Strategic Investment Frameworks Reshaping Global Mining Dynamics

Mining sector capital allocation strategies have undergone fundamental transformation as commodity markets navigate unprecedented volatility and structural demand shifts. The interplay between production scaling, technological advancement, and portfolio diversification now determines which mining enterprises can maintain competitive advantages across multiple commodity verticals. Understanding these strategic frameworks becomes essential for evaluating long-term value creation potential in resource extraction industries, particularly as iron ore price trends continue to influence global investment decisions.

Brazil's Vale investment in iron ore copper and nickel represents a comprehensive approach to multi-commodity portfolio optimisation. The company's strategic positioning across three distinct commodity markets demonstrates sophisticated risk management while capitalising on emerging market opportunities. This investment methodology reflects broader industry trends toward operational diversification and technological integration.

Vale's Strategic Capital Deployment Framework Across Commodity Verticals

Vale's $5.7 billion investment strategy for 2026 represents a carefully calibrated approach to multi-commodity portfolio expansion. The allocation methodology distributes capital across iron ore, copper, and nickel operations, each serving distinct market segments and demand drivers. This strategic framework positions the company to capture value across different economic cycles and commodity price environments.

The investment distribution follows a risk-adjusted capital deployment model that prioritises high-return projects while maintaining operational flexibility. Unlike traditional mining companies that concentrate investments in single commodities, this approach enables portfolio-level optimisation and reduces exposure to individual commodity price volatility.

Key Investment Allocation Priorities:

- Production capacity expansion across three commodity verticals

- Technological infrastructure supporting autonomous operations

- Environmental compliance and sustainability initiatives

- Transportation and logistics optimisation systems

- Workforce development and safety enhancement programmes

Competitive positioning analysis reveals significant advantages compared to global mining giants. While competitors like BHP and Rio Tinto maintain larger overall operations, Vale's geographic concentration in Brazil provides cost advantages and operational synergies. The S11D complex serves as a benchmark for operational excellence, demonstrating scalable production methodologies applicable across multiple mining sites.

Capital efficiency metrics indicate superior returns compared to industry peers. The integrated nature of Vale's Brazilian operations creates economies of scale in transportation, processing, and administrative functions. This operational integration translates to lower unit costs and higher profit margins across the commodity portfolio.

Iron Ore Production Scaling and Market Positioning Strategy

Brazil's Vale investment in iron ore copper and nickel begins with substantial iron ore capacity expansion targeting 325-335 million tonnes annual production. This production scaling strategy addresses growing global steel demand while maintaining cost leadership through operational efficiency improvements.

The Carajás complex represents the cornerstone of production expansion efforts. Water elimination initiatives scheduled for completion by 2027 will reduce operational costs while enhancing environmental compliance. These technological improvements demonstrate how sustainability investments can drive operational excellence simultaneously.

Autonomous Trucking Implementation Impact:

- 70 autonomous trucks deployed across Brazilian mining operations

- Labour cost reduction through operational efficiency gains

- Safety risk mitigation in hazardous mining environments

- Consistent production performance independent of workforce limitations

- Real-time optimisation capabilities through integrated control systems

Furthermore, Vale's ambitious plans to capitalise on shifting demand patterns position the company strategically as Chinese steel output stagnates and Indian demand accelerates. Revenue generation projections indicate substantial economic impact beyond direct mining operations. The R$ 440 million annual royalty generation potential supports regional government budgets, while R$ 3 billion in salary distributions across 60,000 professionals creates significant multiplier effects throughout Minas Gerais mining communities.

Tailings reduction technology implementation across five operational hubs addresses environmental concerns while improving resource utilisation. This approach minimises waste generation and reduces long-term environmental liability, supporting sustainable mining practices that align with evolving regulatory requirements.

Copper Market Entry Strategy and Production Scaling

Vale's copper strategy represents a transformative shift toward becoming a top-five global copper producer by 2035. The Novo Carajás programme provides the foundation for production capacity doubling through systematic satellite project development within the established Carajás mineral province.

The $290 million Bacaba copper project demonstrates strategic project development capabilities with targeted 50,000 tonnes annual capacity upon commercial operations in the first half of 2028. This timeline reflects careful planning and execution methodologies that minimise development risks while optimising capital deployment.

Quarterly Performance Acceleration Metrics:

- 92,600 tonnes copper production achieved in Q2 2025

- Production trajectory supporting ambitious capacity expansion targets

- Operational learning curves improving efficiency across mining sites

- Technology transfer capabilities from iron ore operations to copper projects

Supply chain integration receives substantial support through the $340 million Carajás Railway locomotive investment. This transportation infrastructure enhancement enables increased throughput volumes while supporting multi-commodity export operations. The integrated logistics approach creates operational synergies that reduce unit transportation costs across all commodity verticals.

