Strategic Portfolio Optimization in Global Mining Operations

Modern mining conglomerates face unprecedented pressure to demonstrate capital efficiency while navigating complex jurisdictional frameworks across multiple continents. The contemporary mining landscape demands sophisticated asset allocation strategies that balance production growth trajectories against operational risk exposure. Portfolio optimization has evolved from simple divestiture decisions to intricate financial engineering that considers end-of-life provisioning costs, currency exposure management, and regulatory compliance burdens across diverse political environments.

Mining executives increasingly deploy scenario modelling frameworks to evaluate when operational assets transition from value-creating to value-destroying positions within broader corporate portfolios. This analytical approach recognises that profitable operations may still warrant divestiture when capital can generate superior returns through reallocation to higher-grade deposits, longer-life assets, or jurisdictions offering enhanced regulatory stability.

Understanding Strategic Asset Divestiture in Modern Mining

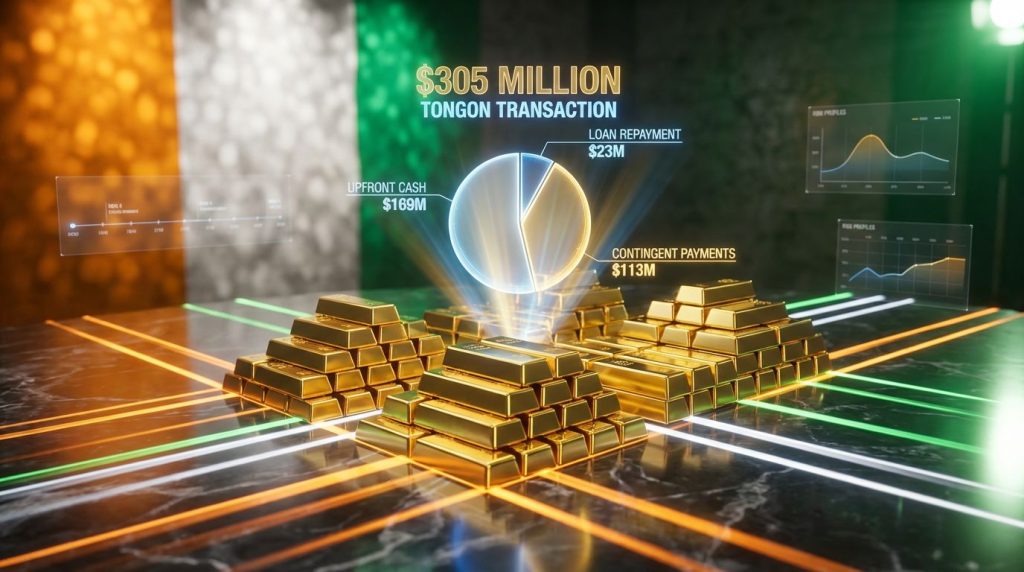

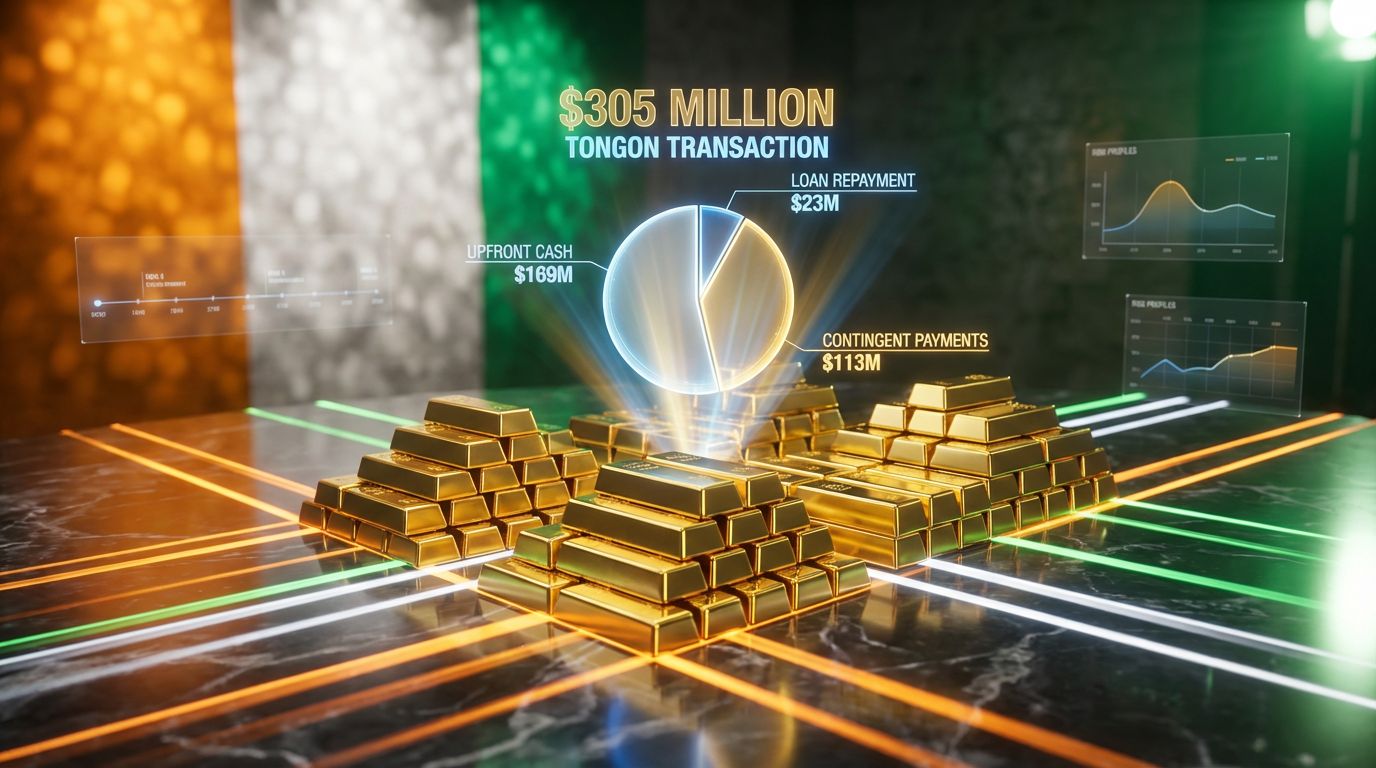

The barrick sale of tongon mine to Atlantic Group represents a calculated $305 million portfolio optimisation transaction that extends beyond conventional asset disposal mechanisms. The December 2, 2025 transaction demonstrates how mining conglomerates structure complex risk-sharing arrangements while maintaining exposure to potential upside performance.

The transaction structure incorporated $192 million in immediate cash payments, including a $23 million shareholder loan repayment component due within six months of closing. An additional $113 million in contingent payments creates a sophisticated risk distribution mechanism tied to gold price forecast performance over 2.5 years and resource conversion milestones extending over five years.

Mining companies increasingly face pressure to demonstrate capital efficiency through strategic asset concentration rather than geographic diversification. Furthermore, this trend reflects broader mining consolidation trends across the industry. Mark Hill, serving as Chief Operating Officer and interim Chief Executive Officer following Mark Bristow's resignation, articulated this strategic framework by emphasising Barrick's intent to "sharpen its focus on core gold and copper operations."

Asset Life Cycle Management Framework

