Strategic Capital Access Through Geographic Diversification

Global capital markets face unprecedented complexity as companies navigate fragmented liquidity pools, regulatory variations, and currency fluctuations across multiple jurisdictions. Traditional single-market equity raising strategies increasingly fail to capture the full spectrum of available investment capital, particularly for resource sector companies with international operations and diverse investor bases. The evolution toward sophisticated multi-market capital structures represents a fundamental shift in how companies access and deploy growth capital through dual-market equity raise strategies.

Mining companies particularly benefit from these expanded funding mechanisms, as their operational footprints often span multiple continents while their capital requirements demand access to the deepest possible investor pools. Recent market developments demonstrate how dual-market equity raise structures enable companies to optimise capital costs, enhance liquidity, and align funding sources with operational geography.

Understanding Multi-Exchange Capital Structures

Strategic Capital Access Through Geographic Diversification

Dual-market equity raise represents a sophisticated approach to capital allocation where companies simultaneously access distinct investor ecosystems across multiple stock exchanges. This methodology creates parallel funding channels that transcend traditional geographic and regulatory boundaries, enabling companies to capture capital from diverse risk appetites and investment mandates.

Unlike sequential fundraising approaches that rely on single-market execution followed by expansion, dual-market structures establish concurrent market presence across jurisdictions. Companies maintain separate but coordinated capital raising activities, each tailored to specific regulatory frameworks and investor preferences.

Key Components of Modern Dual-Market Structures:

• Direct dual-listing arrangements maintaining separate legal compliance across markets

• Cross-listing frameworks utilising specialised financial instruments

• Hybrid structures combining elements of multiple approaches

• Concurrent regulatory approval processes across jurisdictions

Each mechanism creates unique investor access patterns while requiring sophisticated coordination across legal, regulatory, and operational frameworks. Furthermore, Firefly's recent success in December 2025 demonstrated this approach through concurrent Canadian and Australian market access, raising A$139 million total capital through coordinated but separate offerings.

Core Mechanisms Driving Multi-Market Capital Access

Companies pursuing dual-market strategies typically employ three primary structural approaches. Direct share issuance across multiple exchanges provides the most straightforward mechanism, enabling companies to issue securities directly to investors in each target market. This approach requires full regulatory compliance in each jurisdiction but offers maximum flexibility in pricing and structure.

Depositary receipt frameworks create alternative pathways for international market access without direct listing requirements. For instance, dual listing arrangements enable domestic investors to purchase foreign securities through familiar trading mechanisms while providing companies access to broader capital pools.

Hybrid structures combine elements of both approaches, creating customised solutions for specific company circumstances. The optimal structure depends on factors including operational geography, investor base preferences, regulatory complexity, and capital deployment requirements.

