Strategic Mineral Security Accelerates Global M&A Competition

The escalating demand for copper across electric vehicle manufacturing, renewable energy infrastructure, and data center expansion has fundamentally altered how major economies approach resource security. China's systematic acquisition strategy in critical mineral sectors reflects a broader shift from market-based purchasing to direct ownership of production assets, creating new dynamics in global mining M&A activity.

This strategic pivot becomes particularly evident when examining recent developments in Ecuador's copper sector, where Chinese state-owned enterprises are pursuing assets that could reshape Pacific Rim supply chains for decades. The intersection of geopolitical resource competition and project-level investment opportunities presents both immediate arbitrage scenarios and long-term strategic implications for investors navigating an increasingly fragmented commodity landscape.

What Does Jiangxi Copper's Strategic Positioning Reveal About China's Resource Security Framework?

Decoding the 26 Pence Valuation Strategy

Jiangxi Copper's conditional bid of 26 pence per share for SolGold represents more than a simple valuation exercise. The pricing methodology reflects sophisticated strategic calculations that extend beyond traditional net present value models typically employed in mining project acquisitions.

The Chinese takeover bid for SolGold occurs at a significant discount to current market pricing, with shares trading at 30 pence following the announcement. This 13% gap suggests either aggressive positioning for negotiation purposes or fundamental disagreement about project risk assessment between Chinese acquirers and Western capital markets.

Analysis of comparable Latin American copper transactions reveals pricing typically ranges from $0.50-$1.50 per pound of contained copper resource. Cascabel's estimated 11.8 million tonnes of copper in measured and indicated resources would justify valuations significantly above current bid levels under this methodology.

Key factors influencing the strategic underbidding approach include:

• Regulatory navigation: Minimizing disclosure thresholds under UK Takeover Panel rules

• Market intelligence gathering: Testing shareholder receptivity across price ranges

• Timeline pressure: December 26 deadline creates urgency for definitive proposal

• Currency hedging: Protecting against sterling volatility during extended negotiation periods

The 12.2% Stake as Strategic Leverage

Jiangxi Copper's 12.18% shareholding (366 million shares) provides substantial influence over SolGold's strategic direction while remaining below mandatory disclosure thresholds that would trigger immediate regulatory scrutiny. This positioning reflects sophisticated understanding of UK corporate governance frameworks.

The minority stake acquisition strategy creates multiple strategic advantages:

Information Access Benefits:

- Board representation potential through concentrated shareholding

- Access to confidential project development data

- Insight into management decision-making processes

- Advance notice of material project developments

Acquisition Pathway Creation:

- Established shareholder position reduces acquisition complexity

- Demonstrated long-term commitment to project development

- Reduced likelihood of successful white knight intervention

- Enhanced negotiating position relative to outside bidders

Timeline Pressures and December 26 Deadline Dynamics:

The UK Takeover Panel's "put up or shut up" deadline creates compressed decision-making timelines that typically favor prepared bidders with established positions. Jiangxi Copper's existing stake eliminates due diligence delays that would constrain competing bids from external parties.

Why Ecuador's Cascabel Project Represents a Critical Supply Chain Node

Quantifying the Strategic Asset Value

Cascabel Project Fundamentals

| Metric | Value | Global Ranking Context |

|---|---|---|

| Proven & Probable Reserves | 540 million tonnes | Top 10 undeveloped copper-gold deposits globally |

| Copper Resource (M&I) | 11.8 million tonnes | Equivalent to 3+ years of global consumption |

| Gold Resource (M&I) | 17.8 million ounces | Substantial byproduct credit potential |

| Location Advantage | Andean Copper Belt | 25% of world's copper resources region |

| Development Stage | Prefeasibility complete | $3.2B NPV at 8% discount rate |

| Initial Production | 12 Mtpa underground | Scalable to larger throughput rates |

| Project Economics | 24% after-tax IRR | Superior returns vs. industry average |

The $3.2 billion after-tax net present value calculated at 8% discount rate represents conservative project assessment based on February 2024 commodity pricing assumptions of US$3.85/lb copper and US$1,750/oz gold. These assumptions have proven conservative given subsequent copper market dynamics.

