The UK critical minerals strategy emerges as a pivotal response to mounting supply chain vulnerabilities that threaten national security and economic competitiveness. As geopolitical tensions reshape global trade dynamics, advanced economies face critical decisions about strategic mineral security that could define industrial competitiveness for decades. The intersection of clean energy transitions, defence requirements, and technological sovereignty creates complex policy challenges where market mechanisms must balance against national security imperatives.

What Defines the UK's Strategic Approach to Critical Minerals Independence?

The UK critical minerals strategy represents a comprehensive framework targeting fundamental supply chain transformation through strategic diversification and domestic capacity building. Launched in November 2025, this initiative encompasses systematic approaches to reducing foreign dependency whilst building resilient industrial capabilities across key mineral value chains.

The strategic framework centres on ambitious quantitative targets designed to reshape the UK's mineral security profile:

- Domestic production expansion: From current 6% to 10% of national demand through UK-based extraction by 2035

- Recycling infrastructure development: 20% of mineral requirements sourced through circular economy initiatives

- Strategic stockpiling integration: Critical minerals incorporated into defence procurement planning

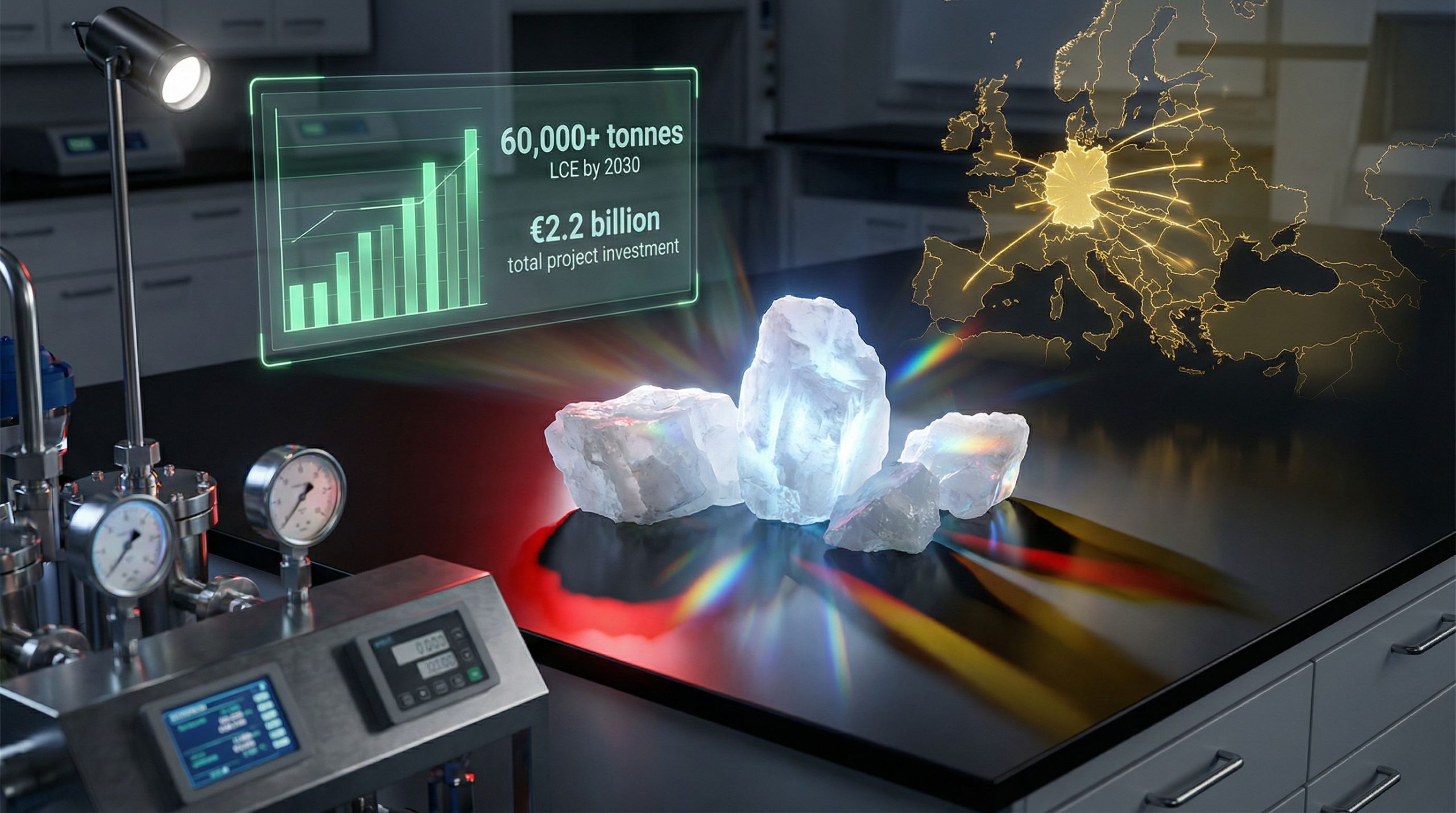

- Lithium production milestone: Minimum 50,000 metric tons annually by 2035

Core Mineral Focus Areas

The strategy concentrates efforts on four critical mineral categories that underpin advanced manufacturing and clean energy infrastructure: lithium for battery storage systems, nickel for corrosion-resistant applications, tungsten for high-temperature industrial processes, and rare earth elements for electronics and precision manufacturing.

This selective focus reflects analysis of supply chain vulnerabilities where China's market dominance challenges create strategic dependencies. China controls approximately 70% of global rare earth mining operations and 90% of refining capacity, establishing bottlenecks that extend beyond raw material extraction into processed materials essential for technological applications.

Investment Framework and Funding Mechanisms

