Strategic Infrastructure Development Transforms West African Mining Landscape

Major infrastructure investments across mineral-rich regions demonstrate how integrated transportation corridors can unlock previously inaccessible deposits while fundamentally altering global commodity supply chains. The Simandou iron ore project in Guinea exemplifies this transformation through its comprehensive approach to mining development and infrastructure integration. Furthermore, the convergence of rail networks, port facilities, and mining operations represents a paradigm shift from traditional extraction models toward comprehensive development strategies that maximise operational efficiency and economic impact.

How Does Simandou's Scale Compare to Global Iron Ore Giants?

The scale of Guinea's Simandou iron ore project in Guinea positions it among the world's most significant mining endeavours, with operational capacity designed to challenge established market leaders. The project's integrated approach combines mining operations with purpose-built transportation infrastructure, creating a vertically integrated supply chain that distinguishes it from conventional mining developments.

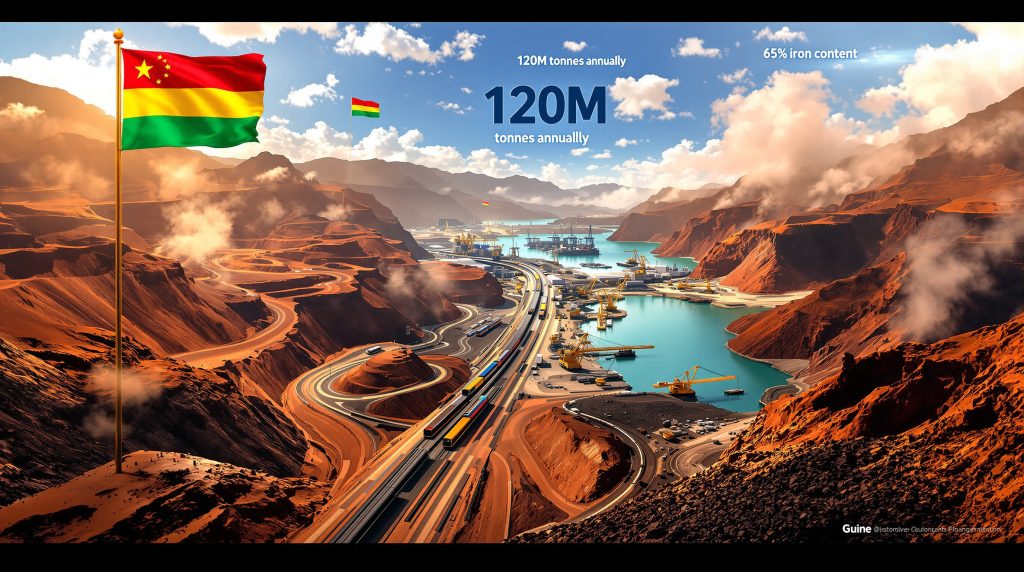

Production Capacity Analysis – 120 Million Tonnes Annually

Simandou's projected annual output of 120 million tonnes of iron ore represents approximately 7-8% of global iron ore demand when fully operational. This capacity places the project in the same category as major Australian and Brazilian operations, though achieving this scale requires coordination across multiple operational components.

The production ramp-up follows a phased approach:

• Phase 1: Initial production targeting 20-30 million tonnes annually

• Phase 2: Expansion to 60-80 million tonnes as infrastructure capacity increases

• Phase 3: Full operational capacity reaching 120 million tonnes annually

Current market dynamics suggest that sustained high-volume production at this scale requires consistent demand from steel-producing regions, particularly China, which consumes approximately 70% of global seaborne iron ore. Additionally, iron ore price trends will significantly influence the project's economic viability.

Reserve Quality Assessment – Superior Grade Advantage

The geological composition of Simandou deposits provides a competitive advantage through higher iron content compared to industry averages. While specific grade percentages vary across different areas of the deposit, the ore quality reduces processing requirements and transportation costs per unit of contained iron.