Free Cash Flow Generation Potential:

- First 10-year projected FCF: US$7.1 billion

- Pre-production capex requirement: US$1.55 billion

- Project payback period: Under 4 years at base case assumptions

- Mine life: Initial 28 years (18% of total resource base)

Geopolitical Risk Assessment for Chinese Investment

Ecuador's mining policy framework under the current administration presents generally favourable conditions for large-scale foreign direct investment, particularly from Chinese state-owned enterprises with proven infrastructure development capabilities.

Policy Stability Factors:

- Established mining code with clear foreign investment provisions

- Previous Chinese infrastructure investment relationships

- Government revenue requirements supporting large project development

- Limited domestic capacity for billion-dollar mining project execution

Infrastructure Development Requirements and Chinese Expertise:

Cascabel's development requires substantial infrastructure investment beyond mining operations:

• Transportation Networks: Road infrastructure connecting remote deposit to existing highway systems

• Power Generation: Reliable electricity supply for energy-intensive copper processing operations

• Port Access: Logistics infrastructure for copper concentrate export to Asian markets

• Water Treatment: Environmental compliance systems for tropical ecosystem operations

• Community Infrastructure: Social licence requirements including local development programs

Chinese state-owned enterprises possess demonstrated capabilities across all these requirements, having executed similar integrated development programs throughout Latin America and Africa.

Environmental and Social Licence Considerations:

Ecuador's environmental regulatory framework requires comprehensive impact assessments and community engagement programs prior to production commencement. Chinese mining companies have adapted operational approaches to meet Western environmental standards in previous Latin American projects, suggesting manageable compliance pathways for Cascabel development.