The UK government has committed up to £50 million in initial funding to support critical minerals development, though this represents a markedly different approach compared to international counterparts employing direct price intervention mechanisms. Rather than guaranteeing minimum prices, the UK strategy emphasises regulatory clarity, infrastructure development, and strategic demand creation through government procurement.

Industry Minister Chris McDonald indicated confidence in market-driven investment attraction, stating that current investment flows demonstrate adequate private sector engagement without requiring guaranteed pricing mechanisms. This perspective suggests the UK's existing competitive advantages, including regulatory stability and established industrial infrastructure, provide sufficient incentives for project development.

Why Are Traditional Price Floor Mechanisms Absent from UK Policy Architecture?

The UK's decision to avoid price floor guarantees distinguishes its approach from emerging international precedents, particularly the US mineral production executive order that includes guaranteed minimum pricing for domestic producers.

Comparative Policy Analysis

The United States implemented a guaranteed minimum price mechanism for rare earth producer MP Materials in July 2025, representing part of broader Pentagon investment commitments designed to reduce Chinese supply chain dependencies. This approach couples price stability assurances with strategic procurement commitments, creating dual-layer support for domestic production expansion.

Furthermore, European critical materials supply initiatives and other G7 nations reportedly consider similar price floor mechanisms alongside potential taxes on Chinese exports, according to September 2025 intelligence sources. These coordinated approaches suggest widespread recognition of market intervention necessity to compete against Chinese state-supported production.

| Policy Mechanism | United States | United Kingdom | Implementation Status |

|---|---|---|---|

| Price Floor Guarantees | ✓ Active | ✗ Not Planned | US: July 2025 / UK: No timeline |

| Strategic Stockpiling | ✓ Defence Priority | ✓ Under Development | Both nations planning |

| Processing Subsidies | ✓ Pentagon Investment | ✓ £50M Commitment | Different scale approaches |

| Export Restrictions | Under G7 Discussion | Under G7 Discussion | Coordinated consideration |

Market Efficiency Versus Strategic Security

McDonald's rationale for avoiding price floors reflects confidence in alternative policy mechanisms generating adequate investment flows. His assessment that "we are attracting the investment" suggests the UK's existing competitive framework provides sufficient private sector incentives without direct price intervention.

