Sims Ltd recycling metals operations represent a cornerstone of Australia's circular economy infrastructure, demonstrating how sophisticated material recovery systems can transform industrial waste streams into valuable resources. The company has evolved from humble beginnings in 1917 to become a global leader in metal recovery, processing over 7 million tonnes of material annually across more than 130 facilities worldwide. Furthermore, their operations span continents while maintaining technological excellence that achieves recovery rates exceeding 90% for many material streams.

Understanding Australia's Largest Metal Recovery Operation

Modern industrial economies depend on sophisticated material recovery systems to transform waste streams into valuable resources. The metal recycling sector represents a critical component of this infrastructure, processing millions of tonnes of discarded materials annually through advanced mechanical and chemical separation technologies.

In Australia, one company has evolved from humble origins into a dominant force across this sector, establishing processing networks that span continents and handle diverse waste streams. Founded in 1917 as a small scrap-metal operation in Sydney, this enterprise has grown to process over 7 million tonnes of material annually across more than 130 facilities worldwide.

The transformation from basic scrap collection to integrated circular economy services reflects broader shifts in how societies approach resource management. Today's metal recycling operations employ sophisticated waste management solutions including dense media separation, automated sorting systems, and precision shredding equipment to achieve recovery rates exceeding 90% for many material streams.

Processing Capacity and Geographic Distribution

Global metal recycling networks require strategic facility placement to optimise collection efficiency and minimise transportation costs. Sims Ltd recycling metals operations demonstrate this principle through their distributed processing model across three primary regions.

The company's Australia and New Zealand operations handle approximately 2.1 million tonnes annually, serving local steel mills while maintaining export capabilities to Asian markets. This regional network benefits from proximity to mining-intensive economies that generate substantial industrial waste streams.

North American facilities represent the largest segment of processing capacity at 4.2 million tonnes annually. These operations primarily serve Electric Arc Furnace (EAF) steel mills and foundries throughout the United States and Canada, capitalising on the region's expanding secondary steel production capacity.

Additional markets contribute 0.7 million tonnes of processing capacity, focusing on specialty metal recovery and international trading activities. This geographic diversification provides operational resilience against regional market downturns while capturing arbitrage opportunities in global commodity markets.

Advanced Shredding and Separation Technologies

Modern metal recovery facilities employ cascading technology systems designed to maximise material extraction from complex waste streams. The initial processing stage typically involves industrial shredding equipment capable of reducing bulky scrap materials into uniform fragments suitable for downstream separation.

Shredding systems achieve recovery rates between 85-92% while producing high-grade metal fragments that meet furnace input specifications. These machines process everything from automotive hulks to industrial equipment, creating standardised particle sizes that enable efficient separation.

Following size reduction, magnetic sorting systems extract ferrous materials with recovery rates reaching 95-98%. Electromagnetic separation technology can process both shredded and pre-sorted material streams, producing steel-ready materials with minimal contamination levels.

Dense Media Separation (DMS) represents the most sophisticated stage of the recovery process, utilising heavy liquid suspension mediums to separate materials based on specific gravity differences. This technology achieves 90-95% recovery rates for non-ferrous metals including copper, aluminium, and brass alloys.

Quality Control Standards for Recycled Materials

End-user specifications for recycled metals demand consistent quality standards that meet or exceed virgin material properties. Quality assurance programmes monitor contamination levels, alloy composition, and physical characteristics throughout the processing chain.

Laboratory testing protocols verify metal purity levels, chemical composition, and mechanical properties before shipment to customers. These standards ensure compatibility with Electric Arc Furnace operations that utilise up to 90% recycled content in steel production.

Traceability systems track material origins and processing history, enabling quality control managers to identify contamination sources and optimise separation efficiency. This documentation proves essential for customers requiring certified recycled content for sustainability reporting purposes.

What Makes Sims Ltd's Recycling Methods Industry-Leading?

Competitive advantages in metal recycling emerge from operational efficiency improvements, technology integration, and process optimisation. Leading operators distinguish themselves through superior recovery rates, contamination control, and cost management across diverse material streams.

The integration of multiple separation technologies creates synergistic effects that maximise value recovery from complex waste streams. Rather than relying on single-technology solutions, sophisticated operations employ sequential processing stages that progressively purify material streams, which has become critical for the ongoing sustainability transformation across industrial sectors.

Dense Media Separation for Non-Ferrous Recovery

Dense Media Separation technology utilises precisely controlled suspension mediums to achieve gravity-based separation of materials with different specific densities. This process proves particularly effective for recovering valuable non-ferrous metals from mixed waste streams.

The technology operates by immersing shredded materials in heavy liquid solutions with densities calibrated to specific separation requirements. Non-ferrous metals with higher specific gravities sink through the medium, while lighter contaminants float to the surface for removal.