In addition, understanding copper & uranium investment opportunities across multiple jurisdictions provides valuable context for Vale's strategic positioning. Strategic satellite project development within the Carajás mineral province leverages existing infrastructure investments while accessing high-grade copper deposits. This approach minimises capital requirements for new projects while maximising returns on established operational capabilities.

Nickel Operations and Energy Transition Market Alignment

Brazil's Vale investment in iron ore copper and nickel includes substantial nickel capacity expansion aligned with energy transition demand growth. 44% quarterly growth acceleration in Q2 2025 operations demonstrates production scaling capabilities that position the company for battery technology market opportunities.

The Onça Puma expansion adds a second furnace contributing 15,000 tonnes annual capacity, elevating total capacity to 40,000 tonnes per year. This production threshold enables participation in long-term supply contracts with battery manufacturers and electric vehicle producers seeking reliable nickel sources.

Geographic Diversification Strategy:

- Canadian asset performance optimisation driving growth metrics

- Voisey's Bay Mine Expansion contributing to production increases

- Brazil-Canada operational synergies in nickel processing

- Technology transfer between operations improving efficiency

- Risk mitigation through geographic distribution of assets

Future production targets reflect ambitious scaling objectives. 175,000 tonnes projected for 2025 closing positions, advancing to 200,000 tonnes annual production capacity by 2026. The 2030 strategic milestone alignment with portfolio objectives demonstrates long-term commitment to nickel market participation.

However, regional competitive dynamics, including Indonesian nickel trends, continue to influence global pricing mechanisms and supply chain considerations. The timing of capacity expansion aligns with projected battery technology demand growth. Electric vehicle adoption rates and energy storage system deployment create substantial nickel demand increases, supporting premium pricing for high-quality nickel products from established producers.