High-grade iron ore commands premium pricing in global markets due to:

• Reduced energy consumption in steel production processes

• Lower carbon emissions per tonne of steel produced

• Decreased shipping costs per unit of contained iron

• Simplified beneficiation requirements

This quality advantage becomes increasingly valuable as environmental regulations tighten globally and steel producers seek cleaner input materials.

Infrastructure Investment Scale – Multi-Billion Dollar Commitment

The capital commitment for Simandou's integrated infrastructure exceeds $20 billion, distributed across mining operations, railway construction, and port development. This investment scale reflects the project's comprehensive approach to addressing West Africa's infrastructure challenges while establishing long-term operational capacity.

| Infrastructure Component | Scope | Strategic Importance |

|---|---|---|

| Mining Operations | Multi-pit complex | Ore extraction and processing |

| Railway Network | 600+ kilometres | Landlocked deposit access |

| Port Facilities | Deep-water terminal | Export capacity and logistics |

| Supporting Infrastructure | Power, telecommunications | Operational reliability |

Why Are Multiple Nations Competing for Simandou Stakes?

The international consortium structure reflects the strategic importance of securing reliable access to high-quality iron ore resources. Multiple stakeholders bring different capabilities and motivations to the project, creating a complex but potentially more resilient partnership structure. However, this global mining expansion approach requires careful coordination amongst partners.

Chinese Strategic Positioning Through State Enterprises

China's involvement through Chinalco and China Baowu represents a strategic approach to securing raw materials for domestic steel production. These state-owned enterprises bring both financial resources and guaranteed off-take agreements, providing demand certainty for project development.

China's raw materials security strategy encompasses:

• Direct equity participation in overseas mining projects

• Long-term supply agreements with guaranteed volumes

• Infrastructure financing through development banks

• Technology transfer and operational expertise

This approach reduces China's dependence on spot market purchases while securing preferential access to strategic commodities.

Rio Tinto's African Expansion Strategy

Rio Tinto's participation leverages the company's global mining expertise and established marketing networks. The partnership provides technical capabilities and international market access while diversifying Rio Tinto's geographical footprint beyond traditional Australian and South American operations.

For Rio Tinto, Simandou offers:

• Portfolio diversification across multiple continents

• Access to high-grade reserves for long-term production

• Strategic positioning in emerging African markets

• Operational scale to justify infrastructure investments

Guinea's Resource Sovereignty Framework

Guinea's government maintains significant influence over the project through regulatory oversight and revenue-sharing arrangements. The integrated infrastructure model creates lasting economic benefits beyond direct mining revenues, including improved transportation connectivity and industrial development opportunities.

The project structure balances foreign investment with national interests through:

• Government equity participation and revenue sharing

• Local content requirements for goods and services

• Skills development programmes for Guinean workers

• Infrastructure access for non-mining economic activities

What Infrastructure Challenges Did Simandou Overcome?

Developing the Simandou iron ore project in Guinea required solutions to significant logistical challenges, particularly the 600-kilometre distance from mining areas to viable port facilities. The integrated infrastructure approach addresses these challenges through coordinated development of transportation and export facilities.

Railway Engineering Solutions Across Diverse Terrain

The 600-kilometre multi-use rail line traverses varied topographical conditions, requiring engineering solutions for:

• Gradient management in mountainous regions

• Bridge construction across rivers and valleys

• Geological stability in different soil and rock conditions

• Environmental protection through sensitive areas

Railway capacity targets 220 million tonnes annually to accommodate not only Simandou iron ore but also other potential freight traffic, creating a regional transportation corridor that extends beyond mining applications.

Deep-Water Port Development at Forécariah

Port construction in Forécariah prefecture provides the export infrastructure necessary for large-scale iron ore shipments. The deep-water terminal design accommodates large ore carriers while incorporating modern cargo handling technologies.