Recovery efficiency reaches 90-95% for most non-ferrous applications, with the ability to process materials containing complex alloy mixtures. This capability proves essential for recovering copper wiring from automotive waste or aluminium components from electronic equipment.

Process control systems monitor medium density, flow rates, and separation parameters in real-time, enabling operators to optimise recovery rates based on feed material characteristics. These automated systems reduce operator dependency while maintaining consistent separation performance.

Mechanised Sorting Systems and Automation

Advanced sorting technologies integrate optical sensors, artificial intelligence, and robotic handling systems to identify and separate materials based on multiple characteristics simultaneously. These systems process material streams at speeds exceeding manual sorting capabilities while maintaining superior accuracy.

Optical sorting equipment employs near-infrared spectroscopy and visible light analysis to identify material composition and surface characteristics. Machine learning algorithms continuously improve identification accuracy based on processing history and operator feedback.

Robotic sorting systems utilise computer vision and mechanical handling equipment to physically separate identified materials into designated collection streams. These systems operate continuously without fatigue-related performance degradation that affects manual sorting operations.

Air classification systems employ controlled airflow patterns to separate materials based on aerodynamic properties. Light materials such as plastics and paper are removed from heavier metal streams, reducing contamination in final products.

Bulk Processing Through Shearing and Baling

Large-scale material handling requires specialised equipment designed to process oversized items that exceed standard shredding capacity. Industrial shearing equipment cuts through heavy structural materials, thick-walled vessels, and reinforced components using hydraulic cutting systems.

Baling operations compress processed materials into standardised package sizes that optimise transportation efficiency and storage requirements. High-density baling reduces shipping costs per unit of material while facilitating mechanical handling at customer facilities.