Strategic Framework Analysis: Capital Optimisation Drivers

Regional Capital Cost Arbitrage and Risk Distribution

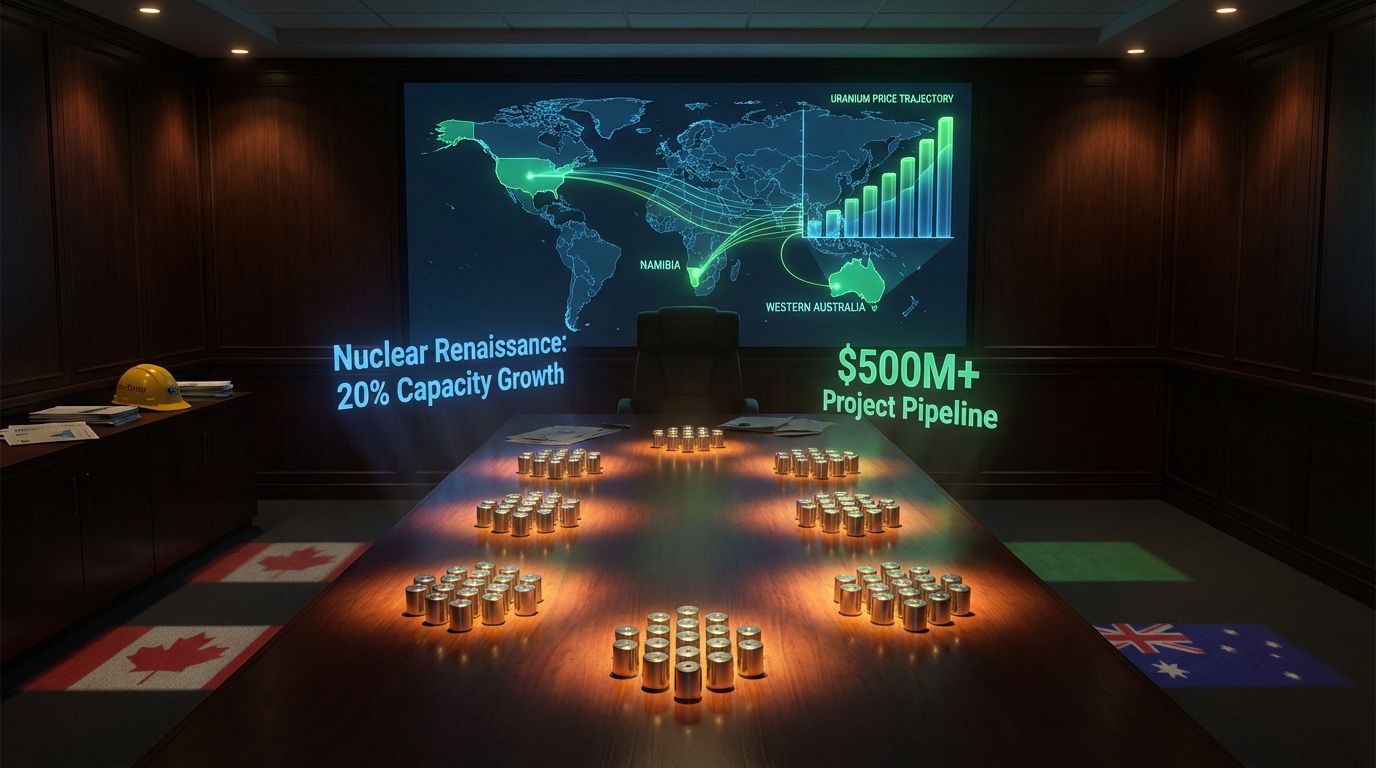

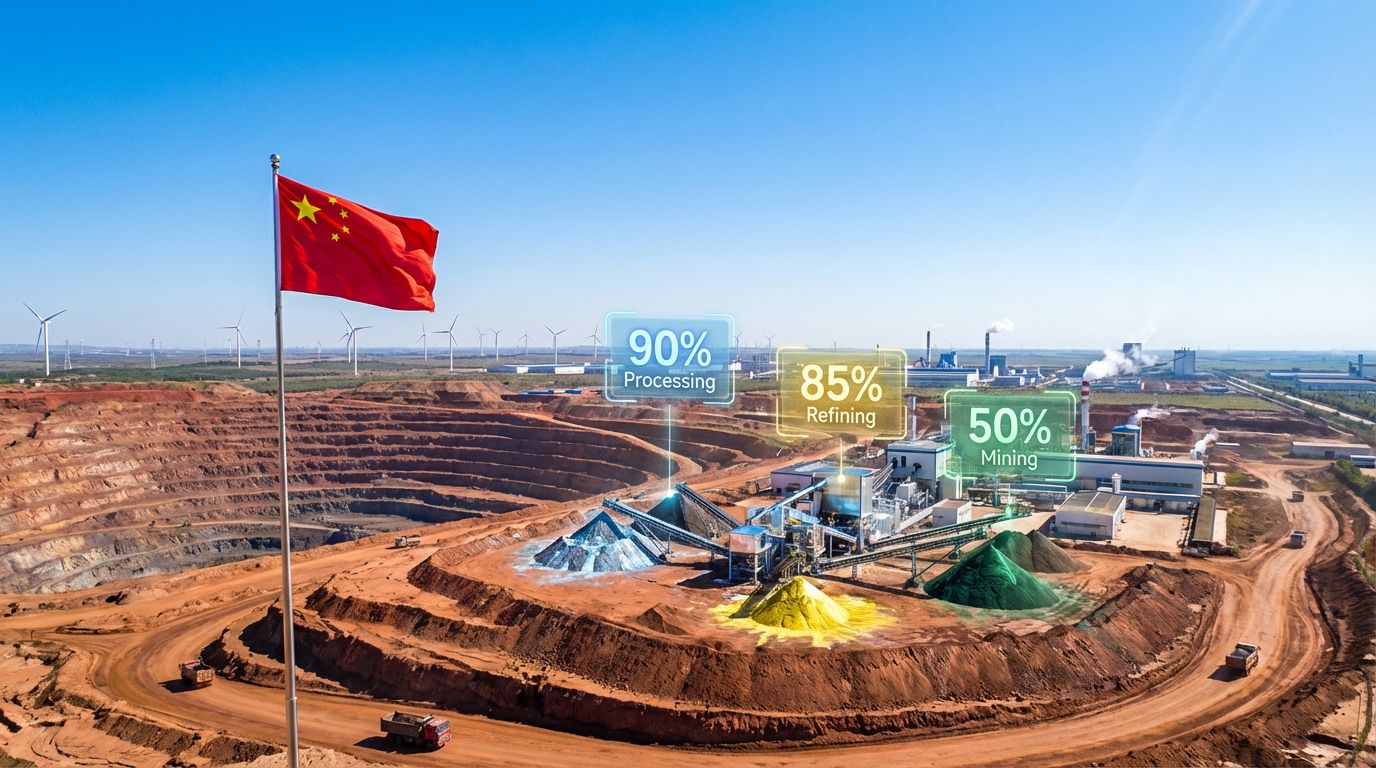

Companies pursue dual-market equity raise strategies primarily to capitalise on regional variations in capital costs, investor risk tolerances, and market liquidity patterns. Different geographic markets exhibit distinct characteristics in terms of sector preferences, valuation methodologies, and return expectations, particularly given the evolving geopolitical mining landscape.

Canadian capital markets often demonstrate strong appetite for resource sector investments, particularly projects with clear development timelines and established resource bases. Australian markets similarly favour resource sector opportunities but with particular emphasis on Asia-Pacific operational exposure and supply chain integration.

The Firefly Metals transaction exemplified this dynamic through its structured approach: C$30 million raised through Canadian bought-deal financing with BMO Capital Markets, while A$101.5 million was accessed through Australian institutional and retail offerings via Canaccord Genuity. This geographic distribution aligned capital sources with operational requirements and investor preferences.

Operational Footprint Alignment and Currency Matching

Resource companies with international operations benefit significantly from aligning capital structures with operational geography. Currency matching enables natural hedging against foreign exchange volatility while reducing translation risks in financial reporting. However, companies must also consider tariffs impact on investment when structuring these arrangements.

Project-Specific Capital Deployment Benefits:

• Canadian dollar capital deployment for Canadian operational expenses

• Natural currency hedging reducing foreign exchange exposure

• Simplified accounting treatment for project expenditures

• Reduced working capital requirements for currency conversion

The Firefly structure demonstrated this alignment through its Green Bay project in Newfoundland, Canada, where Canadian-denominated capital could be deployed directly for early works and underground development without currency conversion requirements.

Operational Mechanics: Execution Coordination

Regulatory Synchronisation Across Multiple Jurisdictions

Executing dual-market equity raises demands precise coordination across distinct regulatory frameworks, each carrying specific disclosure requirements, approval timelines, and compliance standards. Companies must navigate varying prospectus requirements, filing deadlines, and institutional approval processes simultaneously. Additionally, understanding various ASX capital raising methods becomes crucial for Australian market components.

The Firefly transaction illustrated these coordination challenges through its staggered closing schedule: Canadian component targeted December 17, 2025, while Australian components closed December 12, 2025. This five-day differential reflected the different regulatory approval processes and market settlement requirements across jurisdictions.