This approach assumes market discovery mechanisms can effectively price strategic value whilst maintaining competitive efficiency. However, the strategy maintains policy flexibility, with McDonald noting willingness to monitor international developments, particularly US price floor outcomes.

According to the UK's official critical minerals strategy, the government emphasises building resilient supply chains through market mechanisms rather than direct subsidisation.

Strategic Optionality and Future Adaptations

The UK position allows strategic flexibility as international coordination mechanisms evolve. Should G7 nations implement coordinated price floors or export restrictions targeting Chinese dominance, the UK retains optionality to adapt its framework without reversing established policy positions.

This measured approach may reflect analysis suggesting coordinated international responses could prove more effective than unilateral interventions, particularly if combined with technological cooperation agreements and shared strategic reserve management.

What Investment Dynamics Are Driving UK Critical Minerals Development?

Private sector engagement in UK critical minerals development demonstrates market confidence despite the absence of guaranteed pricing mechanisms, according to government assessments. This organic investment attraction suggests underlying competitive advantages that differentiate the UK market from other nations requiring direct price interventions.

Northern England Lithium Processing Hub Development

Lithium processing projects in Northern England represent the most advanced development within the UK critical minerals strategy, with industry officials expecting project commencement within the next few years. These facilities are designed to contribute substantially toward the 50,000 metric ton annual lithium production target by 2035.

The geographic concentration in Northern England leverages existing industrial infrastructure, including established transportation networks, electrical grid capacity, and skilled manufacturing workforces. This infrastructure utilisation reduces capital requirements compared to greenfield development, potentially improving project economics without requiring price guarantees.

Investment Attraction Factors

Several competitive advantages support the UK's market-driven approach to critical minerals investment:

Regulatory Certainty: The November 2025 strategy launch provides clear policy frameworks and government commitment signals that reduce regulatory risk for long-term capital investments.

Market Access: Proximity to European clean energy markets creates natural demand channels for processed materials, reducing marketing and logistics costs compared to more distant production locations.

Industrial Integration: Existing manufacturing capabilities in automotive, aerospace, and defence sectors provide downstream integration opportunities that enhance project viability.

Political Stability: Established democratic institutions and rule of law frameworks reduce sovereign risk premiums that affect project financing costs.

Technology and Processing Advantages

The UK strategy emphasises advanced processing capabilities rather than raw material extraction alone, potentially capturing higher value-added segments of critical mineral supply chains. This approach addresses Chinese dominance in refining operations, where technical expertise and processing infrastructure create more significant barriers than mining operations.

Processing technology development could establish competitive advantages in recycling operations, where urban mining and circular economy approaches offer growth opportunities as global critical mineral demand expands. These technologies may prove exportable to other markets, creating additional revenue streams beyond domestic mineral security objectives.

How Does China's Market Dominance Influence UK Strategic Planning?

China's overwhelming control of critical mineral supply chains creates structural dependencies that extend far beyond raw material availability into processed materials essential for advanced technologies. With 70% of global rare earth mining and 90% of refining capacity under Chinese control, alternative supply chains currently lack sufficient redundancy to maintain supply security during geopolitical disruptions.

Supply Chain Concentration Analysis

| Supply Chain Stage | Chinese Market Share | Strategic Vulnerability | UK Response Strategy |

|---|---|---|---|

| Raw Material Mining | 70% | Supply interruption risk | Domestic extraction target: 10% by 2035 |

| Processing/Refining | 90% | Technical dependency | Advanced processing facility development |

| Component Manufacturing | 60-80% | Technology integration risk | End-to-end supply chain building |

| Strategic Reserve Management | Variable | Emergency supply gaps | Defence procurement stockpiling |

Historical Precedent and Risk Assessment

China's documented use of rare earth export restrictions during the 2010 Japan-China territorial dispute demonstrates precedent for supply chain weaponisation. During this period, Chinese export quotas effectively disrupted global technology manufacturing, forcing companies to seek alternative suppliers and governments to reassess strategic vulnerabilities.