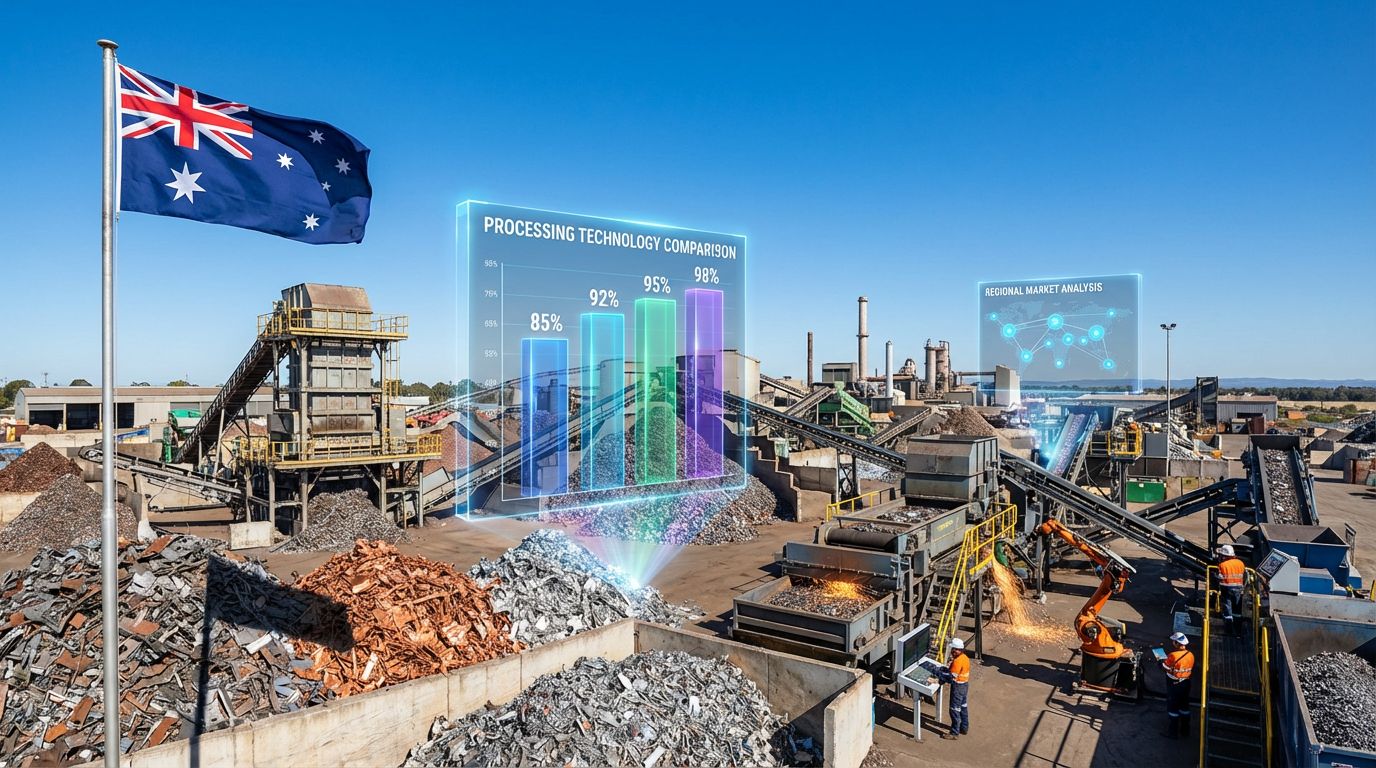

Processing Technology Comparison

| Technology Type | Purpose | Recovery Rate | End Product Quality |

|---|---|---|---|

| Shredding Systems | Size reduction | 85-92% | High-grade fragments |

| Dense Media | Metal separation | 90-95% | Pure metal streams |

| Magnetic Sorting | Ferrous extraction | 95-98% | Steel-ready material |

| Optical Sorting | Material identification | 88-94% | Contamination-free streams |

Load balancing systems coordinate material flow between processing stages, preventing bottlenecks that reduce overall facility throughput. These systems monitor inventory levels at each processing stage and adjust feed rates to maintain optimal equipment utilisation.

Which Industries Rely on Sims Ltd's Recycled Metal Output?

The demand structure for recycled metals reflects the evolving landscape of global manufacturing, with particular concentration in steel production, foundry operations, and specialty manufacturing applications. Understanding customer requirements proves essential for optimising processing operations and maintaining competitive positioning.

Electric Arc Furnace steel production represents the largest consumer segment for recycled ferrous materials. These facilities utilise recycled content rates approaching 90%, compared to traditional blast furnace operations that typically incorporate 25-30% recycled materials.

Electric Arc Furnace Steel Mills as Primary Customers

EAF technology enables steel producers to manufacture high-quality products using predominantly recycled feedstock, creating consistent demand for processed scrap materials. This production method generates significantly lower carbon emissions compared to integrated steel mill operations using virgin iron ore.

Global steel production currently incorporates approximately 30% recycled materials, with EAF capacity expanding rapidly in response to decarbonisation mandates and economic advantages. Industry innovation trends suggest EAF capacity could reach 50% of global steel production by 2030, potentially increasing scrap demand by 40%.

Regional EAF expansion varies significantly based on local energy costs, environmental regulations, and raw material availability. North American and European markets demonstrate particularly strong EAF adoption rates, while emerging markets maintain higher reliance on integrated steel production methods.

Customer specifications for EAF feedstock emphasise consistent chemical composition, minimal contamination levels, and standardised physical characteristics. Meeting these requirements necessitates sophisticated quality control systems and reliable supply chain management.

Foundry Operations and Specialty Manufacturers

Foundry operations represent a distinct customer segment with specialised requirements for specific alloy compositions and material properties. These facilities produce castings for automotive, aerospace, and industrial equipment applications using carefully controlled metal chemistry.

Non-ferrous foundries require precise alloy specifications for aluminium, copper, and brass applications. Recycled materials must meet stringent purity standards to ensure consistent mechanical properties in finished castings.

Investment casting operations demand particularly high material quality for aerospace and medical device applications. These customers often pay premium prices for recycled materials that meet aerospace specifications and traceability requirements.

Specialty manufacturing applications include producers of electrical components, plumbing fixtures, and decorative hardware. These markets value consistent material availability and customised processing services that meet specific application requirements.

International Export Markets and Trading Networks

Global commodity trading creates arbitrage opportunities for recycled materials based on regional supply-demand imbalances and transportation economics. Export markets provide demand flexibility that reduces dependence on domestic consumption patterns.

Asian steel markets represent significant export opportunities, particularly for Australian and North American recycling operations. These markets benefit from geographic proximity to major steel-producing regions with growing EAF capacity.

Regional Market Analysis

| Region | Processing Capacity | Primary Output | Key Customers |

|---|---|---|---|

| Australia/NZ | 2.1M tonnes | Ferrous/Non-ferrous | Local steel mills, exports |

| North America | 4.2M tonnes | Shredded steel | EAF mills, foundries |

| Other Markets | 0.7M tonnes | Specialty metals | International traders |

Trade relationships require long-term contracts that provide supply security while managing commodity price volatility. Successful export operations maintain diversified customer bases that reduce concentration risk from individual market downturns.

How Does Metal Recycling Economics Drive Profitability?

The economic model underlying metal recycling operations involves complex interactions between raw material acquisition costs, processing expenses, commodity price volatility, and operational efficiency metrics. Understanding these dynamics proves essential for evaluating investment opportunities and operational performance.

Revenue generation depends heavily on commodity market conditions that fluctuate based on global economic cycles, supply-demand imbalances, and geopolitical factors. Sims Ltd recycling metals operations generated $7.5 billion in revenue during fiscal year 2025, demonstrating the substantial scale of modern recycling enterprises.