Critical Coordination Elements:

• Synchronised marketing and roadshow activities across time zones

• Coordinated pricing mechanisms accounting for currency fluctuations

• Parallel legal documentation and regulatory submissions

• Simultaneous underwriter management across markets

Pricing Coordination and Market Timing Challenges

Successful dual-market raises require sophisticated pricing coordination across time zones, market opening hours, and currency fluctuation patterns. Companies typically establish pricing windows that accommodate multiple market schedules while maintaining fair allocation principles across diverse investor bases.

The Firefly Canadian component priced at C$1.56 per share for 19.23 million shares, with a 30-day over-allotment option for up to 15% additional shares. This pricing mechanism provided flexibility for demand accommodation while establishing clear valuation benchmarks for concurrent Australian market pricing.

Currency considerations add significant complexity to pricing coordination. Companies must account for real-time exchange rate movements during pricing periods and establish mechanisms for maintaining valuation consistency across markets despite currency volatility.

Financial Engineering: Cross-Border Instrument Design

Direct Share Issuance Versus Depositary Instruments

| Approach | Regulatory Complexity | Investor Accessibility | Cost Structure | Liquidity Impact |

|---|---|---|---|---|

| Direct Share Issuance | High (Multiple jurisdictions) | Maximum (Direct market access) | Moderate (Dual compliance) | Enhanced (Multiple markets) |

| Depositary Receipts | Moderate (Home + depositary) | Good (Familiar instruments) | Higher (Depositary fees) | Concentrated (Single market) |

| Hybrid Structures | Variable | Customisable | Complex | Market-dependent |

The Firefly transaction employed direct share issuance across both Canadian and Australian markets rather than depositary receipt structures. This approach provided maximum market accessibility while requiring coordination across separate regulatory frameworks.

Currency Hedging and Natural Risk Mitigation

Dual-market structures create inherent currency diversification, enabling companies to match revenue currencies with funding currencies where operationally feasible. This alignment reduces foreign exchange exposure while providing flexibility in capital deployment across international operations. Furthermore, implementing effective market volatility hedging strategies becomes essential.

Multi-Currency Capital Benefits:

• Natural hedging against single-currency exposure

• Operational currency matching for project expenditures

• Reduced foreign exchange transaction costs

• Enhanced financial reporting stability

The Firefly structure exemplified this through Canadian dollar capital (C$30 million) aligned with Canadian operational requirements, while Australian dollar components (A$101.5 million) provided flexibility for corporate activities and additional project support.

Investor Psychology and Market Dynamics

Behavioural Finance Factors in Multi-Market Investing

Different investor bases exhibit varying risk tolerances, return expectations, and sector preferences based on geographic location and market experience. North American investors often emphasise operational efficiency metrics and near-term production potential, while Australian investors may prioritise resource base quality and Asia-Pacific market access.

The Firefly transaction structure reflected these differences through its component design:

• Canadian bought-deal structure appealing to risk-averse institutional investors seeking certainty

• Australian institutional placement targeting sophisticated investors comfortable with resource sector exposure

• Charity flow-through component (A$16.5 million) designed for tax-motivated investor segments

• Retail share purchase plan providing access for smaller Australian and New Zealand investors

Liquidity Enhancement Through Market Fragmentation

Paradoxically, distributing equity across multiple markets often enhances overall liquidity by creating diverse trading patterns, extended trading hours, and varied investor participation cycles. This geographic distribution can result in improved price discovery and reduced bid-ask spreads through increased market maker participation.

Multiple market presence also provides resilience against regional market disruptions, enabling continued trading and capital access when individual markets experience volatility or closure events.

Cost-Benefit Analysis: Economic Implications

Direct Implementation and Compliance Costs

| Cost Category | Annual Impact Range | Key Components |

|---|---|---|

| Regulatory Compliance | $500,000 – $2,000,000 | Filing fees, legal counsel, audit requirements |

| Exchange Listing Fees | $100,000 – $500,000 | Initial listing, ongoing maintenance fees |

| Investor Relations | $300,000 – $1,000,000 | Multi-market roadshows, communication programmes |

| Administrative Systems | $200,000 – $800,000 | Dual reporting infrastructure, specialised staff |

These cost ranges reflect typical mid-cap resource company implementations. Larger companies may experience higher absolute costs but better cost efficiency through economies of scale, while smaller companies face proportionally higher cost burdens relative to capital raised.