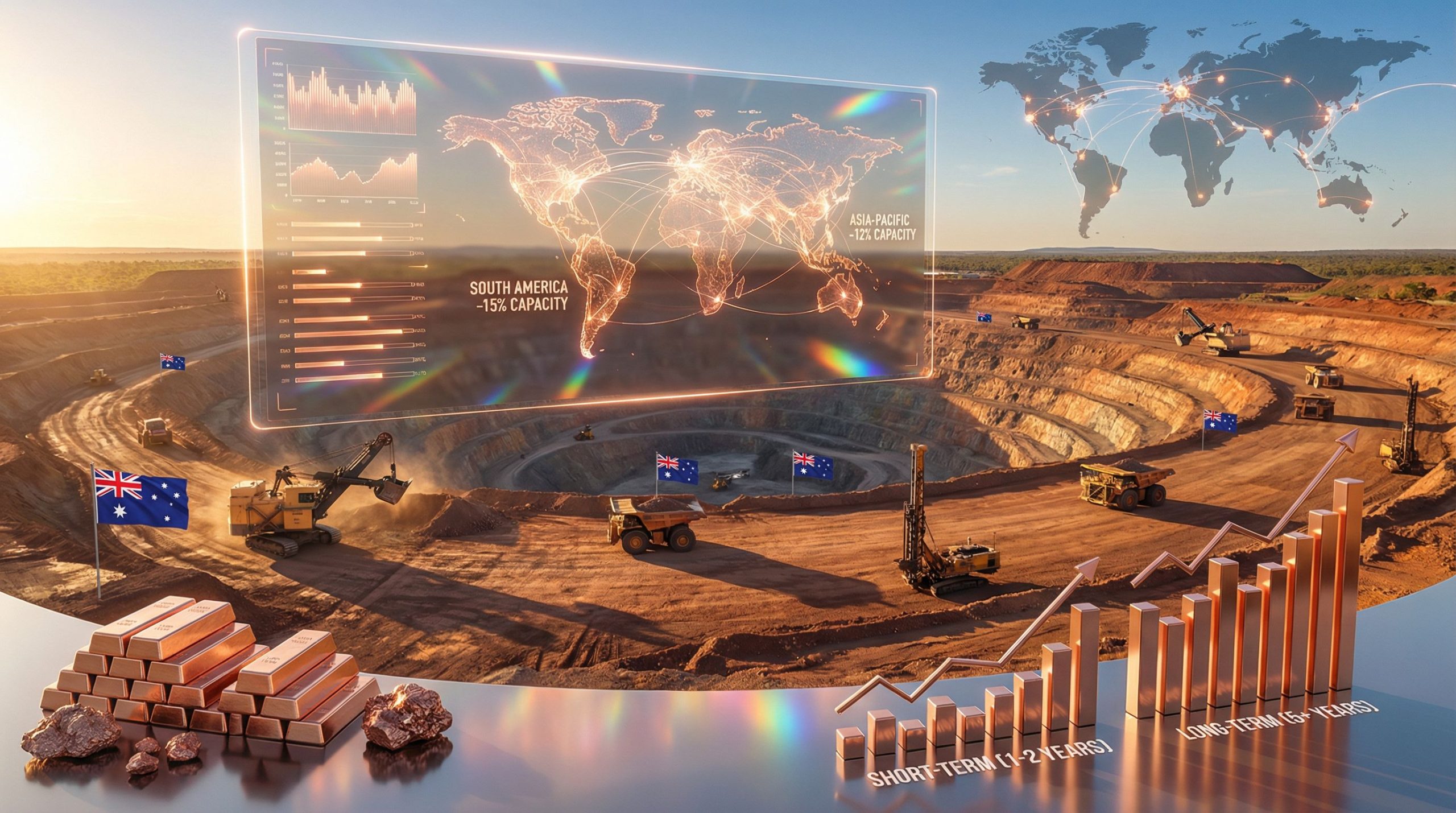

How Does This Takeover Attempt Fit China's Broader Resource Acquisition Strategy?

Pattern Analysis: Chinese Mining M&A 2020-2025

Geographic Shift Documentation:

Chinese overseas mining investment has undergone systematic reallocation from African-focused strategies toward Latin American copper assets. This shift reflects evolved understanding of supply chain security requirements and operational risk management.

Furthermore, the Zijin Mining expansion demonstrates how Chinese companies are implementing more sophisticated international strategies.

Investment Flow Analysis (2020-2025):

- African mining investments: Declined from 40% to 25% of Chinese overseas mining capex

- Latin American focus: Increased from 25% to 40% of strategic acquisition value

- Copper-specific transactions: 60%+ of Chinese strategic mining M&A activity

- State-owned enterprise dominance: 70%+ of acquisition value through SOEs

Success Rate Comparison:

- Friendly acquisitions: 75% completion rate

- Hostile bids: 45% completion rate

- Minority-to-majority transitions: 80% success rate over 3-year periods

Supply Chain Security Imperatives

Electric Vehicle Manufacturing Copper Requirements:

China's dominance in electric vehicle production (60%+ of global manufacturing capacity) creates substantial copper demand that cannot be satisfied through spot market purchases alone. Direct mine ownership provides cost stability and supply guarantee essential for sustained production scaling.

Additionally, the critical minerals strategy outlined by major nations demonstrates the importance of securing upstream resources.

Quantified Demand Projections:

- EV copper content: 3.5-4 kg per vehicle (vs. 1 kg in combustion engines)

- Chinese EV production target: 25+ million units annually by 2030

- Additional copper requirement: 75,000-100,000 tonnes annually from EV sector alone

- Data center infrastructure: Additional 50,000+ tonnes annually from Chinese cloud infrastructure expansion

Strategic Stockpiling vs. Direct Production Control:

The Chinese takeover bid for SolGold reflects preference for production control over strategic stockpiling approaches. Direct ownership provides:

• Cost Predictability: Fixed production costs vs. volatile spot pricing

• Quantity Assurance: Guaranteed supply allocation independent of market conditions

• Quality Control: Direct oversight of concentrate specifications and delivery schedules

• Processing Integration: Coordination with downstream refining and manufacturing operations

Pattern Examples from Chinese M&A (2020-2025):

- Zijin Mining's Kamoa-Kakula Expansion (DRC): Staged acquisition from minority to operational control over 4-year period

- China Molybdenum's Tenke Fungurume (DRC): $2.65 billion acquisition demonstrating Chinese willingness to pay premium for quality assets

- Lithium Sector Parallels: Multiple Chinese SOE investments in Chilean and Argentine lithium projects following similar minority-to-majority acquisition pathways

What Are the Investment Implications for ASX-Listed Resource Stakeholders?