Raw Material Acquisition Costs vs. Processing Margins

Ferrous metal recycling contributed $4.5 billion or 60% of total revenue, while non-ferrous operations generated $2.5 billion representing 33% of revenue streams. The remaining 7% originated from IT recycling and secondary processing services that achieved 22% growth during the reporting period.

Acquisition costs vary significantly based on material type, geographic location, and competitive dynamics in collection markets. Dense urban markets typically command higher scrap prices due to collection competition, while industrial waste streams may offer more predictable pricing through long-term contracts.

Processing margins depend on operational efficiency, technology deployment, and scale advantages that reduce unit processing costs. Facilities with higher throughput capacity typically achieve lower per-unit processing costs through fixed cost absorption and labour productivity improvements.

Transportation economics significantly impact overall profitability, particularly for bulky materials with relatively low value-to-weight ratios. Strategic facility location near both collection sources and end customers reduces logistics costs while improving service levels.

Commodity Price Volatility and Hedging Strategies

Commodity price cycles create substantial earnings volatility for recycling operations, with steel prices fluctuating based on global economic conditions, Chinese production levels, and inventory cycles. Ferrous markets proved challenging during fiscal 2025 due to steel oversupply and soft macroeconomic conditions.

Despite market headwinds, underlying EBIT increased substantially during fiscal 2025, demonstrating the effectiveness of operational diversification and efficiency improvements. This performance occurred while statutory EBIT declined to approximately 50% of prior year levels, primarily due to asset sale gains recorded in fiscal 2024.

Risk management strategies include inventory management, forward sales contracts, and financial hedging instruments that reduce exposure to short-term price volatility. Successful operators balance inventory levels to capture favourable price movements while avoiding excessive carrying costs.

Working capital management proves critical during volatile market conditions, as inventory values can fluctuate significantly between acquisition and sale. Efficient operations maintain inventory turnover rates that minimise exposure to adverse price movements.

Operational Efficiency Metrics and Cost Management

Profitability recovery to $83.1 million net profit from prior year losses demonstrates the impact of operational improvements and portfolio optimisation. Dividend payments more than doubled year-over-year, reflecting management confidence in sustainable earnings generation.

Key Financial Metrics: Sims Ltd processes over 7 million tonnes of material annually across 130+ facilities, generating approximately $7.5 billion in revenue with margins heavily dependent on global steel demand cycles.

Capital allocation discipline emphasises investments in processing efficiency, logistics optimisation, and capacity expansion in strategic locations. This approach positions operations to better handle commodity price volatility while improving competitive positioning.

Portfolio simplification included closing non-performing assets such as UK metal recycling operations, enabling management focus on higher-return activities. These strategic decisions demonstrate commitment to operational excellence over pure scale expansion.

Analyst expectations project revenue growth to $8.0 billion in fiscal 2026 and $8.3 billion in fiscal 2027, with P/E ratios declining from 20.8x to 15.3x over the forecast period. Current analyst price targets of $14.95 compare to recent trading levels near $16.96, suggesting potential valuation adjustments.

What Role Does Electronics Recycling Play in Sims' Portfolio?

The diversification into electronics recycling represents a strategic evolution beyond traditional metal recovery, addressing growing volumes of end-of-life electronic equipment while capturing higher-value materials and specialised service revenues. This segment demonstrates different economic characteristics compared to bulk metal processing operations.

Electronic waste streams contain precious metals including gold, silver, platinum, and palladium in concentrations often exceeding natural ore deposits. Recovery of these materials requires specialised processing technologies and strict environmental controls that create barriers to entry for smaller operators.

IT Asset Disposition and Data Security Services

Data security services provide enterprise customers with certified destruction of sensitive information stored on electronic devices. This service category commands premium pricing due to regulatory compliance requirements and liability considerations that extend beyond simple material recovery.

Asset disposition services include equipment refurbishment, component harvesting, and material recovery optimisation. These services create multiple revenue streams from individual devices while extending product lifecycles through component reuse programmes.

Certification programmes ensure compliance with environmental regulations, data protection laws, and industry standards for electronic waste processing. Maintaining these certifications requires ongoing investment in training, equipment, and process documentation that smaller competitors may find economically challenging.

Corporate sustainability programmes increasingly require certified electronic waste disposal as part of environmental, social, and governance (ESG) reporting initiatives. This demand driver creates relatively stable revenue streams that prove less sensitive to commodity price fluctuations.

Precious Metal Recovery from Electronic Components

Circuit board processing requires sophisticated technology to separate precious metals from complex electronic assemblies containing multiple material types. Recovery rates for precious metals typically exceed 85% using specialised hydrometallurgical and pyrometallurgical processes.

