruptions.

Private storage options include safe deposit boxes, home safes, and specialised precious metals depositories. Each approach involves different risk-return tradeoffs regarding security, accessibility, insurance coverage, and verification capabilities. Professional storage generally provides superior security and verification services at higher costs than private arrangements.

Historical Currency Reset Patterns and Precious Metals Performance

Currency reset events throughout history demonstrate consistent patterns where precious metals preserve purchasing power during monetary transitions. The 1971 Nixon Shock, which ended dollar-gold convertibility, initiated a decade-long precious metals bull market as investors lost confidence in fiat currency stability. Gold prices increased from $35 per ounce to over $800 by 1980, representing substantial real returns during inflationary periods.

Weimar Germany hyperinflation (1921-1923) provides extreme examples of currency failure and precious metals performance. Citizens who held gold and silver maintained purchasing power while paper currency became worthless, demonstrating metals' function as wealth preservation vehicles during monetary collapse. Similar patterns occurred during various Latin American currency crises throughout the 20th century.

The Silver Thursday Case Study and Market Corners

The Hunt Brothers' silver market manipulation attempt in 1979-1980 demonstrates both the potential and limitations of cornering precious metals markets. Nelson Bunker Hunt and William Herbert Hunt accumulated substantial silver positions through futures contracts and physical purchases, driving prices from $6 to over $48 per ounce before market interventions and rule changes forced liquidation.

Exchange rule modifications during the Hunt Brothers episode included position limits, increased margin requirements, and liquidation-only trading periods that prevented further accumulation. These interventions demonstrated exchange operators' willingness to modify rules during extreme market conditions, though such changes face legal and regulatory constraints in modern markets.

The silver price collapse from $48 to under $15 within months showed how rapidly leveraged positions can unwind when market conditions change. The Hunt Brothers filed for bankruptcy, illustrating risks associated with excessive leverage and concentrated positions in commodity markets. These lessons inform current risk management approaches for precious metals investors.

Modern Market Structure Differences

Contemporary precious metals markets operate under different regulatory frameworks and technological infrastructure compared to historical periods. Electronic trading systems, sophisticated derivatives markets, and global interconnectedness create both opportunities and risks not present during previous currency reset events.

Regulatory oversight has increased substantially since historical manipulation episodes, with position limits, reporting requirements, and surveillance systems designed to prevent market corners. However, these same regulations may prove inadequate during genuine supply shortages or systemic confidence breakdowns that exceed normal market parameters.

Global interconnectedness means local supply disruptions can rapidly propagate across international markets, potentially amplifying volatility and stress conditions. Conversely, geographic diversification provides more alternatives and arbitrage opportunities than existed during historical currency reset periods.

Future Market Scenarios and Risk Assessment

Probability assessment for various silver market scenarios requires analysing multiple converging factors including industrial demand growth, monetary policy trajectories, and geopolitical developments. Conservative scenarios assume gradual supply-demand rebalancing through higher prices and increased production, while more aggressive projections envision rapid repricing events triggered by confidence breakdowns or delivery defaults.

Industrial demand projections suggest continued growth from solar energy adoption, electric vehicle production, and technological applications. The International Energy Agency forecasts substantial increases in clean energy infrastructure requiring significant silver consumption, creating baseline demand support regardless of financial market conditions. Bloomberg reports on how these supply shortage concerns have already contributed to record-breaking silver prices.

Physical Delivery Crisis Probability Assessment

Current stress indicators suggest elevated probability for delivery disruptions across major precious metals exchanges. Backwardation signals, declining registered inventories, and extended delivery timeframes indicate supply tightness that could escalate during confidence breakdowns or coordinated physical demand increases.

System breaking points depend on the percentage of outstanding contracts demanding physical delivery simultaneously. Historical patterns suggest problems emerge when physical demand exceeds 5-10% of outstanding paper positions, though exact thresholds vary based on available inventory and market conditions.

Emergency intervention mechanisms include exchange rule modifications, position limits, cash settlement requirements, and regulatory coordination to maintain orderly markets. However, these interventions may prove inadequate during genuine supply shortages or systemic confidence collapses that exceed normal market parameters.