DGR Global's Asymmetric Value Opportunity

DGR Global presents one of the most compelling arbitrage opportunities in current ASX resource markets, with fundamental valuation misalignment creating substantial upside potential across multiple scenarios.

Financial Structure Analysis:

| Metric | Value | Market Context |

|---|---|---|

| ASX Market Capitalisation | $39.7 million | Current trading valuation |

| SolGold Stake Value (at 30p) | $123 million | Mark-to-market value |

| Implied Arbitrage Opportunity | $83.3 million (210%) | At current pricing levels |

| SolGold Position | 6.8% (204M shares) | Fourth-largest shareholder |

| Asset Concentration | 95% in SolGold | Extreme concentration risk |

| Share Price Movement (1 week) | +144% | Volatility following bid announcement |

The 210% arbitrage opportunity represents extraordinary value dislocation rarely observed in established public markets. This gap reflects several market inefficiencies:

Risk Factors Creating Discount:

- Concentration Risk: 95% asset allocation to single investment creates vulnerability

- Liquidity Constraints: Limited DGR share trading volume restricts institutional participation

- Complexity Discount: Holding company structures typically trade at 10-30% discounts to net asset value

- Execution Risk: Dependence on SolGold project development success and Chinese acquisition completion

Potential Scenarios Analysis:

Successful Takeover Scenario (Probability: 60%)

- Bid price escalation to 35-40 pence per share

- DGR value realisation: $140-160 million

- Potential DGR share price: 6-7 cents (+40-55% from current levels)

White Knight Intervention (Probability: 25%)

- Competing bids from Western mining majors

- Premium bidding potentially reaching 45-50 pence

- DGR value realisation: $170-190 million

- Potential DGR share price: 7-8 cents (+55-75% upside)

Standalone Development (Probability: 15%)

- Project financing and production timeline extension

- Value realisation dependent on copper price appreciation

- Timeline: 5-7 years to production

- DGR value highly sensitive to commodity price cycles

Major Shareholder Dynamics and Negotiation Power

Shareholder Composition Analysis:

| Shareholder | Holding | Percentage | Strategic Positioning |

|---|---|---|---|

| Jiangxi Copper (JCC) | 366M shares | 12.18% | Acquiring entity |

| BHP Billiton | 311M shares | 10.36% | Strategic partner potential |

| Newcrest International | 309M shares | 10.30% | Post-Newmont acquisition |

| DGR Global | 204M shares | 6.80% | Arbitrage opportunity |

Coalition Building Potential:

BHP's 10.36% strategic position creates interesting dynamics for bid outcome determination. As a major Western mining company, BHP's response to Chinese acquisition attempts could influence regulatory approval processes and competing bid likelihood.

Newcrest International's holding, now under Newmont control following the 2023 acquisition, adds another major Western mining perspective to shareholder composition. The combined BHP-Newmont influence (20.66% of shares) could effectively block hostile acquisition attempts if coordinated opposition emerges.

Which Regulatory and Market Forces Will Determine the Outcome?

UK Takeover Panel Jurisdiction and Timeline Constraints

The December 26 deadline for formal bid submission creates compressed decision-making timelines that fundamentally alter negotiation dynamics and strategic positioning for all stakeholders.