Current geopolitical tensions suggest similar supply disruption risks could emerge from Taiwan-related conflicts, trade disputes, or broader strategic competition between China and Western alliance systems. These scenarios inform UK planning assumptions about supply chain resilience requirements.

Technological Dependency Challenges

Chinese dominance extends beyond resource control into processing technology and technical expertise accumulated over decades of investment and market development. Rare earth refining requires specialised knowledge of chemical processes, environmental management, and quality control systems that represent significant barriers to market entry.

The UK strategy acknowledges these technical challenges through emphasis on advanced processing development and recycling technology innovation. In addition, the energy transition and critical minerals connection highlights the importance of securing supply chains for renewable energy infrastructure.

Geopolitical Coordination Opportunities

G7 discussions regarding coordinated responses to Chinese mineral dominance suggest potential for multilateral supply chain initiatives that could reduce individual nation dependency whilst sharing development costs and technical risks. These coordination mechanisms may include shared strategic reserves, technology development partnerships, and coordinated investment in alternative supply sources.

The UK's current policy flexibility positions the nation to participate in such coordination whilst maintaining strategic autonomy over domestic mineral security decisions. This approach may prove advantageous if coordinated responses prove more effective than unilateral strategies.

What Role Will Defence Procurement Play in Market Development?

Strategic defence procurement represents a crucial demand anchor within the UK critical minerals framework, providing predictable government purchasing commitments that support project financing and long-term investment decisions. The integration of critical minerals stockpiling into defence planning transforms national security requirements into market demand signals.

Defence as Strategic Demand Creator

Unlike civilian markets where demand fluctuates with economic conditions and technological changes, defence procurement offers relatively stable, long-term purchasing commitments that reduce market risk for domestic producers. This demand predictability enables project developers to secure financing based on government purchase agreements rather than volatile commodity markets.

The approach decouples demand assurance from price intervention, allowing market mechanisms to determine pricing whilst government commits to volume purchases. This strategy addresses investor concerns about market development risks without requiring direct price subsidies.

Critical Minerals Defence Applications

Defence applications span multiple mineral categories within the UK strategic focus:

Lithium Applications: Advanced battery systems for portable electronics, unmanned systems, communication equipment, and energy storage for remote installations.

Tungsten Applications: Armour materials, kinetic energy penetrators, high-temperature engine components, and specialised alloys for aerospace applications.

Rare Earth Applications: Precision guidance systems, radar electronics, communication systems, night vision equipment, and advanced sensors.

Nickel Applications: Corrosion-resistant alloys for naval applications, aerospace components, and specialised manufacturing processes.

Strategic Reserve Management Framework

The planned integration of critical minerals stockpiling into defence procurement creates systematic approaches to strategic reserve management that balance security requirements with cost optimisation. This framework must address storage requirements, inventory rotation, and emergency release procedures.

Strategic reserves serve multiple functions beyond emergency supply: they provide demand signals that support domestic industry development, create buffers against price volatility, and establish release mechanisms for market stabilisation during supply disruptions.

Dual-Use Technology Development

Defence-funded critical minerals research often generates civilian applications that expand market opportunities beyond government procurement. Advanced extraction technologies, recycling processes, and material science innovations developed for defence applications frequently transfer to commercial markets.

This dual-use potential multiplies the economic value of defence investment whilst accelerating technological development timelines. Commercial applications provide additional revenue streams that improve project viability and reduce government subsidy requirements.

How Might G7 Coordination Affect UK Policy Evolution?