Modern mining operations require sophisticated planning for end-of-life operational transitions. Assets approaching depletion phases demand substantial closure provisioning that can strain capital allocation efficiency across broader portfolios. The Tongon transaction exemplifies how companies divest mature assets to specialist operators while retaining upside exposure through contingent payment structures.

Key operational factors driving divestiture decisions include:

• Escalating regulatory compliance costs in final operational years

• Capital allocation shifts toward higher-return, longer-duration assets

• Geographic risk diversification requirements

• Local content compliance complexities

• Currency exposure management across multiple jurisdictions

Geographic Risk Diversification Strategy

West African political stability considerations increasingly influence long-term strategic planning for multinational mining operations. The barrick sale of tongon mine enables Barrick to reduce exposure to emerging market operational complexities while maintaining focus on tier-one jurisdictions with established regulatory frameworks.

Currency exposure management becomes critical for multinational operations spanning multiple monetary systems. Local content requirements in various jurisdictions may impact operational flexibility, particularly for companies maintaining diverse geographic portfolios across different regulatory environments.

Transaction Structure Analysis: Risk Distribution Mechanisms

The Tongon sale demonstrates sophisticated financial engineering that creates value for both buyer and seller through carefully structured payment mechanisms. The transaction's multi-component structure distributes risk across different time horizons while providing immediate liquidity alongside potential future returns.

Payment Component Analysis

| Payment Type | Amount (USD) | Timeline | Risk Profile | Performance Metrics |

|---|---|---|---|---|

| Immediate Cash | $169 million | At closing | Low risk | Immediate liquidity |

| Loan Repayment | $23 million | 6 months post-closing | Moderate risk | Contractual obligation |

| Contingent Gold Price | Portion of $113 million | 2.5 years | High risk | Gold price performance |

| Resource Conversion | Portion of $113 million | 5 years | High risk | Exploration success |

The contingent payment structure creates a sophisticated risk-sharing mechanism where Atlantic Group assumes operational responsibility while Barrick retains exposure to potential asset appreciation. This arrangement aligns buyer incentives with long-term asset development while providing seller participation in future value creation.

