A New Era in Global Resource Strategy

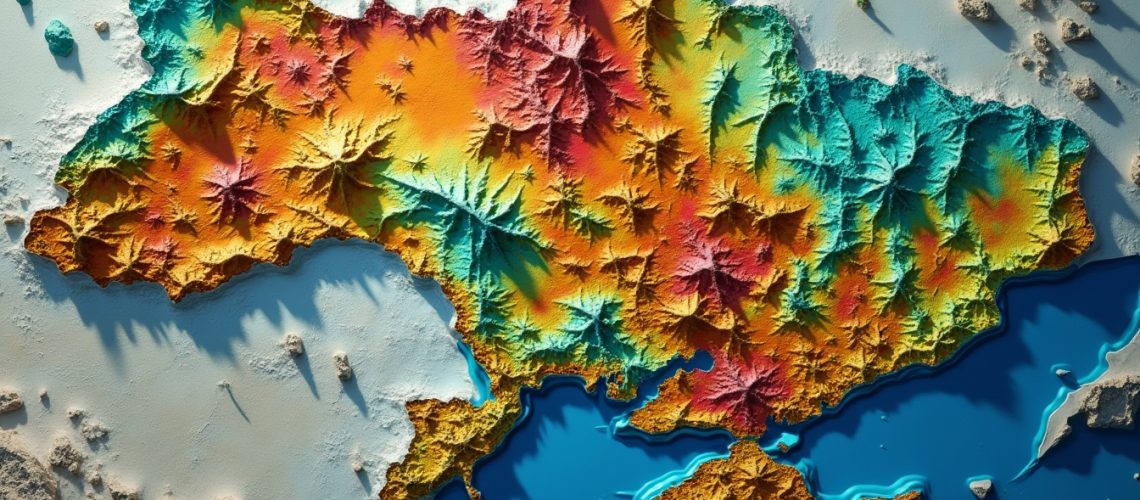

Former US President Donald Trump’s renewed focus on Ukraine’s mineral resources has cast a spotlight on the potential of Ukraine minerals—a subject that has rapidly risen to prominence in geopolitical debates. With a projected value of around $10 trillion in mineral deposits, these resources are drawing international attention for both their economic promise and strategic significance. As nations scramble to secure their own supply chains, the fate of Ukraine minerals has become a linchpin in broader global dynamics.

In recent years, the discussion around Ukraine minerals has steadily increased, with stakeholders analysing not only the financial implications but also the extensive political chess game that underpins access to these resources.

The Global Strategic Landscape: Why Ukraine Minerals Matter

The allure of Ukraine minerals extends far beyond mere extraction. The geopolitical landscape is shifting as countries seek to reduce their reliance on traditional suppliers and diversify their sources of critical elements. Analysts argue that Trump’s interest is not simply about seizing valuable resources, but about counterbalancing global market dependencies. In this context, Ukraine minerals are viewed as a vital tool in challenging existing power structures.

Key reasons driving this strategy include:

- Diversifying mineral acquisition to counteract monopolistic control by certain countries.

- Securing long-term investments in resource-rich regions.

- Strengthening alliances and trading positions in international negotiations.

Each of these points illuminates how Ukraine minerals are intertwined with the broader ambitions of countries aiming to reshape global economic power.

What Makes Ukraine’s Mineral Wealth Unique?

Ukraine’s mineral diversity stands out on the global stage. The country’s soils and rock formations foster a rich variety of elements including:

- Rare earth elements

- Lithium

- Graphite

- Titanium

- Uranium

These components, especially when considered collectively, have the potential to unlock significant strategic advantages. For instance, ukraine graphite reserves hold promise for industries that rely on advanced battery technology and electronics.

Moreover, the world’s increasing reliance on renewable energy and modern electronics has accelerated the demand for these critical metals. Consequently, Ukraine minerals have emerged as a focal point for investors and governments alike, keen to harness these resources to bolster national security and economic growth.

Challenges in Extracting Ukrainian Mineral Wealth

While the estimated deposit value is eye-catching, the extraction and processing of Ukraine minerals face several significant obstacles. The reality of deep-mining operations in Ukraine includes a mixture of technical, environmental, and economic complexities:

- Dominance of specific supply chains: For example, china’s rare-earth export controls currently lie at the forefront, with China controlling approximately 90% of the global capacity for rare earth processing.

- Environmental concerns: Mining operations must overcome environmental and technical barriers, including the need for cleaner extraction technologies.

- Limited interest from international mining conglomerates: Despite the wealth of deposits, the lack of established infrastructure and proven economically viable reserves has deterred many global investors.

- Strained regional stability: The continuing geopolitical instability, exacerbated by the ongoing conflict and Russian invasion, further complicates the operational landscape.

These challenges underscore that the process of capitalising on Ukraine minerals is much more complicated than simple extraction. The intricate web of processing requirements, environmental regulations, and market volatility—such as seen in the lithium sector (lithium market shifts)—demands a multifaceted approach to resource management.

