The uranium exploration landscape has evolved beyond traditional binary partnerships between majors and junior companies. Today's complex market dynamics demand sophisticated capital allocation strategies that address scale challenges while optimising discovery probability across extensive properties. Modern joint ventures now employ multi-tiered ownership structures, staged earn-in mechanisms, and operator flexibility to unlock value in previously challenging exploration scenarios.

Contemporary partnerships recognise that large-scale properties exceeding 70,000 hectares present operational constraints that single operators struggle to address efficiently. The solution involves strategic segmentation where specialised teams focus on defined geological corridors while maintaining coordinated exploration objectives across the broader property complex. Effective joint venture frameworks enable parallel exploration programs to proceed simultaneously, reducing timeline constraints that typically limit large-property exploration.

What Makes the Russell Lake Strategic Partnership a Game-Changing Transaction?

Multi-Tiered Joint Venture Architecture

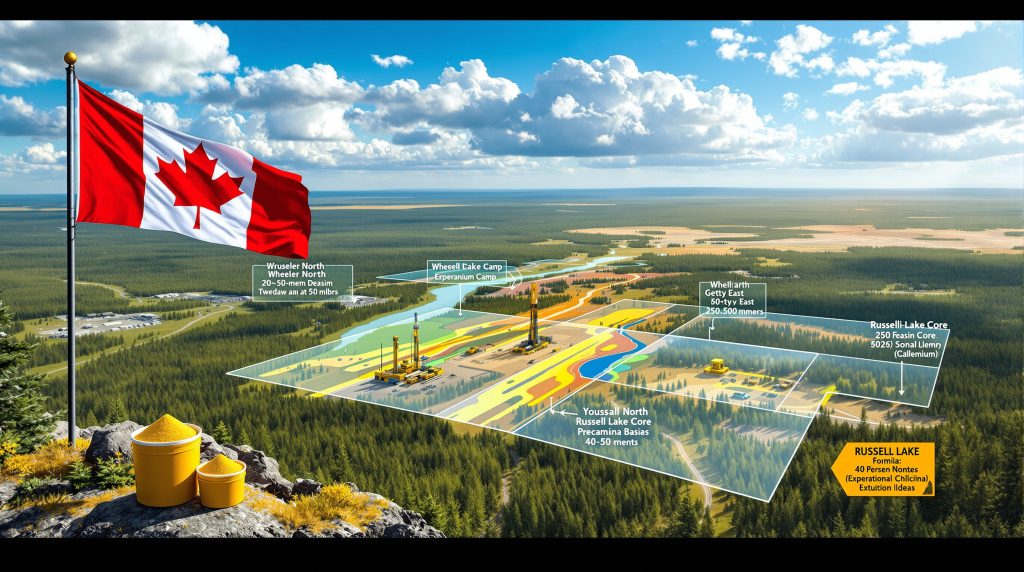

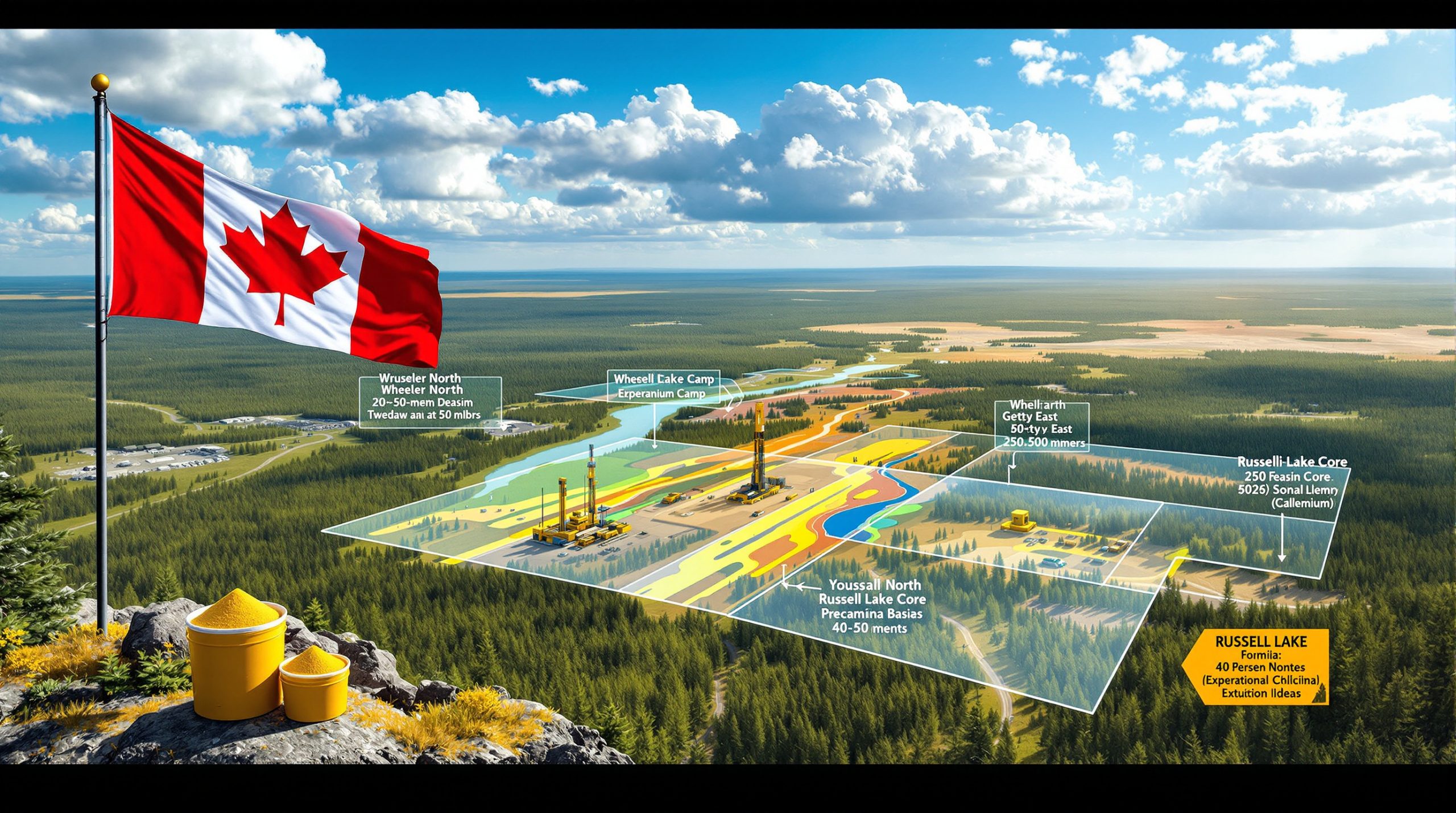

The Russell Lake project strategic partnership represents a departure from conventional exploration models through its four-segment operational framework. Spanning 73,314 hectares of prospective uranium terrain in Saskatchewan's Eastern Athabasca Basin, the partnership addresses the fundamental challenge facing junior exploration companies: effectively exploring massive properties with limited capital resources.

The transaction structure creates operational independence across distinct geological zones while maintaining strategic coordination between Denison Mines and Skyharbour Resources. This segmentation approach allows parallel exploration programs to proceed simultaneously, reducing timeline constraints that typically limit large-property exploration.