Risk Distribution Innovation

Traditional mining transactions typically employ all-cash structures or production-based earnouts. The Tongon transaction innovatively links payments to external commodity price factors, creating shared exposure beyond conventional buyer-seller arrangements. This structure enables both parties to benefit from favourable gold price environments while distributing operational risk to the party best positioned to manage day-to-day operations.

Moreover, gold bond trends indicate increasing correlation between commodity prices and fixed income markets. Gold price volatility over the 2.5-year contingent period will significantly impact total consideration realisation. Resource conversion milestones over five years incentivise Atlantic Group to invest in exploration and development while providing Barrick with upside participation in potential discoveries.

Impact on Operational Efficiency Metrics

Mining divestments create operational efficiency improvements through concentrated management attention and capital allocation across smaller, higher-quality asset portfolios. The barrick sale of tongon mine enables Barrick to focus resources on assets offering superior long-term value creation potential.

Production Concentration Benefits

Remaining assets within Barrick's portfolio will receive enhanced capital allocation focus following the Tongon divestiture. Management bandwidth concentrates on higher-priority operations, potentially creating operational synergies across geographically clustered assets. This concentration effect often improves per-asset productivity metrics through increased technical expertise and capital deployment.

Operational efficiency improvements typically include:

• Enhanced capital allocation toward prime assets

• Reduced legacy maintenance obligations

• Concentrated management expertise

• Geographic operational synergies

• Streamlined regulatory compliance across fewer jurisdictions

Financial Performance Indicators

| Metric Category | Pre-Divestment Challenge | Post-Divestment Benefit |

|---|---|---|

| Production Efficiency | Diluted by aging operations | Concentrated on optimal assets |

| Capital Intensity | High maintenance requirements | Reduced legacy obligations |

| Management Focus | Dispersed across diverse assets | Strategic concentration |

| Jurisdictional Risk | Broad geographic exposure | Focused market presence |

The divestiture enables Barrick to improve capital intensity metrics by eliminating assets requiring substantial maintenance capital expenditure. Geographic concentration reduces operational complexity across diverse regulatory environments while enabling deeper expertise development in preferred jurisdictions.

Strategic Options Enabled by Transaction Proceeds

The Tongon sale proceeds provide Barrick with enhanced flexibility to pursue strategic initiatives, including potential North American asset separation through initial public offering structures. In addition, Mark Hill confirmed that Barrick is "assessing additional strategic options, including potentially separating its North American assets."

North American Asset Separation Framework

Hill noted that potential initial public offering of North American assets would provide shareholders with "more optionality around jurisdiction in a pure gold company with growth." This strategic option suggests management views North American operations as sufficiently valuable to merit standalone capital structure while enabling investor choice between pure-play gold exposure and diversified mining operations.

Potential separation benefits include:

• Creation of pure-play investment vehicles

• Jurisdiction-specific capital allocation strategies

• Reduced operational complexity

• Enhanced investor optionality

• Improved valuation recognition for distinct asset classes

Capital Reallocation Scenarios

Growth Investment Focus

The $305 million proceeds could support expansion of existing operations, acquisition of complementary assets in preferred jurisdictions, or deployment toward exploration and development projects offering superior return profiles.

Shareholder Return Enhancement

Alternative deployment includes increased dividend distributions, share buyback programs to improve per-share metrics, or debt reduction to strengthen balance sheet position. Each option reflects different strategic priorities regarding immediate shareholder returns versus long-term growth investment.

Comparative Analysis with Recent Mining Divestments

The barrick sale of tongon mine represents one component of an accelerated portfolio optimisation strategy that includes multiple significant transactions over the past year. This divestiture pattern reflects broader industry evolution trends toward asset concentration and capital efficiency improvement.

Barrick's Strategic Divestiture Timeline

| Transaction | Asset Location | Value (USD) | Strategic Rationale | Completion Status |

|---|---|---|---|---|

| Hemlo Sale | Canada | Up to $1.09 billion | Geographic consolidation | Completed |

| Alturas Exit | Chile | $50 million | Early-stage risk reduction | Completed |

| Donlin Divestment | Alaska | $2 billion cash | Capital intensity mitigation | April 2025 |

| Tongon Sale | Côte d'Ivoire | Up to $305 million | End-of-life optimisation | December 2, 2025 |

The $2 billion Donlin gold project divestiture in April 2025, where Barrick sold its interest to affiliates of Paulson Advisers and Novagold, demonstrates the company's willingness to exit capital-intensive development projects. The transaction pattern suggests strategic focus on operational assets offering immediate cash flow generation rather than development projects requiring substantial capital investment.