Port specifications include:

• Large vessel accommodation for efficient shipping

• Automated loading systems to reduce handling time

• Storage facilities for production smoothing

• Expansion capability for future capacity increases

Multi-Use Transportation Corridor Benefits

The transportation infrastructure serves multiple economic functions beyond iron ore exports, creating opportunities for:

• Agricultural product transportation from interior regions

• Import cargo distribution to landlocked areas

• Passenger services connecting rural and urban areas

• Economic development along the railway corridor

This multi-use approach improves the project's economic viability while generating broader developmental benefits for Guinea.

How Will Simandou Reshape Global Iron Ore Markets?

Simandou's market entry introduces a new major supplier to global iron ore markets, potentially affecting pricing dynamics and supply chain patterns. The project's high-grade ore and African location create both opportunities and challenges for existing market participants. Consequently, this development reflects broader mining industry evolution trends.

Supply Chain Diversification Impact

Additional iron ore supply from West Africa provides steel producers with geographic diversification options, potentially reducing dependence on Australian and Brazilian sources. This diversification offers strategic benefits during supply disruptions or geopolitical tensions.

Market diversification benefits include:

• Reduced concentration risk from dominant suppliers

• Alternative shipping routes and logistics options

• Competitive pressure on established producers

• Price stability through increased supply sources

Premium Pricing for High-Grade Materials

Superior ore quality positions Simandou to capture premium pricing relative to lower-grade alternatives. Steel producers increasingly value high-grade inputs that reduce energy consumption and environmental impacts.

Quality premiums reflect:

• Reduced processing costs for steel manufacturers

• Environmental compliance benefits

• Energy efficiency in production processes

• Carbon footprint reduction capabilities

Competition with Established Producers

Simandou's entry challenges existing market leaders to maintain competitiveness through operational improvements and cost reductions. The additional supply may pressure margins for higher-cost producers while benefiting steel manufacturers through increased competition. According to recent analysis, the project represents a significant shift in global supply dynamics.

| Production Timeline | Projected Output | Potential Market Share | Key Development Milestones |

|---|---|---|---|

| 2025-2026 | 20-40 million tonnes | 1.5-2.5% | Operations commencement |

| 2027-2028 | 60-80 million tonnes | 3.5-4.5% | Railway capacity optimisation |

| 2029-2030 | 100-120 million tonnes | 6.5-7.5% | Full operational capacity |

What Economic Benefits Will Guinea Experience?

The Simandou iron ore project in Guinea creates multiple economic benefits extending beyond direct mining revenues. The integrated infrastructure approach generates employment opportunities and enables broader economic development across multiple sectors.

GDP Growth Projections from Mining Revenue

Iron ore exports at full capacity could represent a significant portion of Guinea's total exports, potentially doubling or tripling current export revenues. Government revenue from taxes, royalties, and equity participation provides funding for public investment and development programmes.

Economic impact projections suggest:

• Export revenue of several billion dollars annually

• Government revenues through various taxation mechanisms

• Foreign exchange earnings supporting currency stability

• Investment attraction in related industries and services

Employment Generation Across Value Chain

Direct employment in mining operations, railway management, and port activities creates thousands of jobs across skill levels. Indirect employment in supporting services, suppliers, and related industries multiplies the total employment impact.

Employment categories include:

• Direct mining operations – extraction, processing, transportation

• Infrastructure maintenance – railway, port, equipment servicing

• Support services – catering, security, logistics, administration

• Induced employment – retail, housing, education, healthcare

Infrastructure Development Spillover Effects

The transportation corridor enables economic development beyond mining through improved connectivity between interior regions and coastal areas. Enhanced infrastructure supports agricultural development, trade facilitation, and regional economic integration.

Guinea's emergence as a major iron ore producer represents more than mining expansion. The integrated infrastructure development creates foundations for diversified economic growth and regional connectivity that extends far beyond the mining sector.