Gold recovery from electronic components averages 300-400 grams per tonne of processed material, compared to typical gold ore grades ranging from 1-5 grams per tonne. This concentration advantage makes electronic waste an increasingly attractive feedstock for precious metal recovery operations.

Silver content in electronic waste often exceeds 3,000 grams per tonne, primarily from electrical contacts, circuit traces, and photovoltaic cells. Recovery of these materials requires specialised leaching processes that differ significantly from traditional silver mining operations.

Palladium and platinum concentrations in catalytic converters and electronic components create additional value streams that benefit from automotive recycling integration. These materials command premium prices due to supply constraints and growing industrial demand.

Circular Economy Integration Beyond Traditional Metals

Rare earth element recovery from electronic waste addresses supply chain vulnerabilities in critical materials essential for renewable energy technologies. These materials prove difficult to mine and refine, making recycling increasingly important for supply security.

Lithium-ion battery recycling represents a rapidly growing market opportunity as electric vehicle adoption accelerates and energy storage systems reach end-of-life. Recovery of lithium, cobalt, and nickel from spent batteries creates new revenue streams while addressing waste disposal challenges, particularly through advanced battery recycling process technologies.

Plastic recovery from electronic waste provides feedstock for manufacturing new electronic components, creating closed-loop material cycles that reduce virgin material requirements. Advanced sorting technologies enable separation of different plastic types with purities suitable for remanufacturing applications.

Component refurbishment extends product lifecycles by harvesting functional components for resale or remanufacturing applications. This approach maximises value recovery by prioritising reuse over material recovery when economically advantageous.

How Do Global Steel Market Dynamics Affect Operations?

The interconnected nature of global steel markets creates complex demand patterns that significantly influence recycling operations through price signals, capacity utilisation, and technological adoption trends. Understanding these relationships proves essential for strategic planning and operational optimisation.

Chinese steel production represents approximately 50% of global output, creating substantial influence over international scrap markets through demand fluctuations and export activities. Production policy changes in China can rapidly affect global scrap pricing and availability across all regions.

Electric Arc Furnace Growth Trends Worldwide

EAF capacity expansion continues accelerating globally, driven by economic advantages and environmental considerations that favour recycled steel production. This technology requires 90% recycled content compared to 30% for integrated steel mills using blast furnace technology.

Energy efficiency improvements in EAF technology reduce operating costs while improving environmental performance. Modern EAF systems consume approximately 60% less energy per tonne compared to integrated steel production, creating competitive advantages in markets with high energy costs.

Capital cost advantages enable EAF mills to achieve shorter construction timelines and lower initial investments compared to integrated steel plants. This flexibility allows rapid capacity adjustments in response to market conditions while maintaining competitive cost structures.

Regional adoption patterns vary based on local energy costs, environmental regulations, and raw material availability. European and North American markets demonstrate highest EAF adoption rates, while developing economies maintain greater reliance on integrated production methods.

Chinese Steel Production Impact on Scrap Demand

Production capacity adjustments in China create ripple effects throughout global scrap markets due to the scale of Chinese steel operations. Policy-driven production curtailments or expansions rapidly influence international scrap pricing and trade flows.

Export competitiveness of Chinese steel products affects domestic demand for scrap materials by influencing capacity utilisation rates at Chinese steel mills. Periods of high export activity typically correlate with increased scrap consumption and higher international pricing.

Environmental policies in China increasingly favour EAF production over blast furnace operations, potentially creating substantial new demand for recycled materials. These policy shifts could fundamentally alter global scrap trade patterns and pricing structures.

Infrastructure development cycles in China drive domestic steel consumption patterns that affect global supply-demand balances. Major infrastructure programmes create sustained demand periods, while completion cycles may generate temporary overcapacity situations.

Decarbonisation Policies Driving Recycled Content Requirements

Carbon reduction mandates increasingly favour recycled steel production due to substantially lower emissions compared to virgin steel manufacturing. EAF steel production generates approximately 75% fewer carbon emissions than integrated steel mill operations.

Regulatory frameworks in developed markets increasingly mandate minimum recycled content percentages in construction materials and manufactured goods. These requirements create stable demand foundations that prove less sensitive to economic cycles.

Corporate sustainability commitments drive demand for certified recycled materials as companies seek to reduce scope 3 emissions associated with raw material consumption. This trend creates premium pricing opportunities for recycled materials with verified environmental attributes.

Carbon pricing mechanisms make virgin steel production increasingly expensive compared to recycled alternatives, creating structural cost advantages for EAF operations using recycled feedstock. These policy trends appear likely to accelerate rather than reverse over time.

What Investment Factors Should Investors Consider?

Investment evaluation in metal recycling operations requires understanding of cyclical business patterns, capital allocation strategies, and diversification benefits that distinguish leading operators from commodity-dependent enterprises. The sector presents both attractive structural trends and significant volatility challenges.