Key Structural Components:

- Four distinct operational segments with specialised management frameworks

- Risk distribution across multiple high-probability target zones

- Focused exploration zones with dedicated funding mechanisms

- Operational efficiency through specialised technical team deployment

Capital Deployment Strategy and Financial Architecture

The partnership's financial structure demonstrates sophisticated capital allocation designed to maximise exploration effectiveness while providing non-dilutive funding to the junior partner. Denison Mines commits CAD $61.5 million over a seven-year timeline across the four-segment structure, representing one of the largest exploration commitments in the Athabasca Basin.

Financial Framework Breakdown:

| Component | Amount (CAD) | Purpose | Timeline |

|---|---|---|---|

| Initial Cash Payment | $18 million | Immediate liquidity | Before year-end 2024 |

| Wheeler North Earn-in | $25 million | Exploration expenditure | 7 years |

| Getty East Earn-in | $15 million | Exploration expenditure | 7 years |

| Additional Cash Payments | $3.5 million | Wheeler North option | 7 years |

| Total Commitment | $61.5 million | Combined programmes | 2025-2032 |

The immediate CAD $21.5 million liquidity injection to Skyharbour Resources provides substantial operational runway while the staged earn-in commitments ensure sustained exploration activity across multiple target zones. After accounting for the CAD $10 million Rio Tinto buyout, Skyharbour retains CAD $8 million in net proceeds, sufficient for 18-24 months of operational funding. Furthermore, these exploration funding strategies provide non-dilutive capital while maintaining operational flexibility.