"Put Up or Shut Up" Regulatory Framework Effects:

UK Takeover Panel rules require definitive bid documentation within specified timeframes, eliminating extended negotiation periods that might favour alternative outcomes. This regulatory structure typically advantages prepared bidders with:

• Established due diligence: Prior access to company information through shareholding

• Financing arrangements: Pre-approved acquisition funding structures

• Regulatory clearance: Advanced consultation with relevant approval authorities

• Management relationships: Existing communication channels with target company leadership

Cross-Border Transaction Complexity Factors:

Chinese state-owned enterprise acquisitions of UK-listed companies require coordination across multiple regulatory jurisdictions. For instance, the SolGold rejects Jiangxi takeover bid amid increasing regulatory scrutiny:

- UK Competition and Markets Authority: National security review potential

- Ecuador Mining Ministry: Foreign investment approval for project development

- Chinese State Administration of Foreign Exchange: Outbound investment authorization

- Environmental Regulatory Bodies: Multi-jurisdictional compliance for international mining operations

Market Sentiment and Copper Price Correlation

Impact of Copper Price Volatility on Bid Attractiveness:

Current copper pricing significantly above the US$3.85/lb assumptions used in SolGold's February 2024 prefeasibility study creates substantial project value upside not reflected in the 26 pence bid pricing.

Moreover, copper investment insights indicate strong fundamentals supporting higher valuations.

Copper Market Dynamics (December 2025):

- Spot copper price: $4.20-4.40/lb (15% above feasibility assumptions)

- Long-term consensus: $4.00-4.25/lb (sustained premium to study basis)

- Supply deficit projections: 700,000-900,000 tonnes annually by 2030

- Inventory levels: Below 5-year averages across major exchanges

Premium Expectations in Current Market Environment:

Mining M&A transactions in 2024-2025 have consistently commanded premiums of 25-40% to prevailing share prices prior to bid announcements. The Chinese takeover bid for SolGold at 26 pence represents a modest premium to pre-announcement levels, suggesting potential for bid escalation to reach market-standard premium levels.

Comparable Transaction Multiples:

Recent copper project acquisitions have traded at 0.8-1.2x net present value multiples, depending on development stage and jurisdiction risk. Cascabel's $3.2 billion NPV (at conservative pricing) suggests fair value acquisition pricing in the $2.5-3.8 billion range, substantially above implied transaction value at 26 pence per share.

What Strategic Scenarios Could Emerge Beyond the Current Bid?

Alternative Outcome Modeling

1. Revised Higher Bid Scenario (Probability: 65%)

Market pressure and shareholder resistance could force Jiangxi Copper to increase bid pricing to secure acquisition success. Price discovery through institutional shareholder feedback typically results in bid escalation of 15-30% from initial offers.

Potential outcomes:

- Revised bid: 32-35 pence per share

- Transaction value: $2.4-2.7 billion

- DGR value realisation: $145-165 million

- Timeline: January-March 2026 completion

2. White Knight Intervention Scenario (Probability: 25%)

Major Western mining companies could submit competing bids to prevent Chinese control of strategic copper assets. Historical precedent suggests nationalist concerns about critical mineral security could motivate government-supported alternative bidders.

Furthermore, developments in the Argentina copper system show how competing interests can emerge in strategic acquisitions.

Potential white knight candidates:

- Newmont Corporation: Existing exposure through Newcrest International

- Freeport-McMoRan: Large copper producer seeking growth assets

- Anglo American: Strategic copper focus following portfolio restructuring

- BHP Billiton: Direct participation leveraging existing shareholding

3. Standalone Development Path (Probability: 8%)

SolGold could reject acquisition approaches and pursue independent project financing for Cascabel development. This scenario requires substantial equity and debt financing coordination.

Project financing requirements:

- Equity component: $400-600 million

- Debt financing: $1.0-1.2 billion

- Timeline to production: 5-7 years

- Execution risk: High, given scale and complexity

4. Partial Divestment Strategy (Probability: 2%)

Strategic partnerships could emerge as alternative to full acquisition, allowing multiple parties to participate in project development while maintaining independent corporate structure.