International coordination mechanisms under development within G7 frameworks could significantly influence UK critical minerals policy evolution, particularly regarding price floor adoption and coordinated responses to Chinese export policies. Current discussions suggest potential policy convergence that may affect UK strategic calculations.

Multilateral Policy Development Trends

G7 nations and European Union members reportedly consider coordinated price floor mechanisms alongside potential taxes on Chinese exports, according to September 2025 intelligence assessments. These coordinated approaches reflect widespread recognition that unilateral responses may prove insufficient against state-supported Chinese production advantages.

Coordinated policies could include shared strategic reserve management, technology development partnerships, financing cooperation, and harmonised regulatory standards that reduce compliance costs for multinational projects.

As noted by Chatham House's analysis, the UK's strategy represents "an ambitious step forward, but now it needs a champion" to drive implementation effectively.

Policy Adaptation Scenarios

Scenario 1: Multilateral Price Floor Adoption

Should G7 nations implement coordinated price floor mechanisms, the UK's current market-driven approach could face competitive disadvantages if other nations attract greater investment through guaranteed pricing. This scenario might necessitate UK participation to maintain level competitive conditions.

Multilateral coordination could reduce individual nation fiscal costs whilst providing collective bargaining power against Chinese export policies. Shared price floors might prove more sustainable than unilateral interventions whilst maintaining market efficiency within alliance frameworks.

Scenario 2: Technology Cooperation Agreements

Advanced processing technology development partnerships could leverage combined G7 technical expertise and financial resources to accelerate alternative supply chain capabilities. The UK's industrial base and research capabilities position the nation advantageously for such cooperation.

Technology sharing agreements might include rare earth processing innovations, recycling methodologies, extraction techniques, and material science research that collectively challenge Chinese technical dominance.

Scenario 3: Strategic Trade Integration

Critical minerals provisions integrated into bilateral and multilateral trade agreements could create preferential market access for alliance producers whilst establishing supply chain cooperation frameworks. These agreements might include investment protection, technology transfer facilitation, and coordinated export financing.

Such integration could establish secure supply chains within democratic alliance systems whilst reducing dependency on Chinese-controlled supply networks.

UK Strategic Positioning Advantages

The UK's current policy flexibility allows strategic positioning for various coordination scenarios without premature commitment to specific mechanisms. This optionality enables the UK to evaluate international development effectiveness whilst maintaining strategic autonomy over domestic policy decisions.

Geographic position, established industrial capabilities, and existing international relationships position the UK favourably for potential G7 coordination roles, particularly in European market integration and Atlantic alliance cooperation.

What Are the Long-Term Implications for Global Supply Chain Architecture?

The UK's strategic approach represents broader trends toward supply chain regionalisation that could fundamentally restructure global critical minerals markets. Success in achieving domestic production targets and recycling capabilities could influence other nations' approaches whilst demonstrating market-driven alternatives to direct government intervention.

Regional Supply Chain Reconfiguration

Strategic mineral security initiatives across multiple nations suggest potential emergence of regional supply chain hubs that reduce dependency on Chinese-controlled networks. The UK's emphasis on processing capabilities positions the nation as a potential European regional centre for critical minerals transformation.

Regional approaches may prove more resilient than globally integrated supply chains whilst offering improved transportation economics and regulatory coordination. Furthermore, the critical minerals and renewable energy strategy demonstrates how nations are increasingly linking mineral security with clean energy objectives.

Technology Transfer and Innovation Acceleration

Competition with Chinese mineral dominance drives technological innovation in extraction, processing, and recycling methodologies. UK investments in advanced processing and recycling technologies could generate exportable innovations that expand market opportunities beyond domestic security objectives.

Technological differentiation through superior recycling capabilities, environmental performance, or processing efficiency could establish competitive advantages that sustain market position even without ongoing government support.

Investment Pattern Transformation

Successful demonstration of market-driven critical minerals development could influence global investment patterns by proving alternative approaches to Chinese state-supported production. Private sector confidence in non-Chinese supply chains could accelerate capital deployment across multiple nations simultaneously.