Strategic Risk Distribution Model

Unlike traditional joint ventures where single discovery failure impacts entire property value, the four-segment structure creates independent value centres. Each operational zone operates with distinct geological characteristics, target depths, and discovery probability profiles, reducing binary risk exposure that typically constrains large-property exploration.

The partnership model addresses the scale challenge identified by industry executives: properties exceeding 70,000 hectares become operationally unwieldy for junior companies working independently. By creating specialised exploration zones with dedicated operators and funding streams, the structure enables aggressive exploration programmes that would be impossible under single-operator constraints. Additionally, implementing risk mitigation models ensures comprehensive protection against operational uncertainties.

How Does the Four-Segment Joint Venture Framework Operate?

Russell Lake Core Claims Operational Structure

The Russell Lake (RL) Claims segment represents the largest component of the partnership, encompassing over 50,000 hectares of the original 73,314-hectare property. Under this framework, Skyharbour Resources retains 80% ownership and operational control, while Denison Mines holds 20% as a funding partner.

This structure allows Skyharbour to prioritise exploration targets including Christy Lake, Cowchuck Lake, and eastern conductor extensions while Denison provides proportional funding without operational distraction from Wheeler River project activities. The funding mechanism requires Denison to maintain proportional capital contributions to retain ownership percentages, with automatic dilution adjustments if funding obligations are not met.

Operational Characteristics:

- Operator: Skyharbour Resources (80% owner)

- Funding Partner: Denison Mines (20% stake)

- Property Size: 50,000+ hectares

- Dilution Protection: Proportional funding requirements

- Target Focus: Multiple drill-ready prospects with historical mineralisation

Wheeler North Earn-In Mechanism

The Wheeler North property operates under a performance-based earn-in structure where Denison initially holds 51% ownership with Skyharbour retaining 49%. Through committed exploration expenditures totalling CAD $25 million over seven years, Denison can increase ownership to 70%, with additional CAD $3.5 million in cash payments to Skyharbour over the earn-in period.

This segment's strategic positioning adjacent to Wheeler River project with a 55-kilometre shared border creates immediate operational synergies. Denison's geological teams can directly apply Wheeler River depositional models and conductor interpretations to Wheeler North exploration programmes, accelerating target definition and drilling efficiency. Moreover, these operational synergies enhance cost-effectiveness across both properties.

Wheeler North Performance Gates:

- Initial Ownership: 51% Denison, 49% Skyharbour

- Earn-in Target: 70% Denison ownership

- Expenditure Requirement: CAD $25 million over 7 years

- Cash Payments: CAD $3.5 million to Skyharbour

- Annual Milestone: Approximately CAD $500,000 yearly cash payments

Getty East Development Framework

The Getty East segment employs a minority-to-majority earn-in structure where Denison starts with 30% ownership and Skyharbour holds 70%. Through CAD $15 million in exploration expenditures over seven years, Denison can earn up to 70% ownership, effectively swapping positions with Skyharbour.

Initially Skyharbour-operated, this segment allows the junior partner to implement exploration programmes targeting Man Lake and Little Man Lake zones positioned on the Key Lake trend. The proximity to established Key Lake mining complex provides infrastructure advantages and geological continuity with proven uranium deposits.

Getty East Earn-In Structure:

- Initial Position: 30% Denison, 70% Skyharbour

- Target Position: 70% Denison, 30% Skyharbour

- Expenditure Threshold: CAD $15 million over 7 years

- Initial Operator: Skyharbour Resources

- Strategic Location: Key Lake trend extension

Wheeler River Inlier Claims Integration

The Wheeler River Inlier Claims segment represents immediate operational integration with Denison assuming 70% ownership and Skyharbour retaining 30% without earn-in requirements. This structure provides Denison-operated exploration with direct synergies to existing Wheeler River operations and planned Phoenix mine development.

The immediate majority control transfer enables Denison to coordinate exploration activities with Wheeler River geological programmes while providing Skyharbour with exposure to high-probability extensions of established mineralisation trends. This segment offers the highest probability of near-term discovery given its direct connection to proven uranium systems.

What Strategic Advantages Does Geographic Positioning Provide?