Economic and Political Implications

The intersection of resource extraction and geopolitics creates both opportunities and challenges. Trump’s strategic pursuit of Ukraine minerals is a reflection of deeper agendas, where energy policies and economic negotiations merge. The key implications include:

- A shift in global power dynamics by challenging China’s near-monopoly on high-value minerals.

- A reconfiguration of global trade networks and supply chains designed to secure alternative sources.

- The potential for technology transfer and enhanced processing capabilities within allied nations.

Analysts have noted that strategies like these could offer the United States and its allies greater leverage in international relations. For instance, understanding the impact of trump’s energy strategies on oil stocks and international investments can offer insight into how similar approaches might be applied to mineral extraction. Furthermore, with the looming possibility of resource-based negotiations, the stakes for global diplomacy are higher than ever.

Additional research published in a global commodities report suggests that the dynamics around mineral supply chains are not only reshaping economic alliances but are also prompting a rethinking of national security priorities. Such external insights further highlight that the unfolding scenario around Ukraine minerals is both complex and consequential.

Deep Dive: Extraction, Infrastructure, and Investment Needs

To truly appreciate the potential of Ukraine minerals, one must understand the underlying issues associated with their extraction and subsequent processing. Here are several key factors to consider:

- Investment Horizon: Long-term infrastructure investment is essential to rival China’s established refining capabilities.

- Technology Transfer: Advancing local processing capabilities will require significant collaboration between Ukraine and international partners.

- Environmental Safeguards: As extraction processes intensify, ensuring that local ecosystems are preserved becomes paramount.

- Market Fluctuations: The volatility of commodity markets, particularly in sectors like lithium, remains a significant hurdle for investors.

Given these considerations, various stakeholders are rethinking their strategies. Governments recognise that a coordinated approach to infrastructure development and technology transfer can transform Ukraine minerals from untapped potential into a robust pillar of national industries. The ripple effects of these developments may well be felt across global markets and geopolitical arenas.

Expert Perspectives and Future Implications

Industry experts such as Willis Thomas from CRU Group offer critical insights into the operational realities of Ukraine minerals. His analysis highlights several points:

- The deposits, though vast, are often by-products of other mining endeavours.

- Processing capabilities outside of Asia remain a significant bottleneck.

- Immediate large-scale investment is hampered by the current state of technological and infrastructural development.

These expert observations suggest that while the promise of Ukraine minerals is substantial, overcoming the existing challenges will require coordinated policy efforts and international partnerships. Additionally, trends observed in other regions—for example, the initiatives spearheaded by saudi mining revolution efforts—demonstrate that a strategic overhaul of resource management can yield profound economic and political dividends.

Moreover, external perspectives from the mining industry trends provide additional context for the current challenges and opportunities. The convergence of environmental pressures, technological advancements, and economic necessity is steering the global community toward innovative approaches in mining and resource governance.

What Lies Ahead for Ukraine Minerals?

As the global market continues to evolve, the strategic outlook for Ukraine minerals remains a subject of keen interest. With uncertainty characterising international politics and market volatility, the coming years could see transformative changes in how these resources are managed and exploited.

Several scenarios may unfold:

- Increased international collaboration could lead to joint ventures that mitigate extraction risks and bolster processing capabilities.

- Enhanced diplomatic efforts may result in favourable trade agreements, shifting the balance of power within supply chains.

- Technological breakthroughs in mining and processing could reduce the environmental footprint, paving the way for more sustainable practices.

In all these potential futures, Ukraine minerals are poised to play a central role. The ongoing focus on diversifying resources and reducing over-reliance on singular supply chains marks a definitive turning point in global economic strategy.

Concluding Thoughts

Ukraine minerals are at the centre of a strategic realignment poised to redefine global energy and economic policies. While the promise of untapped wealth is undeniable, the challenges—from environmental concerns to entrenched supply chain monopolies—present formidable obstacles. Nevertheless, Trump’s renewed focus, coupled with expert insights and global market trends, suggests that the strategic recalibration of resource control is underway.

In summary:

- Ukraine minerals offer unprecedented economic value but come with critical extraction and processing challenges.

- The global power dynamic is shifting as nations seek to secure alternative sources and reduce dependency on established suppliers.

- Collaboration, technology transfer, and long-term investments are crucial for realising the full potential of this mineral wealth.

- External analyses underscore the complex interplay between market demands, environmental sustainability, and geopolitical strategy.

The evolving story of Ukraine minerals is a testament to how natural resources remain intricately linked with political ambition and economic strategy. As the world braces for further shifts in global markets, strategic investments in Ukraine’s vast mineral potential may well determine the future of international trade, alliances, and even security.

Want to Uncover Strategic Mineral Investment Opportunities?

Discover fast, AI-driven alerts on significant ASX mineral discoveries with Discovery Alert, designed to help investors—from newcomers to seasoned traders—navigate the complex world of mineral exploration and capitalize on emerging opportunities. Start your 30-day free trial today and transform how you approach resource investment strategies.