Price Repricing Event Modeling

Conservative repricing scenarios assume gradual adjustment through higher spot premiums, extended delivery periods, and modest futures price increases. These adjustments would restore supply-demand balance without triggering systemic disruptions or delivery defaults across major exchanges.

Aggressive repricing events could involve rapid price increases of 200-500% or more during short timeframes, similar to historical precedents during currency reset periods or supply squeeze events. Such movements would likely trigger exchange interventions, trading halts, and regulatory responses designed to restore orderly market conditions.

Industrial demand growth modelling suggests sustained upward pressure on silver prices regardless of financial market dynamics. Solar panel installation targets, electric vehicle adoption rates, and technological innovation create baseline consumption levels that must be satisfied at prevailing market prices.

Risk Management and Investment Protection Strategies

Effective precious metals positioning requires diversification across storage methods, geographic locations, and market exposure types. Physical ownership provides direct asset control and counterparty risk elimination, while paper instruments offer liquidity and trading flexibility. Balanced approaches combine both methods based on individual risk tolerance and investment objectives.

Geographic storage diversification reduces concentration risk from political instability, regulatory changes, or operational disruptions affecting specific jurisdictions. International storage options include Switzerland, Singapore, Canada, and various other stable jurisdictions with established precious metals infrastructure and legal frameworks.

Liquidity maintenance becomes crucial during market stress periods when normal trading relationships may breakdown or face extended delays. Maintaining readily accessible positions alongside longer-term storage arrangements provides flexibility for changing market conditions or personal financial requirements.

Timing Market Entry Points and Signal Recognition

Backwardation signals occur when spot prices exceed futures prices, indicating immediate physical supply stress and potential delivery constraints. These conditions typically emerge during supply shortages, increased physical demand, or confidence breakdowns affecting paper market functioning. Monitoring backwardation across different contract months provides early warning indicators.

Spot premium analysis measures the difference between physical metal prices and paper market quotes. Normal premiums range from 2-5% depending on product type and market conditions, while stress levels may involve premiums of 10-20% or higher. Escalating premiums indicate physical supply constraints and potential delivery difficulties.

Central bank buying patterns provide macro-level demand indicators that influence long-term precious metals trends. Furthermore, analysing gold market performance alongside silver can provide broader context for precious metals positioning strategies.

Warning Signs of Market Stress Escalation

Inventory depletion thresholds at major exchanges provide quantitative stress indicators. CME COMEX publishes weekly warehouse inventory reports showing registered and eligible metal quantities. Declining registered inventories suggest reduced available supply for immediate delivery, while total inventory reductions indicate broader supply constraints.

Exchange behaviour pattern recognition involves monitoring rule changes, margin requirement adjustments, position limit modifications, and trading halt implementations. These administrative actions often precede or accompany significant market stress periods and may signal exchange concerns about delivery capacity or market stability.

Confidence breakdown indicators include extended delivery timeframes, cash settlement preferences over physical delivery, and increased spot premiums across multiple geographic markets simultaneously. These symptoms suggest systemic supply constraints rather than localised disruptions that markets can easily resolve. In addition, monitoring the gold price forecast outlook can provide valuable context for understanding broader precious metals market sentiment.

Disclaimer: This analysis contains forward-looking statements and speculative assessments based on current market conditions and historical patterns. Precious metals investments involve substantial risks including price volatility, storage costs, and liquidity constraints. Market conditions can change rapidly, and past performance does not guarantee future results. Investors should conduct independent research and consider professional advice before making investment decisions. The information presented here does not constitute personalised investment recommendations and should not be used as the sole basis for financial decisions.

Looking to Position Yourself Ahead of Market Disruptions?

Discovery Alert's proprietary Discovery IQ model provides instant notifications on significant ASX mineral discoveries, empowering investors to identify actionable opportunities during market volatility when precious metals companies often emerge as key beneficiaries. Explore Discovery Alert's proven track record of identifying major discoveries and begin your 30-day free trial today to secure your competitive advantage in uncertain market conditions.