Infrastructure Access and Cost Optimisation

The Russell Lake project strategic partnership benefits from exceptional infrastructure positioning within the Eastern Athabasca Basin. The Holladay Road connecting to MacArthur River mine operations runs directly through the property, while power line infrastructure provides grid connectivity for exploration operations.

The partnership inherited a 40-person state-of-the-art exploration camp from Rio Tinto's previous involvement, representing significant capital cost avoidance typically consuming 10-15% of annual exploration budgets at remote locations. This infrastructure advantage contributes to all-in drilling costs of CAD $350 per metre, substantially below regional averages. Implementing comprehensive cost optimisation insights further enhances operational efficiency.

Infrastructure Advantages:

- Holladay Road access to MacArthur River operations

- Power line connectivity reducing operational costs

- 40-person exploration camp inherited infrastructure

- Year-round accessibility eliminating seasonal constraints

- Drive accessibility from Saskatoon operational base

Proximity to Established Mining Operations

The strategic positioning adjacent to multiple established uranium operations creates operational and logistical synergies unavailable at greenfield locations. The property shares a 55-kilometre border with Wheeler River project, positioning exploration activities to benefit from existing geological knowledge and technical expertise.

Proximity Benefits:

| Operation | Distance | Strategic Value |

|---|---|---|

| Phoenix Deposit | Few kilometres | Future production timeline alignment |

| Wheeler River Project | Shared 55km border | Geological continuity and technical synergy |

| Key Lake Complex | Trend extension | Processing infrastructure access |

| MacArthur River Mine | Direct road access | Regional expertise and logistics |

The Phoenix deposit's projected production timeline (targeting construction commencement in late 2026) creates pipeline development opportunities where Russell Lake discoveries could support expanded production capacity and resource base extensions.

Geological Corridor Strategic Positioning

The Russell Lake property's location within the Eastern Athabasca Basin's prolific mining corridor provides geological advantages based on proven uranium deposit models. The property occupies structural positions along established uranium-bearing geological trends connecting Wheeler River, Key Lake, and MacArthur River deposit areas.

Regional geological continuity supports conductor extension potential where mineralised structures from established deposits continue onto Russell Lake property. Multiple depth profiles ranging from 250-500 metres optimise drilling economics while maintaining discovery potential across various geological environments.

Geological Advantages:

- Proven uranium-bearing geological structures extend across property

- Multiple target zones with varying depth profiles

- Continuation of established depositional models from adjacent deposits

- Conductor extensions from Wheeler River and Key Lake systems

- Basin margin proximity for shallow target development

How Will Exploration Economics Drive Project Success?

Cost Efficiency Metrics and Operational Advantages

The Russell Lake project strategic partnership demonstrates exceptional exploration economics through infrastructure advantages and operational efficiency. All-in drilling costs of CAD $350 per metre include comprehensive expenses: geological services, assays, camp operations, and equipment deployment, representing significant cost savings compared to remote exploration locations.

Year-round drillability eliminates seasonal constraints that typically limit exploration programmes to 6-8 month windows in northern Saskatchewan. Combined with road accessibility and drive-in camp access from Saskatoon, operational efficiency enables maximum utilisation of committed exploration expenditures.

Economic Efficiency Factors:

- CAD $350/metre all-in drilling costs including full operational support

- Year-round accessibility maximising drilling season utilisation

- 250-500 metre target depths optimising drilling efficiency

- Road-accessible targets reducing mobilisation costs

- Established camp infrastructure eliminating setup expenses

Resource Allocation and Drilling Optimisation

The CAD $40 million minimum exploration expenditure across Wheeler North and Getty East earn-in programmes, combined with additional Skyharbour funding at RL Claims, positions the partnership as one of the most actively funded exploration programmes in the Athabasca Basin. This capital deployment enables parallel exploration programmes across multiple geological targets simultaneously.

Target depth optimisation contributes significantly to drilling economics. Most prospects range from 250-450 metres depth, avoiding expensive deeper drilling while maintaining discovery potential across various geological environments. This depth profile maximises hole completion rates and allows efficient rig utilisation across multiple targets.