Market capitalisation exceeding $3 billion positions the company among larger ASX industrial enterprises, providing liquidity advantages while requiring institutional-quality operational performance and governance standards.

Cyclical Nature of Commodity-Dependent Business Models

Commodity price exposure creates inherent earnings volatility that requires careful risk management and patient investment approaches. Steel market conditions can shift rapidly based on global economic trends, inventory cycles, and production capacity adjustments.

Revenue correlation with global economic activity means recycling operations typically experience pronounced cycles that mirror broader industrial activity. Strong economic periods drive increased scrap generation and steel demand, while recessions reduce both supply and demand simultaneously.

Working capital requirements fluctuate significantly with commodity prices, as inventory values change rapidly during market transitions. Efficient operations maintain inventory turnover rates that minimise exposure while capturing favourable pricing opportunities.

Margin compression during weak markets tests operational efficiency and financial flexibility. Companies with diversified revenue streams and operational excellence typically outperform pure commodity plays during challenging market conditions.

Capital Allocation Strategy and Asset Optimisation

Disciplined investment in processing efficiency, logistics optimisation, and strategic capacity expansion demonstrates management focus on sustainable returns rather than growth-oriented strategies. This approach typically produces superior long-term results in cyclical industries.

Portfolio optimisation through asset sales and facility closures eliminates underperforming operations while concentrating resources on higher-return activities. Recent UK operations closure exemplifies this strategic approach to capital allocation.

Technology investments in automation, sorting efficiency, and processing capacity create competitive advantages that persist through commodity cycles. These investments typically generate returns through cost reduction and recovery rate improvements rather than volume growth alone.

Acquisition strategies should focus on operational synergies, geographic expansion, or technology enhancement rather than pure scale expansion. Successful acquisitions in recycling typically create value through integration benefits and operational improvements, particularly when leveraging data-driven operations methodologies.

Diversification Benefits from Non-Metal Recycling Segments

Electronics recycling provides revenue streams less correlated with steel market cycles while offering higher margins and more stable demand patterns. 22% growth in non-metal revenues demonstrates the commercial viability of this diversification strategy.

Service-based revenues from IT asset disposition and data security create recurring income streams with predictable cash flow characteristics. These services command premium pricing due to regulatory compliance requirements and specialised expertise barriers.

Precious metal recovery from electronic waste provides exposure to different commodity markets with distinct supply-demand dynamics. Gold, silver, and platinum prices often move independently of steel markets, creating natural hedging benefits.

Circular economy services address growing regulatory requirements and corporate sustainability mandates that create relatively stable demand independent of economic cycles. This positioning proves increasingly valuable as environmental regulations tighten globally.

How Does Environmental Regulation Shape Future Growth?

Regulatory frameworks increasingly drive structural changes in waste management, manufacturing processes, and material sourcing decisions that create sustained demand for recycling services. Understanding these policy trends proves essential for evaluating long-term growth opportunities and competitive positioning.

Global decarbonisation initiatives fundamentally favour recycled materials over virgin production due to substantial emission reduction benefits. These policy trends appear irreversible and likely to accelerate rather than moderate over time.

Carbon Reduction Mandates Favouring Recycled Steel

Emission reduction targets in developed economies increasingly mandate lower carbon intensity in manufacturing processes, creating competitive advantages for recycled steel production. EAF steel generates approximately 75% fewer emissions compared to integrated steel mill operations.

Carbon border adjustments proposed in Europe and other markets would impose taxes on high-carbon imports, potentially creating substantial cost advantages for domestic recycled steel production. These policies could fundamentally alter global trade patterns in steel markets.

Corporate emission reduction commitments drive demand for low-carbon materials as companies seek to reduce scope 3 emissions associated with raw material consumption. This trend creates premium pricing opportunities for certified low-carbon recycled materials.

Green building standards increasingly require minimum recycled content percentages in construction materials, creating stable demand foundations independent of economic cycles. These requirements typically include certification and traceability requirements that favour established operators.

Waste Management Policies Creating New Revenue Streams

Extended producer responsibility regulations require manufacturers to finance end-of-life management for their products, creating funded waste streams for recycling operations. These policies typically include collection, processing, and material recovery requirements that generate service revenues.

Landfill diversion mandates prohibit disposal of recyclable materials, effectively creating captive supply streams for recycling operations. These regulations typically include enforcement mechanisms and penalties that ensure compliance and material availability.

Electronic waste regulations require specialised processing and certification for electronic equipment disposal, creating barriers to entry that protect established operators. Data security requirements further increase complexity and service value for corporate customers.

Packaging regulations increasingly mandate recycled content percentages and recyclability standards that drive demand for recovered materials. These requirements typically phase in over multiple years, providing predictable demand growth trajectories.