Industry Divestiture Trends

Major mining companies increasingly divest non-core or aging assets to specialist operators with regional expertise advantages. Regional players acquire operations where local knowledge provides operational efficiencies unavailable to multinational corporations. Consequently, this trend creates value for both parties through improved operational fit between asset characteristics and operator capabilities.

Capital efficiency has become increasingly critical for investor relations as mining companies face pressure to demonstrate disciplined capital allocation. Portfolio concentration enables enhanced per-asset returns while reducing operational complexity across diverse regulatory environments.

Market Dynamics Influencing Asset Valuations

Current gold price environments significantly enhance mining asset valuations across the sector. Elevated gold prices enable companies to maximise divestiture proceeds while timing transactions during favourable market conditions. The Tongon contingent payment structure captures potential future price appreciation while providing immediate liquidity.

What makes African mining investments attractive to regional operators?

Local and regional operators increasingly acquire Western-divested assets throughout Africa. Government participation requirements influence transaction structures, while infrastructure development costs affect operational viability assessments. The Atlantic Group acquisition reflects broader ownership transition patterns where domestic operators assume control of assets previously held by international mining conglomerates.

Regional operator advantages include:

• Enhanced government relations

• Superior regulatory navigation capabilities

• Reduced political risk through domestic ownership

• Lower operational costs via regional supply chain integration

• Cultural and linguistic advantages in stakeholder management

Western Miner Strategic Repositioning

International mining companies increasingly focus on tier-one jurisdictions with stable regulatory frameworks. This repositioning concentrates resources on large-scale, long-life assets while reducing exposure to emerging market operational complexities. The strategy enables enhanced capital allocation efficiency through geographic and operational focus.

Investment Implications and Risk Assessment

The Tongon transaction creates both opportunities and considerations for Barrick shareholders and broader gold mining sector analysis. Improved capital allocation efficiency across the remaining portfolio enhances focus on core North American and tier-one international assets while reducing exposure to end-of-life operational risks.

Shareholder Impact Analysis

Positive Investment Factors:

• Enhanced capital allocation efficiency

• Reduced end-of-life operational risk exposure

• Improved focus on core asset portfolio

• Potential for superior per-asset returns

• Strategic flexibility through increased liquidity

Risk Considerations:

• Contingent payment realisation depends on gold price performance

• Production volume reduction requires replacement through other sources

• Transaction costs and closure provisions impact near-term cash flows

• Concentration risk increases with smaller portfolio

Sector-Wide Implications

The transaction signals broader mining industry consolidation trends where major miners divest non-core assets to achieve optimal portfolio composition. Capital efficiency becomes increasingly critical as investors demand disciplined allocation strategies rather than geographic diversification for its own sake.

Regional specialisation creates value through operational expertise matching between asset characteristics and operator capabilities. This trend benefits both divesting major miners and acquiring regional specialists through improved operational efficiency and strategic focus.

Future Strategic Scenario Development

Elevated gold prices may accelerate additional non-core asset sales as Barrick optimises portfolio composition ahead of industry peers. The successful Tongon transaction provides a template for future divestitures that balance immediate liquidity needs with upside participation through contingent payment structures.

Accelerated Portfolio Optimisation Scenario

If gold prices remain elevated, Barrick may pursue additional strategic transactions to fund major development projects in preferred jurisdictions, return excess capital to shareholders, or achieve optimal asset portfolio composition. The company's demonstrated execution capability in complex transaction structures positions it advantageously for future optimisation opportunities.

North American Separation Execution Framework

Tongon proceeds could facilitate North American asset separation by providing working capital for independent operational structures, reducing debt allocation complexity, and demonstrating successful divestiture execution to potential IPO investors. The strategic option provides enhanced flexibility for capital structure optimisation.

Disclaimer: This analysis is based on publicly available information and should not be construed as investment advice. Mining investments carry inherent risks including commodity price volatility, operational challenges, and regulatory changes. Contingent payment realisations depend on future performance metrics and market conditions that cannot be predicted with certainty.

Ready to Capitalise on the Next Major Mining Discovery?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering investors to identify actionable opportunities ahead of the broader market. Understand why historic discoveries can generate substantial returns and begin your 30-day free trial today to position yourself ahead of market movements in the evolving mining landscape.