Drilling Economics Analysis:

| Parameter | Specification | Economic Impact |

|---|---|---|

| Average Target Depth | 250-500 metres | Optimal drilling efficiency |

| All-in Cost | CAD $350/metre | Below regional averages |

| Accessibility | Year-round | Maximum utilisation |

| Infrastructure | Established camp | Reduced overhead |

| Mobilisation | Drive-in access | Minimal setup costs |

Discovery Probability Enhancement Through Capital Deployment

The partnership's diversified exploration approach across four operational segments reduces binary risk while increasing overall discovery probability. Multiple simultaneous exploration vectors enable systematic testing of various geological models and conductor systems across the property.

Enhanced funding capacity through structured partnerships provides sustained exploration capability extending beyond typical junior company funding cycles. The seven-year earn-in timeline ensures consistent exploration activity while performance-based mechanisms align discovery incentives between partners.

Risk Mitigation Through Diversification:

- Four independent exploration zones reducing single-point failure risk

- Multiple geological models tested simultaneously

- Sustained funding capability over extended timeline

- Performance-based incentives aligning partner interests

- Parallel programme execution maximising discovery probability

What Are the Key Financial Implications for Both Partners?

Skyharbour Resources Financial Position Enhancement

The Russell Lake project strategic partnership fundamentally transforms Skyharbour Resources' financial profile through non-dilutive capital injection while maintaining operational control across the majority of the property. The transaction provides immediate liquidity while establishing sustained funding mechanisms across multiple exploration programmes.

Skyharbour Financial Impact Analysis:

| Component | Amount (CAD) | Timeline | Financial Impact |

|---|---|---|---|

| Initial Cash/Shares | $18 million | Before year-end 2024 | Immediate liquidity |

| Future Earn-in Payments | $3.5 million | Over 7 years | Sustained cash flow |

| Rio Tinto Buyout Cost | ($10 million) | Immediate | Consolidation expense |

| Net Initial Position | $8 million | 2025 operations | 18-24 month runway |

The retained CAD $8 million net position after Rio Tinto consolidation provides operational funding extending into 2027, while proportional funding from Denison at RL Claims reduces capital requirements for the largest property segment. Additional CAD $3.5 million in Wheeler North cash payments over seven years creates predictable cash flow for corporate activities.

Denison Mines Strategic Investment Framework

Denison's CAD $61.5 million commitment represents strategic asset diversification beyond Wheeler River while leveraging existing technical capabilities and regional expertise. The investment provides pipeline development opportunities supporting post-Phoenix production expansion and resource base growth.

The staged investment structure aligns capital deployment with exploration results, enabling Denison to increase ownership stakes through performance-based earn-ins rather than upfront acquisition costs. This approach provides option value on multiple discoveries while maintaining capital efficiency.

Denison Investment Advantages:

- Strategic asset diversification beyond single-project risk

- Operational leverage of existing Wheeler River expertise

- Pipeline development for post-Phoenix expansion

- Performance-based earn-ins providing discovery option value

- Adjacent property control enhancing Wheeler River resource potential

Return on Investment Projections and Value Creation

The partnership's multiple high-probability discovery targets across four operational segments provide diversified return potential while infrastructure cost savings enhance project economics. Discovery probability increases significantly through sustained funding capability and specialised technical team deployment.

Accelerated timeline to resource definition through parallel exploration programmes enables faster progression from discovery to preliminary economic assessment compared to sequential exploration approaches. The proven geological corridor positioning supports higher confidence resource modelling based on adjacent deposit characteristics.

Value Creation Metrics:

- Discovery potential across multiple high-probability targets

- Infrastructure cost savings through shared facilities utilisation

- Accelerated development timeline via parallel exploration programmes

- Enhanced resource confidence through regional geological continuity

- Pipeline value creation for future production expansion

Which Exploration Targets Offer the Highest Discovery Potential?

Wheeler North Priority Target Analysis

The Wheeler North property contains several high-priority exploration targets with demonstrated mineralisation and direct geological continuity from Wheeler River project. The Grailing target area shows confirmed high-grade intercepts with recent drilling achieving up to 3% U3O8 over 0.5 metres at the Fork target zone, representing significant uranium concentrations.

Fox Lake Trail target area represents direct conductor extensions from Wheeler River project onto Russell Lake property, providing immediate exploration focus based on proven geological models. The geological similarities between Wheeler North targets and established Wheeler River deposits support higher discovery confidence compared to greenfield exploration areas.