Technology Integration and Operational Excellence Implementation

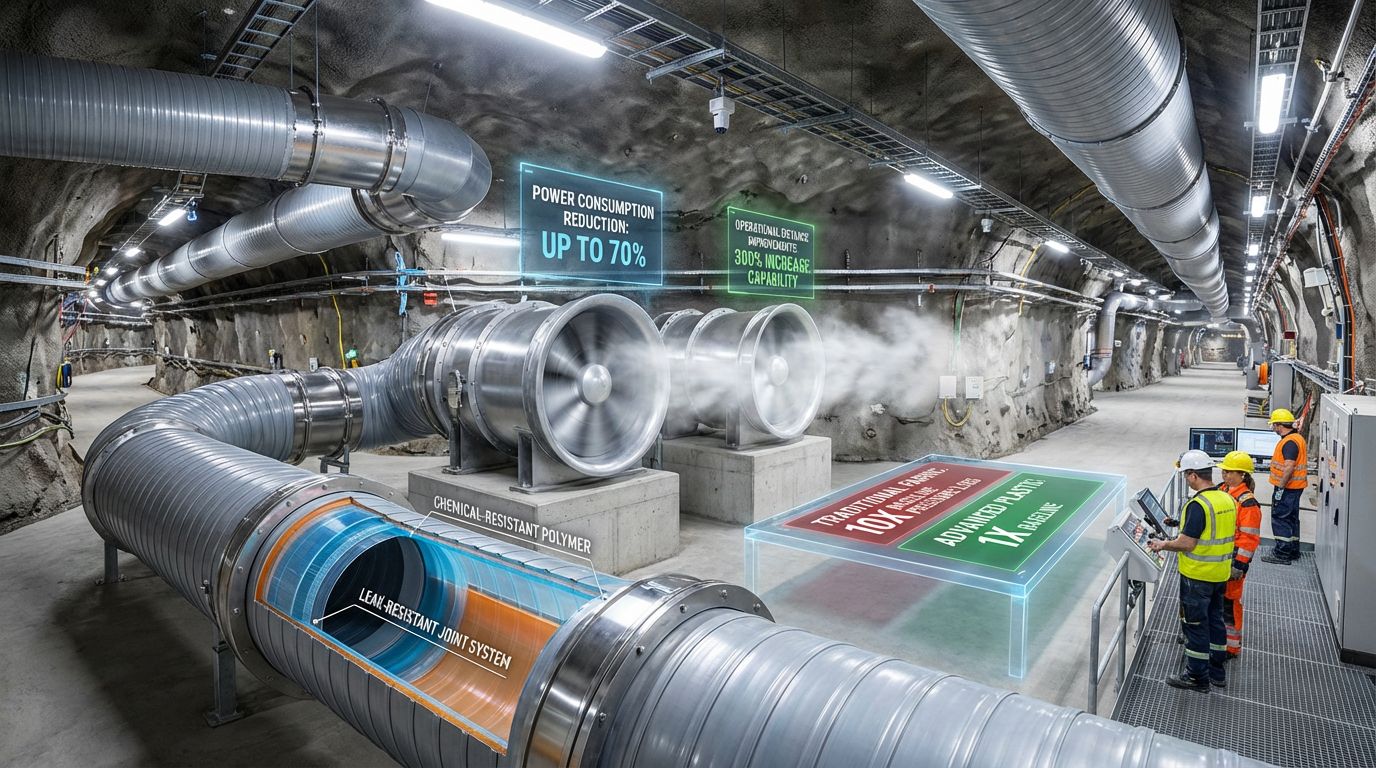

Automation implementation across Vale's operations represents a comprehensive approach to operational efficiency enhancement. The deployment of autonomous systems reduces operational costs while improving safety performance and production consistency across multiple mining sites.

Digital Infrastructure Development Components:

- Real-time monitoring systems enabling production optimisation

- Predictive maintenance protocols reducing operational downtime

- Data analytics platforms supporting strategic decision-making

- Integrated control systems managing multi-site operations

- Performance tracking capabilities across commodity verticals

Consequently, the integration of data-driven mining operations becomes increasingly critical for maintaining competitive advantages in global markets. Environmental technology adoption supports circular mining practices implementation across operational complexes. Carbon emission reduction technologies align with sustainability targets while potentially reducing operational costs through energy efficiency improvements.

Tailings dam usage minimisation through innovative processing methods addresses environmental concerns while recovering additional valuable minerals from waste streams. This approach demonstrates how environmental compliance can create operational value rather than simply representing compliance costs.

The technology integration framework enables scalable implementation across different commodity operations. Lessons learned from iron ore automation can be applied to copper and nickel operations, creating operational synergies and reducing implementation costs for new technology deployments.

Global Commodity Market Impact and Supply Chain Implications

Vale's production capacity increases will influence global commodity market dynamics across multiple sectors. Iron ore supply additions may moderate price volatility while supporting growing steel production requirements in developing economies.

Market Supply Dynamics Analysis:

- Iron ore production increases affecting global pricing mechanisms

- Copper supply timing alignment with energy transition demand growth

- Nickel output expansion supporting battery technology requirements

- Production flexibility enabling market-responsive output adjustments

- Long-term contract strategies stabilising revenue streams

The diversified commodity portfolio reduces single-metal dependency while enabling portfolio-level optimisation. Production flexibility allows responsive output adjustments based on market conditions, maximising revenue across different price environments.

For instance, competitive response scenarios suggest rival mining companies may accelerate capacity expansion plans to maintain market share. Market share redistribution across major commodity producers could intensify competition while potentially moderating commodity price increases.

Regional supply chain reconfiguration implications extend beyond direct mining operations. Enhanced transportation infrastructure and processing capabilities create opportunities for downstream industry development within Brazil, potentially attracting manufacturing investments that utilise locally produced commodities.

Environmental Sustainability and Decarbonisation Framework

Brazil's Vale investment in iron ore copper and nickel incorporates comprehensive environmental sustainability initiatives that align with global decarbonisation objectives. The company's carbon reduction targets exceed regulatory requirements, demonstrating proactive environmental stewardship while creating operational efficiencies.

Water elimination technology deployment across mining operations reduces environmental impact while improving operational efficiency. These initiatives demonstrate how sustainability investments can generate operational benefits rather than merely representing compliance costs.

Sustainability Implementation Strategy:

- Carbon footprint reduction through renewable energy adoption

- Circular economy practices minimising waste generation

- Biodiversity protection measures across mining sites

- Community engagement programmes supporting local development

- Environmental monitoring systems ensuring regulatory compliance

Moreover, understanding the broader decarbonisation benefits across the mining industry highlights the strategic importance of Vale's sustainability investments. The integrated approach to environmental management creates competitive differentiation while supporting long-term operational viability.

Tailings management innovation reduces environmental liability while recovering valuable minerals from waste streams. This circular approach demonstrates how environmental compliance can create economic value while minimising ecological impact.

Risk Assessment and Investment Protection Strategies

Operational risk management encompasses environmental compliance requirements across multiple jurisdictions. Brazilian mining policy stability supports long-term investment confidence, while international trade relationships impact commodity export opportunities.