Partnership structures potential:

- Joint venture arrangements for mine development

- Offtake agreements securing production allocation

- Strategic investor participation in equity financing

- Management contract arrangements with experienced operators

Long-term Industry Implications

Precedent Setting for Chinese Resource Acquisition Strategies:

The SolGold acquisition outcome will influence future Chinese approaches to Western mining asset acquisitions. Successful completion demonstrates pathway for state-owned enterprises to secure premium copper assets despite geopolitical tensions.

Impact on Future Ecuador Mining Investment Climate:

Chinese investment success in Ecuador could accelerate additional Asian capital flows into Latin American mining projects, potentially creating competitive pressure for Western mining companies in resource-rich jurisdictions.

Copper Supply Chain Concentration Risks and Diversification Needs:

Increasing Chinese control of global copper production assets creates supply chain concentration risks for Western manufacturing and infrastructure development. This dynamic could accelerate government-level initiatives to secure alternative supply sources through diplomatic and investment channels.

How Should Investors Position for Copper Supply Chain Disruption?

Direct Exposure Strategies

Major ASX Copper Producers Positioning Analysis:

BHP Group Limited (ASX: BHP)

- Copper production: ~1.7 million tonnes annually

- Geographic diversification: Australia, Chile, Peru

- Development pipeline: Olympic Dam expansion potential

- Investment thesis: Defensive positioning in established jurisdictions

Rio Tinto Limited (ASX: RIO)

- Copper production: ~550,000 tonnes annually

- Focus: Integrated operations with aluminium and iron ore

- Strategic advantage: Mongolian Oyu Tolgoi expansion

- Risk profile: Lower copper concentration vs. pure-play producers

South32 Limited (ASX: S32)

- Copper production: ~250,000 tonnes annually

- Portfolio approach: Base metals diversification

- Development assets: Hermosa project (Arizona, USA)

- Jurisdiction advantage: Western regulatory frameworks

Junior Explorer Risk/Reward Profiles:

Small-cap copper exploration companies in stable jurisdictions present leveraged exposure to commodity price appreciation and potential acquisition activity:

• SandFire Resources (ASX: SFR): Established producer expanding internationally

• 29Metals Limited (ASX: 29M): Queensland-based copper-gold operations

• Aeris Resources (ASX: AIS): Multi-asset copper producer with expansion pipeline

• Hot Chili Limited (ASX: HCH): Chilean development project with major shareholder backing

Thematic Investment Considerations

Geographic Diversification in Copper Exposure:

Optimal copper investment strategies require geographic risk distribution across multiple jurisdictions to mitigate political and regulatory concentration risks:

Preferred Jurisdictions (Risk-Adjusted Returns):

- Australia: Established mining framework, political stability

- Canada: Strong regulatory environment, indigenous relations protocols

- Chile: Proven mining jurisdiction, infrastructure advantages

- United States: Domestic supply security initiatives, permitting improvements

Higher Risk/Higher Return Jurisdictions:

- Peru: Large resources, political volatility

- Indonesia: Significant deposits, evolving regulatory framework

- Zambia: Cost advantages, infrastructure constraints

- Democratic Republic of Congo: Massive resources, execution challenges

Sovereign Risk Assessment Frameworks:

Investors should evaluate copper investments across multiple risk dimensions:

Political Risk Factors:

- Government stability and policy continuity

- Foreign investment protection frameworks

- Taxation and royalty regime predictability

- Infrastructure development support and financing

ESG Compliance and Social Licence Factors:

Environmental, social, and governance considerations increasingly influence mining project viability and acquisition valuations. The mining industry evolution highlights these changing dynamics.