Which Technical Innovations Enable Simandou's Success?

Successful operation of Simandou requires advanced technologies across mining, transportation, and export operations. Technical innovations focus on operational efficiency, environmental management, and system integration.

Advanced Ore Processing Methods

High-grade ore processing employs modern beneficiation techniques to maximise recovery rates while maintaining product quality. Processing technologies include:

• Crushing and screening systems for size optimisation

• Magnetic separation for iron content enhancement

• Flotation processes for impurity removal

• Quality control systems for consistent product specifications

Environmental Management Systems

Environmental protection requires comprehensive monitoring and mitigation systems addressing air quality, water management, and ecosystem protection. Furthermore, mine reclamation innovation plays a crucial role in sustainable operations. Technologies include:

• Dust suppression systems for air quality maintenance

• Water treatment facilities for discharge management

• Ecosystem monitoring through environmental sensors

• Restoration technologies for post-mining land rehabilitation

Logistics Optimisation Technologies

Integrated logistics management coordinates mining output, railway capacity, and port operations through advanced planning and control systems:

• Production scheduling software for mine planning

• Railway traffic management for efficient transportation

• Port operations planning for vessel scheduling

• Inventory management systems for product storage

What Geopolitical Implications Emerge from Simandou?

Simandou's development occurs within broader geopolitical contexts involving China-Africa relationships, Western mining company strategies, and regional economic integration initiatives. The project's international character creates both opportunities and complexities.

China-Africa Resource Partnership Evolution

Chinese involvement in Simandou exemplifies evolving China-Africa economic relationships, moving beyond traditional development aid toward direct investment in strategic industries. This approach provides mutual benefits while creating interdependencies.

Partnership characteristics include:

• Equity investment rather than loan-based financing

• Technology transfer and capacity building

• Long-term supply agreements ensuring market access

• Infrastructure development with multiple-use benefits

Western Mining Company Strategic Responses

Rio Tinto's participation demonstrates how Western companies adapt to changing global mining landscapes by partnering with Chinese enterprises and African governments. This collaborative approach balances competition with cooperation.

Strategic considerations include:

• Market access through partnership arrangements

• Risk sharing across multiple stakeholders

• Technology integration combining different expertise

• Regulatory compliance across multiple jurisdictions

Regional Economic Integration Opportunities

Simandou's transportation infrastructure creates opportunities for broader West African economic integration through improved connectivity and trade facilitation. Regional benefits extend beyond Guinea's borders.

How Does Simandou Address Sustainability Concerns?

Modern mining operations face increasing scrutiny regarding environmental and social impacts. Simandou's development incorporates sustainability measures addressing climate change, biodiversity protection, and community development.

Carbon Footprint Reduction Strategies

Carbon emission management encompasses:

• Energy efficiency improvements in operations

• Renewable energy integration where feasible

• Transportation optimisation to reduce fuel consumption

• Process improvements reducing overall energy requirements

Community Development Programmes

Social sustainability requires ongoing engagement with local communities through:

• Education and training programmes for local residents

• Healthcare facility development and support

• Infrastructure improvements in nearby communities

• Economic opportunity creation beyond direct employment

Environmental Monitoring Frameworks

Comprehensive environmental protection requires:

• Biodiversity conservation in sensitive areas

• Water resource protection and management

• Air quality monitoring and improvement

• Waste management and recycling programmes

What Market Scenarios Could Impact Simandou's Future?

Long-term mining projects face various market uncertainties requiring adaptive strategies. Simandou's success depends on navigating commodity price cycles, trade policy changes, and technological developments.

Steel Demand Fluctuation Responses

Global steel demand varies with economic cycles, infrastructure spending, and manufacturing activity. Simandou's high-grade ore provides some protection during demand downturns through quality premiums.