Investment diversification reduces systemic risks associated with Chinese supply chain concentration whilst creating competitive pressure for continued innovation and efficiency improvements.

Geopolitical Realignment Implications

Critical minerals security represents a component of broader strategic competition between democratic alliance systems and authoritarian state-directed economies. Success in developing alternative supply chains could reduce Chinese leverage whilst strengthening alliance cooperation mechanisms.

Supply chain independence contributes to broader strategic autonomy that affects defence cooperation, technology sharing, and economic policy coordination among democratic partners.

How Will Success Be Measured and Monitored?

The UK critical minerals strategy establishes measurable targets that enable systematic evaluation of progress toward strategic independence objectives. Regular assessment mechanisms will likely influence policy adjustments and potential adoption of additional support measures based on achievement metrics.

Primary Performance Indicators

Domestic Production Metrics: Progress toward 10% domestic production target measured against baseline 6% current capacity, with interim milestones tracking extraction facility development and operational capacity expansion.

Recycling Infrastructure Development: Achievement of 20% recycling target requires systematic measurement of urban mining capabilities, waste stream capture rates, and processing facility capacity utilisation.

Supply Chain Diversification: Maximum dependency thresholds for individual nations measured through import source analysis, supplier relationship mapping, and alternative supply source development.

Investment Attraction Assessment: Private sector capital commitments, project development timelines, and operational facility completion rates compared against international competitors using price floor mechanisms.

Strategic Milestone Tracking

The 50,000 metric ton annual lithium production target by 2035 provides specific performance benchmarks that enable progress assessment and policy effectiveness evaluation. Interim milestones for facility construction, permitting completion, and production ramp-up create accountability mechanisms.

Northern England processing hub development represents concentrated investment that facilitates measurement of regulatory effectiveness, infrastructure adequacy, and market response to government initiatives.

Adaptive Policy Framework

Performance assessment mechanisms must accommodate changing international conditions, technological developments, and market dynamics that affect strategy implementation. Regular policy reviews should incorporate lessons learned from international approaches and evolving strategic requirements.

Flexibility mechanisms enable strategy adjustment based on achievement rates, international coordination developments, and emerging supply chain risks that may require additional policy tools.

Comparative Analysis Requirements

Success measurement requires systematic comparison with nations employing alternative approaches, particularly those utilising price floor mechanisms. Comparative analysis should evaluate investment attraction effectiveness, production capacity development, and strategic independence achievement across different policy frameworks.

International benchmarking provides evidence for policy effectiveness whilst identifying potential improvements or additional mechanisms that may enhance UK strategic mineral security objectives.

The UK critical minerals strategy demonstrates commitment to market-driven solutions whilst maintaining strategic flexibility for future adaptations based on international developments and domestic performance outcomes. By emphasising regulatory clarity, strategic procurement, and infrastructure development rather than direct price interventions, Britain pursues mineral security through competitive advantage rather than subsidisation.

Success depends on maintaining private sector investment confidence whilst building domestic capabilities that reduce strategic vulnerabilities. The approach provides valuable testing of market-driven alternatives to direct government intervention, with outcomes informing broader discussions about balancing market efficiency with national security requirements in critical supply chain development.

Disclaimer: This analysis involves policy forecasts and strategic projections that remain subject to changing international conditions, technological developments, and policy adjustments. Readers should monitor official government announcements and policy updates for current information.

Looking to Capitalise on Critical Minerals Investment Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, including lithium, rare earth elements, and other critical minerals driving the global energy transition. With the UK's ambitious strategy to reduce foreign dependency and secure domestic supply chains, understanding why historic discoveries can generate substantial returns becomes crucial for positioning ahead of market movements. Begin your 30-day free trial today to gain actionable insights into the critical minerals sector's most promising opportunities.