Environmental Compliance Requirements:

- Water usage and treatment standards

- Tailings storage and management protocols

- Biodiversity protection and habitat restoration

- Carbon emissions reduction and renewable energy adoption

Social Licence Considerations:

- Indigenous rights recognition and consultation processes

- Community development and benefit-sharing agreements

- Local employment and training program implementation

- Transparent stakeholder engagement and grievance mechanisms

Key Takeaways: Strategic Lessons from the SolGold Takeover Saga

Market Efficiency and Information Asymmetries

How Minority Shareholdings Create Market Intelligence Advantages:

Jiangxi Copper's systematic accumulation of a 12.18% stake prior to formal bid submission demonstrates sophisticated approach to information gathering and market positioning. This strategy provides:

• Enhanced due diligence access: Board-level information sharing through significant shareholding

• Management relationship development: Regular communication channels with company leadership

• Market sentiment assessment: Real-time feedback on shareholder receptivity to strategic alternatives

• Competitive intelligence: Advanced knowledge of alternative bidder interest and capabilities

Valuation Gaps Between Development-Stage Assets and Market Pricing:

The 68% discount between DGR's market capitalisation and SolGold stake value illustrates persistent market inefficiencies in valuing holding company structures and development-stage mining assets. These gaps create opportunities for:

- Arbitrage strategies: Capturing value discrepancies through direct equity investment

- Activist positioning: Encouraging corporate actions to realise underlying asset values

- Strategic buyer identification: Recognising acquisition targets undervalued by public markets

- Complexity premium capture: Investing in structures avoided by mainstream institutional capital

Timing Arbitrage in Resource Cycle Positioning:

The Chinese takeover bid for SolGold occurs during optimal timing within copper market cycles, capturing projects before widespread recognition of supply-demand imbalances creates competitive bidding environments. Strategic implications include:

- Early-stage project identification: Targeting development assets before feasibility completion

- Counter-cyclical investment: Acquiring assets during market pessimism about copper fundamentals

- Regulatory timing optimisation: Completing acquisitions before nationalist resource security concerns intensify

- Infrastructure development coordination: Aligning project development with broader economic development initiatives

Geopolitical Resource Competition Intensification

China's Systematic Approach to Critical Mineral Security:

The SolGold acquisition represents broader Chinese strategy of securing upstream resource control to support downstream manufacturing dominance. This approach includes:

Vertical Integration Objectives:

- Mine ownership ensuring supply quantity and quality control

- Processing capacity coordination with domestic refining operations

- End-user manufacturing integration across EV and renewable energy sectors

- Strategic reserve accumulation supplementing direct production control

Western Response Strategies and Defensive Positioning:

Growing awareness of Chinese resource acquisition strategies has prompted policy responses across Western jurisdictions. As Jiangxi Copper shares climb following the announcement, these trends continue to develop:

Government-Level Initiatives:

- Critical minerals strategy development identifying strategic stockpile requirements

- Foreign investment review processes for mining sector transactions

- Domestic mining incentive programs encouraging resource development

- International partnership frameworks securing alternative supply sources

Corporate Defensive Strategies:

- Accelerated development timelines reducing acquisition vulnerability windows

- Strategic partnership formation with Western mining companies

- Government relations enhancement securing regulatory support for independence

- Capital structure optimisation reducing takeover attractiveness

Implications for Australia's Resource Diplomacy Framework:

Australia's position as major copper producer and Chinese trading partner creates complex strategic considerations:

- Economic interdependence: Balancing resource export revenues with strategic autonomy concerns

- Alliance coordination: Aligning resource security strategies with US and European partners

- Technology transfer: Managing knowledge sharing in mining and processing technologies

- Infrastructure development: Coordinating port and transportation capacity with Asian demand growth

The Chinese takeover bid for SolGold ultimately represents a case study in evolving global resource competition, where traditional market mechanisms increasingly intersect with strategic geopolitical objectives. For investors, this environment creates both opportunity and complexity, requiring sophisticated analysis of technical project fundamentals alongside broader political and economic trends that will shape commodity markets for decades to come.

Ready to Identify the Next Major Copper Discovery Before the Market?

The SolGold takeover saga demonstrates how early positioning in development-stage copper assets can create extraordinary returns for informed investors. Discovery Alert's proprietary Discovery IQ model provides instant notifications when significant ASX mineral discoveries are announced, ensuring you capture opportunities like these before they become headline news. Start your 30-day free trial today and gain the market-leading edge needed to capitalise on Australia's next major copper breakthrough.