Wheeler North Target Priorities:

- Grailing target area with confirmed high-grade intercepts

- Fork target zone showing 3% U3O8 over 0.5 metres

- Fox Lake Trail conductor extensions from Wheeler River

- Direct geological continuity with proven deposit models

- Proximity advantages to established infrastructure

Getty East Prospective Zone Development

The Getty East property targets positioned on the Key Lake trend offer discovery potential based on established deposit models and geological continuity with regional uranium mineralisation. Man Lake target and Little Man Lake zone show historical mineralisation evidence requiring systematic follow-up exploration.

Northeastern extension potential from established Key Lake deposits supports target prioritisation based on conductor systems and structural controls. The proximity to Key Lake mining complex provides comparative geological models and processing infrastructure access for potential discoveries.

Getty East Target Characteristics:

- Man Lake target positioned on Key Lake trend

- Little Man Lake zone with historical mineralisation

- Northeastern extension potential from established deposits

- Processing infrastructure access through Key Lake complex proximity

- Proven geological models from regional deposit studies

Russell Lake Core Target Portfolio

The RL Claims segment encompasses over 50,000 hectares with multiple drill-ready targets including Christy Lake target positioned at the northern project area with historical drilling intersections indicating notable mineralisation. Cowchuck Lake target near the basin margin offers shallow depth potential reducing drilling costs.

Eastern conductor systems connecting to Moore Lake project provide exploration continuity across Skyharbour's broader property portfolio. These conductor extensions represent systematic exploration opportunities where geological structures continue across property boundaries.

RL Claims Target Development:

- Christy Lake target with drill-ready status and historical intersections

- Cowchuck Lake shallow target near basin margin

- Eastern conductor systems connecting to Moore Lake

- Basin margin positioning for cost-effective shallow drilling

- Property boundary extensions providing systematic exploration continuity

How Does This Partnership Impact Broader Uranium Market Dynamics?

Supply Chain Positioning in Stable Jurisdiction

The Russell Lake project strategic partnership enhances uranium supply chain reliability through strategic reserves development in Saskatchewan's established regulatory framework. The province's proven permitting processes and established mining infrastructure provide jurisdictional stability increasingly valued by nuclear utilities.

Proximity to established processing infrastructure including Key Lake and Rabbit Lake facilities positions potential discoveries for efficient development timelines. The timeline alignment with global uranium demand growth supports strategic positioning as nuclear power expansion accelerates internationally.

Supply Chain Advantages:

- Strategic reserves development in stable jurisdiction

- Proximity to processing infrastructure enabling efficient development

- Established regulatory framework reducing permitting risk

- Timeline alignment with uranium demand growth projections

- Nuclear utility proximity to established Saskatchewan supply chains

Competitive Advantages in Athabasca Basin Consolidation

The partnership creates a consolidated land position exceeding 1.5 million acres across Skyharbour's broader property portfolio, representing one of the largest mineral tenure holdings in the region. This scale advantage enables systematic exploration across geological trends while maintaining operational flexibility.

Technical expertise concentration through partnership between Denison's production experience and Skyharbour's exploration focus creates competitive advantages in proven geological terrain. The collaboration demonstrates industry evolution toward specialised partnership models optimising capital deployment and technical capabilities.

Competitive Position Enhancement:

- Consolidated land position exceeding 1.5 million acres

- Technical expertise concentration in proven geological terrain

- Operational synergies with existing production facilities

- Scale advantages enabling systematic trend exploration

- Industry model innovation demonstrating partnership optimisation

Investment Sector Implications and Market Evolution

The partnership structure represents enhanced project economics through risk distribution and capital optimisation while accelerating development timeline potential. The multi-tiered joint venture approach provides replicable frameworks for future uranium sector collaborations between majors and junior companies.

Risk mitigation through diversified exploration addresses traditional challenges where single discovery failure impacts entire property valuations. The performance-based earn-in mechanisms align partner incentives while providing option value on multiple discovery scenarios.

Investment Model Innovation:

- Enhanced project economics through partnership risk distribution

- Accelerated development timeline potential via parallel programmes

- Replicable framework for future uranium sector collaborations

- Risk mitigation through diversified exploration approach

- Performance alignment through earn-in incentive structures

What Operational Synergies Will Drive Partnership Success?

Technical Team Integration and Knowledge Transfer

The partnership benefits from established technical relationships between Denison and Skyharbour teams, particularly through Skyharbour's VP Exploration who brings nearly 20 years of Denison experience to the collaboration. This cross-company expertise enables immediate geological knowledge transfer and coordinated exploration methodologies.