Sustainability Reporting Requirements and ESG Compliance

Mandatory sustainability reporting requires companies to disclose environmental impact metrics including waste generation, recycling rates, and carbon emissions. These requirements create demand for certified recycling services that provide necessary documentation and verification.

Supply chain transparency mandates require companies to track material origins and processing methods throughout their operations. Recycling operators with robust traceability systems can command premium pricing for materials with verified sustainability attributes.

Investor ESG requirements drive corporate demand for sustainable material sourcing as companies seek to improve environmental ratings and access ESG-focused investment capital. This trend creates relatively stable demand for certified recycled materials.

Regulatory compliance services provide additional revenue opportunities for operators with specialised expertise in environmental regulations and certification processes. These services typically generate higher margins than basic material processing operations.

What Are the Technical Challenges in Metal Recovery?

Advanced metal recovery operations face complex technical challenges that require sophisticated solutions and continuous innovation to maintain competitive performance. Understanding these challenges provides insight into operational complexity and competitive barriers within the industry.

Material complexity in modern waste streams continues increasing as products incorporate diverse alloys, composite materials, and advanced coatings that complicate separation processes. Traditional mechanical separation methods may prove inadequate for recovering valuable materials from these complex assemblies.

Contamination Management and Quality Assurance

Cross-contamination between different material streams reduces recovery efficiency and degrades final product quality. Preventing contamination requires strict process controls, equipment cleaning procedures, and segregated handling systems throughout the processing chain.

Non-metallic contaminants including plastics, rubber, glass, and organic materials must be removed to meet customer specifications for recycled metals. Advanced separation technologies including optical sorting and density separation help address these challenges but require significant capital investment.

Chemical contamination from coatings, lubricants, and industrial processes can render recovered materials unsuitable for specific applications. Quality control testing throughout the processing chain ensures contaminated materials are identified and handled appropriately.

Traceability systems track material sources and processing history to identify contamination sources and optimise separation processes. These systems prove essential for maintaining customer confidence and meeting regulatory requirements for recycled material certification.

Processing Mixed Material Streams Efficiently

Heterogeneous feedstock requires flexible processing systems capable of handling varying material compositions and physical characteristics. Fixed processing configurations may prove inefficient when material streams contain unexpected compositions or contamination levels.

Sorting efficiency becomes increasingly challenging as material streams contain smaller components and more complex alloy compositions. Manual sorting proves economically impractical for high-volume operations, requiring investment in automated identification and separation technologies.

Process optimisation requires real-time adjustment of separation parameters based on feed material characteristics. Advanced control systems monitor material composition and automatically adjust processing conditions to maximise recovery rates.

Quality control systems must provide rapid feedback on separation efficiency and product quality to enable process adjustments during operations. Laboratory testing and inline analysis equipment provide necessary data for operational optimisation.

Technology Upgrades for Higher Recovery Rates

Sensor technology improvements enable more precise material identification and separation decisions. Near-infrared spectroscopy, X-ray fluorescence, and machine vision systems provide enhanced discrimination capabilities for complex material streams.

Artificial intelligence applications optimise sorting decisions based on continuous learning from processing results. Machine learning algorithms improve identification accuracy over time while adapting to changing material stream compositions.

Robotic systems provide precise handling capabilities for complex separation tasks that exceed manual dexterity or prove hazardous for human operators. These systems operate continuously without fatigue-related performance degradation.

Process integration between different separation technologies maximises overall recovery rates by optimising material flow and minimising losses between processing stages. Integrated systems typically achieve higher recovery rates than standalone equipment installations.

How Do Supply Chain Logistics Impact Operational Success?

Efficient supply chain management proves critical for recycling operations due to the geographic distribution of material sources, processing facilities, and end customers. Logistics costs typically represent significant portions of total operating expenses while service levels affect customer relationships and competitive positioning.

Transportation economics significantly influence facility location decisions and operational profitability. Bulk materials with relatively low value-to-weight ratios require optimised logistics networks to maintain competitive cost structures while ensuring reliable service delivery.

Collection Network Optimisation and Transportation Costs

Collection route optimisation reduces transportation costs while improving service levels for material suppliers. Advanced routing software considers traffic patterns, vehicle capacity, material density, and pickup scheduling to minimise total logistics costs.

Vehicle specifications must balance payload capacity with manoeuvrability requirements for urban collection routes. Specialised equipment for handling different material types requires fleet diversity that complicates maintenance and driver training requirements.

Fuel cost management represents significant expense components that require active management through route optimisation, vehicle efficiency improvements, and fuel hedging strategies. Fuel price volatility can substantially affect operational profitability independent of commodity price movements.

Collection scheduling must balance supplier convenience with transportation efficiency to maintain competitive collection pricing while ensuring adequate material flow to processing facilities. Predictable scheduling improves customer relationships and operational efficiency.