Demand scenarios include:

• Economic growth periods driving increased steel consumption

• Infrastructure investment cycles creating sustained demand

• Manufacturing relocations affecting regional demand patterns

• Green transition requirements favouring high-grade inputs

Trade Policy Risk Mitigation

International trade policies affect mining operations through tariffs, sanctions, and bilateral agreements. Diversified ownership structure provides some protection against unilateral policy changes.

Policy considerations include:

• Trade agreement changes affecting market access

• Sanctions regimes impacting business relationships

• Environmental regulations affecting operational requirements

• Investment policies in target markets

Technology Disruption Adaptability

Mining industry technologies continue evolving, requiring ongoing adaptation and investment. Simandou's scale provides resources for technology upgrading and process improvements.

Important Investment Disclaimer: The analysis presented regarding Simandou's market impact, production projections, and economic benefits represents forecasts based on current information and industry expectations. Actual results may vary significantly due to market conditions, operational challenges, regulatory changes, and other factors beyond project control. Investors and stakeholders should conduct independent due diligence and consider multiple scenarios when evaluating mining project investments.

Understanding Simandou's Strategic Importance – Key Questions Answered

What makes Simandou's iron ore superior to global competitors?

Simandou's high iron content significantly exceeds industry averages, reducing steel production costs and carbon emissions. The superior grade commands premium pricing while offering environmental benefits to steel manufacturers seeking cleaner input materials.

How does the integrated infrastructure model create operational advantages?

The mine-to-port integrated system eliminates third-party logistics dependencies, ensuring cost control and supply reliability. Direct control over the entire value chain from extraction to export reduces operational risks and maximises efficiency.

What primary risks could affect Simandou's operational success?

Key operational risks include political stability maintenance, commodity price volatility management, infrastructure maintenance requirements, and environmental compliance across multiple jurisdictions. The international partnership structure provides some risk mitigation through stakeholder diversification.

How does Simandou's development timeline compare to similar projects?

Large-scale integrated mining developments typically require 5-10 years from initial investment to full operational capacity. Simandou's timeline reflects the complexity of coordinated infrastructure development across mining, railway, and port construction.

What makes the 600-kilometre railway economically viable?

Railway viability depends on sustained high-volume throughput and multi-use applications beyond iron ore transport. The infrastructure serves agricultural products, import distribution, and passenger services, improving overall economic returns.

Investment Implications for Mining Sector Stakeholders

Simandou's development creates ripple effects across global iron ore markets, affecting established producers, steel manufacturers, and investors. Understanding these implications helps stakeholders position for changing market dynamics.

Portfolio Diversification Opportunities

Mining investors gain exposure to African iron ore production through direct investment or supplier relationships. Geographic diversification reduces concentration risks while potentially capturing growth premiums in emerging markets.

Supply Chain Security Considerations

Steel manufacturers benefit from additional supply sources reducing dependence on established suppliers. Long-term supply agreements with Simandou provide price stability and delivery security for strategic planning.

Long-Term Commodity Price Forecasting

Additional high-grade supply entering the market affects pricing dynamics for premium iron ore products. Investors should consider supply increases when modelling long-term commodity price scenarios and investment returns.

The Simandou iron ore project in Guinea represents a transformative development in global mining, featuring integrated infrastructure designed to unlock one of the world's largest untapped iron ore deposits. With projected annual exports reaching 120 million tonnes through coordinated mining, railway, and port operations, the project establishes new benchmarks for large-scale resource development while creating lasting economic impacts across West Africa.

Readers interested in comprehensive African mining developments can explore additional educational resources about large-scale infrastructure projects and their economic impacts on emerging markets through reputable mining industry publications and development finance institutions.

Looking to Capitalise on Major Mining Discoveries?

Discovery Alert's proprietary Discovery IQ model instantly identifies significant ASX mineral discoveries, transforming complex announcements into actionable trading opportunities before the broader market reacts. Explore how historic mineral discoveries have generated substantial returns for early investors, then begin your 30-day free trial to position yourself ahead of the next major breakthrough.