Shared geological expertise from Wheeler River experience provides immediate application to adjacent Russell Lake targets through conductor interpretation and depositional model analysis. The technical team collaboration transcends operational boundaries where discovery incentives align across all four project segments.

Knowledge Transfer Advantages:

- Cross-company technical expertise through experienced personnel

- Wheeler River geological models applied to adjacent targets

- Coordinated exploration methodologies across project segments

- Unified discovery incentives transcending operational boundaries

- Immediate knowledge application reducing exploration learning curves

Logistical Coordination Framework and Cost Optimisation

Centralised camp operations utilising the 40-person exploration facility reduce overhead costs while enabling shared equipment utilisation maximising operational efficiency. Coordinated drilling schedules optimise resource deployment across multiple targets while minimising mobilisation expenses.

The shared infrastructure approach creates cost efficiencies where power line access, road networks, and camp facilities support multiple exploration programmes simultaneously. This logistical integration enables sustained exploration activity while maintaining cost discipline across operations.

Operational Efficiency Framework:

- Centralised camp operations reducing overhead costs

- Shared equipment utilisation maximising resource efficiency

- Coordinated drilling schedules optimising deployment

- Infrastructure sharing across multiple exploration programmes

- Cost discipline through integrated operational planning

Regulatory and Environmental Alignment Strategies

The partnership benefits from established permitting processes in Saskatchewan where both companies maintain regulatory relationships and environmental assessment experience. Community engagement through unified approach strengthens stakeholder relationships while coordinating environmental responsibilities across the property.

Regulatory alignment enables streamlined permitting for exploration activities while environmental coordination ensures consistent monitoring and reporting across all operational segments. This unified regulatory approach reduces administrative complexity while maintaining compliance standards.

Regulatory Coordination Benefits:

- Established permitting processes through experienced operators

- Environmental assessment coordination across property segments

- Community engagement through unified stakeholder approach

- Streamlined regulatory compliance reducing administrative burden

- Consistent monitoring protocols across all operational areas

Strategic Partnership Framework as Industry Development Model

The Russell Lake project strategic partnership establishes a sophisticated framework addressing fundamental challenges in large-scale uranium exploration while creating replicable models for future industry collaborations. Through its four-tiered joint venture structure, the partnership combines Denison's operational expertise with Skyharbour's extensive land holdings to optimise discovery potential across 73,314 hectares of prospective terrain.

The transaction's emphasis on staged earn-in mechanisms, operational efficiency, and risk distribution creates sustainable exploration economics while providing both partners with diversified exposure to multiple discovery scenarios. Committed exploration expenditures exceeding CAD $40 million across Wheeler North and Getty East segments, combined with additional Skyharbour funding at RL Claims, positions the partnership among the most actively funded programmes in the Eastern Athabasca Basin.

Strategic positioning within the world's premier uranium district provides geological advantages through proven deposit models and infrastructure access while the seven-year timeline framework ensures sustained exploration activity aligned with global uranium demand growth. The partnership's structural advantages—including cost-effective drilling at CAD $350 per metre, year-round accessibility, and technical expertise concentration—establish strong foundations for achieving discovery objectives.

Success metrics ultimately depend on exploration results across multiple target zones, but the partnership demonstrates industry evolution toward collaborative frameworks optimising capital deployment, technical capabilities, and operational efficiency. As nuclear power expansion accelerates globally, the Russell Lake strategic partnership provides a blueprint for unlocking value in large-scale uranium properties through sophisticated joint venture structures and aligned partner incentives.

The partnership's integration of immediate liquidity provision, performance-based ownership evolution, and operational specialisation addresses traditional constraints limiting junior company exploration while providing major producers with pipeline development opportunities. Furthermore, this model's effectiveness in the Eastern Athabasca Basin may influence future uranium sector collaborations seeking to balance risk distribution, capital efficiency, and discovery acceleration in an increasingly competitive exploration environment.

Ready to Capitalise on ASX Uranium Discoveries?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant uranium and mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understand why major mineral discoveries can lead to substantial market returns by exploring Discovery Alert's dedicated discoveries page, showcasing historic examples of exceptional outcomes, then begin your 30-day free trial today to position yourself ahead of the market.