Quantifiable Capital Cost Reduction Benefits

Research indicates dual-listed companies often achieve 15-30% reductions in weighted average cost of capital (WACC) through expanded investor bases, improved liquidity, and enhanced market visibility. These savings typically offset implementation costs within 2-3 years for companies raising capital above $100 million annually.

The Firefly transaction scale (A$139 million) suggests potential annual cost savings of $2-4 million through reduced cost of capital, assuming mid-range efficiency gains. These savings significantly exceed typical dual-market compliance costs for companies of this scale.

Sector-Specific Applications: Resource Industry Focus

Mining Sector Dual-Market Implementation Patterns

Resource companies demonstrate particular affinity for dual-market structures due to their international operational footprints and capital-intensive development requirements. Mining projects often span multiple years from discovery through production, requiring sustained capital access throughout development cycles.

Canadian mining companies frequently pursue dual-listing relationships with Australian exchanges to access Asia-Pacific investor bases, while maintaining North American institutional relationships for operational proximity benefits. This geographic arbitrage capitalises on Australian market expertise in resource evaluation and Asian investor interest in supply chain security.

Strategic Resource Industry Applications:

• Critical mineral projects aligning with government strategic priorities across multiple jurisdictions

• Large-scale copper developments requiring substantial capital commitments

• Gold projects leveraging different regional valuation methodologies

• Battery metal initiatives capitalising on electric vehicle market growth expectations

The Firefly Green Bay copper-gold project exemplifies this approach through its substantial resource base (50.4 million tonnes measured and indicated resources at 2.0% grade for 1.016 million tonnes copper equivalent) justifying large-scale capital requirements across multiple markets.

Critical Minerals and Strategic Resource Considerations

Companies developing critical mineral projects increasingly utilise dual-market equity raise approaches to align with government strategic resource policies across multiple jurisdictions. This alignment facilitates access to government financing programmes, strategic partnership opportunities, and supply chain integration benefits.

Copper projects particularly benefit from dual-market positioning due to global demand growth expectations and supply constraint concerns. The Firefly Green Bay project, with additional inferred resources of 29.3 million tonnes at 2.5% grade for 722,000 tonnes copper equivalent, represents the scale of resource base required to justify dual-market capital access strategies.

Risk Management in Multi-Market Structures

Operational Risk Mitigation Frameworks

Companies operating dual-market structures must develop robust systems for managing reporting inconsistencies, currency translation differences, and varying accounting standard requirements across markets. Failure to maintain consistency can result in regulatory sanctions, investor confidence erosion, and market access restrictions.

Critical Risk Management Components:

• Harmonised financial reporting systems across jurisdictions

• Currency translation methodology standardisation

• Compliance monitoring across multiple regulatory frameworks

• Investor communication coordination preventing information asymmetries

Scenario Planning for Market Disruption Events

Dual-market companies require comprehensive contingency planning for scenarios including market closures, regulatory changes, and geopolitical tensions affecting cross-border capital flows. These plans should address alternative funding sources, operational continuity measures, and investor communication protocols during disruption events.

Recent global events have demonstrated the importance of geographic diversification in capital access. Consequently, companies with single-market dependence faced significant challenges during regional market disruptions, while dual-market structures provided alternative capital pathways.

Performance Measurement and Success Metrics

Key Performance Indicators for Strategic Success

Successful dual-market strategies demonstrate measurable improvements across multiple performance dimensions. Companies should establish baseline metrics before implementation to accurately track performance improvements and justify ongoing compliance costs.