Financial Risk Management Framework:

- Capital allocation efficiency across three commodity verticals

- Currency exposure management for international operations

- Debt financing strategies supporting expansion investments

- Commodity price hedging protecting against market volatility

- Portfolio diversification reducing single-commodity dependency

Geopolitical considerations include Brazil's mining policy environment and international trade relationship stability. Supply chain security in volatile global markets requires operational flexibility and alternative market access strategies.

However, recent production adjustments reflect the company's responsive approach to market conditions and supply dynamics. Environmental compliance costs continue increasing as regulatory requirements become more stringent. Nevertheless, proactive environmental technology investments can create competitive advantages while ensuring regulatory compliance across all operational sites.

Commodity price volatility remains the primary external risk factor affecting project economics. The diversified commodity approach provides some protection, but individual project returns remain sensitive to specific commodity price movements and global demand patterns.

Stakeholder Value Creation and Economic Impact Assessment

Local community impact extends significantly beyond direct employment creation. Infrastructure development supports regional economic growth while educational and training programme investments enhance local workforce capabilities.

Economic Multiplier Effects:

- Employment generation across mining regions supporting local economies

- Supplier network development creating indirect employment opportunities

- Tax revenue generation supporting regional government services

- Infrastructure improvements benefiting broader community development

- Educational investments enhancing long-term regional capabilities

Investor value creation stems from production growth supporting revenue expansion and operational efficiency improvements enhancing profit margins. Dividend sustainability through diversified commodity exposure provides income stability for long-term investors.

Global supply chain partners benefit from reliable commodity supply supporting manufacturing industries. Long-term contract opportunities with a major mining producer provide supply security while quality assurance through operational excellence standards reduces procurement risks.

The integrated approach to stakeholder value creation demonstrates how mining operations can generate benefits across multiple stakeholder groups simultaneously, supporting social licence to operate while creating sustainable competitive advantages.

Industry Benchmarking and Competitive Positioning Analysis

Capital expenditure benchmarking reveals Vale's $5.7 billion allocation compares favourably to industry peer investments when evaluated on a per-tonne production capacity basis. Return on investment projections exceed sector averages due to operational integration and geographic advantages.

Technology Adoption Leadership Metrics:

- Automation deployment rates exceeding industry standards

- Environmental investment proportion within total capital allocation

- Carbon reduction targets ahead of regulatory requirements

- Circular economy implementation timeline versus competitor initiatives

- Digital infrastructure development speed relative to industry adoption rates

Sustainability leadership positioning creates competitive differentiation in markets increasingly focused on environmental performance. Carbon reduction targets and circular economy implementation demonstrate proactive approaches to environmental management that exceed current regulatory requirements.

Strategic timeline comparison indicates Vale's project development schedules align favourably with competitor expansion plans. Market entry timing for new production capacity positions the company to capture emerging demand opportunities while avoiding oversupply conditions.

The comprehensive approach to multi-commodity operations creates operational synergies unavailable to single-commodity producers, providing sustainable competitive advantages that justify premium valuations relative to industry peers.

Investment Success Metrics and Performance Evaluation Framework

Success measurement requires comprehensive performance tracking across multiple dimensions. Production volume targets across iron ore, copper, and nickel operations provide quantitative benchmarks, while cost reduction achievements through technology implementation demonstrate operational excellence.

Financial Success Indicators:

- Revenue growth from increased production capacity across commodity verticals

- Profit margin expansion through operational optimisation initiatives

- Return on invested capital exceeding industry benchmarks consistently

- Cash flow generation supporting dividend sustainability and growth

- Market share gains in global commodity markets demonstrating competitive positioning

Long-term strategic outcomes include position establishment as a diversified global mining leader with supply chain reliability reputation in international markets. Sustainable mining practices setting industry standards create competitive moats while supporting social licence to operate.

The multi-faceted approach to investment success evaluation recognises that mining operations create value across financial, operational, environmental, and social dimensions. Balanced scorecard methodologies ensure comprehensive performance tracking that supports long-term value creation.

Brazil's Vale investment in iron ore copper and nickel represents a sophisticated approach to mining sector value creation. The strategic framework demonstrates how integrated operations, technological advancement, and stakeholder-focused development can create sustainable competitive advantages in global commodity markets.

Investment Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Commodity investments involve substantial risks including price volatility, operational challenges, and regulatory changes. Potential investors should conduct thorough due diligence and consult qualified financial advisors before making investment decisions.

Seeking Your Next Strategic Mining Investment Opportunity?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly transforming complex mining data into actionable investment insights for both short-term traders and long-term portfolio builders. Explore how major mineral discoveries have historically generated substantial returns and begin your 30-day free trial today to position yourself ahead of the market with immediate access to discovery-rich opportunities.