Inventory Management for Volatile Commodity Markets

Inventory optimisation requires balancing carrying costs against price appreciation potential during favourable market conditions. Excessive inventory levels create working capital requirements and storage costs while insufficient inventory may prevent capturing favourable pricing opportunities.

Storage capacity constraints limit inventory accumulation during favourable purchasing conditions while inadequate storage may compromise material quality through weather exposure or contamination. Strategic storage investments provide operational flexibility during market volatility.

Material degradation during storage reduces recovery rates and final product quality, particularly for materials susceptible to oxidation or contamination. Proper storage procedures and facility design minimise quality degradation while maintaining inventory flexibility.

Market timing strategies require sophisticated understanding of commodity cycles and price patterns to optimise inventory turnover and margin realisation. Successful operators develop pricing expertise that creates competitive advantages through superior market timing.

Strategic Location Planning for Processing Facilities

Proximity analysis balances transportation costs from material sources against shipping expenses to end customers. Optimal facility locations minimise total logistics costs while maintaining competitive service levels for both suppliers and customers.

Infrastructure requirements including rail access, port facilities, and highway connections significantly influence facility location decisions. Transportation infrastructure quality affects both operating costs and service reliability for customers requiring predictable delivery schedules.

Regulatory considerations vary significantly between jurisdictions and may influence facility location decisions independent of transportation economics. Environmental permitting, zoning restrictions, and operating regulations create location constraints that affect strategic planning.

Labour availability and skill requirements influence facility location decisions particularly for operations requiring specialised technical expertise or large workforce populations. Training costs and labour turnover rates vary significantly between geographic markets.

Scenario Analysis: If global steel production shifts toward 50% EAF capacity by 2030, scrap demand could increase by 40%, potentially benefiting integrated recyclers with established collection networks and processing capabilities.

What Future Opportunities Exist in the Recycling Sector?

Emerging opportunities in recycling reflect evolving technology applications, changing waste stream compositions, and regulatory developments that create new market segments beyond traditional metal recovery. Understanding these trends proves essential for strategic planning and competitive positioning.

Technology convergence between different recycling processes creates opportunities for integrated operations that process diverse waste streams through shared infrastructure. These synergies may provide cost advantages and operational efficiencies unavailable to specialised single-stream operations.

Battery Material Recovery and Critical Mineral Recycling

Lithium-ion battery recycling represents rapidly growing market opportunities as electric vehicle adoption accelerates and energy storage systems reach end-of-life stages. Recovery of lithium, cobalt, nickel, and manganese from spent batteries addresses supply chain vulnerabilities while creating valuable revenue streams.

Critical mineral recovery from electronic waste addresses strategic material supply constraints that affect renewable energy technologies and defence applications. Rare earth elements, cobalt, and lithium command premium prices due to supply concentration risks and growing demand from clean energy applications.

Processing technology development for battery materials requires different approaches compared to traditional metal recovery. Hydrometallurgical processes and controlled atmosphere operations prove essential for recovering battery-grade materials with required purity levels.

Supply chain integration opportunities exist for recycling operators to partner with battery manufacturers and electric vehicle producers. These relationships could provide predictable waste streams while creating demand for recovered materials.

Furthermore, the advancement of recycling technologies enables higher recovery rates and improved material quality that meets increasingly stringent specifications. These technological improvements create competitive barriers that favour established operators with research and development capabilities.

In addition, companies like Sims Metal Management continue to demonstrate how strategic investments in advanced processing technologies and geographic diversification create sustainable competitive advantages in the global recycling market. The company's evolution from traditional scrap metal collection to integrated circular economy services positions it well for capturing emerging opportunities in critical material recovery.

Consequently, the combination of environmental regulations, technological advancement, and supply chain integration creates multiple pathways for growth in the recycling sector. Sims Ltd recycling metals operations exemplify how established operators can leverage existing infrastructure and expertise to capture these emerging opportunities while maintaining leadership positions in traditional metal recovery markets.

Through strategic positioning and operational excellence, leading recycling companies remain well-positioned to benefit from the ongoing transition toward circular economy principles and sustainable manufacturing practices. The sustainability transformation across industrial sectors continues creating demand for sophisticated recycling services that extend far beyond simple material recovery operations.

Looking for Investment Opportunities in Australia's Circular Economy Leaders?

Discovery Alert's proprietary Discovery IQ model identifies emerging opportunities across mining, resources, and industrial sectors, including companies driving Australia's circular economy transformation. Join thousands of investors who receive real-time alerts on significant ASX discoveries and industrial developments, positioning themselves ahead of market movements with actionable insights. Start your 30-day free trial today to gain the market edge you need for both short-term trading opportunities and long-term investment success.