Primary Success Metrics:

• Trading volume increases across both markets

• Analyst coverage expansion and research quality improvement

• Institutional investor base diversification and commitment levels

• Weighted average cost of capital reduction over time

• Share price volatility reduction through enhanced liquidity

The Firefly transaction scale and structure suggest expectations for significant performance improvements, given the substantial capital commitment (A$139 million) and sophisticated dual-market coordination required.

Long-term Strategic Value Creation Framework

Ultimate success in dual-market strategies requires alignment with long-term strategic objectives including international expansion capabilities, acquisition financing flexibility, and operational adaptability across multiple jurisdictions. Companies must balance short-term capital raising efficiency with long-term strategic positioning benefits.

Resource sector companies particularly benefit from dual-market positioning during commodity cycles, as different markets may provide varying levels of support during price volatility periods. Geographic diversification enables sustained market access throughout economic cycles affecting individual regions.

Implementation Roadmap: Strategic Planning Framework

Phase 1: Market Assessment and Structure Design

Comprehensive market analysis forms the foundation of successful dual-market implementation. Companies must evaluate target market characteristics, investor base composition, regulatory requirements, and competitive positioning across potential jurisdictions.

Critical Assessment Elements:

• Target market liquidity analysis and trading pattern evaluation

• Regulatory requirement mapping and compliance cost estimation

• Investor base analysis including institutional and retail demand assessment

• Currency exposure evaluation and hedging strategy development

Phase 2: Professional Team Assembly and Execution Preparation

Successful dual-market execution requires specialised professional teams with expertise in target market regulations, investor preferences, and execution mechanics. Firefly's coordinated approach demonstrated this through its selection of BMO Capital Markets for Canadian execution and Canaccord Genuity for Australian coordination.

Professional Team Components:

• Lead underwriters with market-specific expertise

• Legal counsel specialising in cross-border securities regulations

• Depositary banks for international settlement coordination

• Investor relations specialists with multi-market experience

Phase 3: Execution Coordination and Post-Launch Management

Coordinated execution across multiple markets demands precise timing, pricing coordination, and investor communication management. The Firefly model illustrated successful coordination through its structured approach to concurrent but separate market execution.

Execution Coordination Elements:

• Marketing and investor outreach programmes across multiple time zones

• Pricing mechanism coordination accounting for currency fluctuations

• Regulatory submission timing optimisation across jurisdictions

• Settlement and closing coordination across different market infrastructure

Post-launch management requires ongoing coordination across markets, consistent investor communication, and performance monitoring against established success metrics. Companies must maintain regulatory compliance across all markets while optimising ongoing operational efficiency.

Regulatory Evolution and Future Market Development

Cross-Border Regulatory Harmonisation Trends

International regulatory bodies increasingly recognise the benefits of streamlined frameworks for dual-market listings, potentially reducing compliance burdens while maintaining investor protection standards. These developments may significantly alter the cost-benefit analysis for multi-market strategies over the next decade.

Emerging regulatory coordination between major markets could reduce implementation complexity and costs for companies pursuing dual-market strategies. Harmonised disclosure requirements, standardised approval processes, and coordinated settlement systems would enhance accessibility for mid-cap companies previously excluded by complexity considerations.

Technology Integration and Digital Market Evolution

Blockchain-based settlement systems and digital trading platforms reduce technical barriers to multi-market operations, potentially democratising access to dual-market strategies for smaller companies. These technological developments may fundamentally reshape the economics of cross-border capital raising.

Digital infrastructure improvements enable real-time coordination across markets, enhanced price discovery mechanisms, and reduced settlement risks. Companies implementing dual-market strategies will benefit from continued technological integration across global market infrastructure.

Advanced analytics and artificial intelligence applications provide enhanced market monitoring, risk management, and investor communication capabilities across multiple jurisdictions. In addition, these tools enable more sophisticated dual-market management while reducing operational complexity and compliance costs.

Looking to Capitalise on Mining Discoveries Like Firefly's Success?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, enabling subscribers to identify actionable opportunities ahead of the broader market. Explore Discovery Alert's dedicated discoveries page to understand why major mineral discoveries can lead to substantial market returns, then begin your 30-day free trial today to position yourself ahead of the market.