The competitive landscape for U.S. buyers securing European rare earths reveals fundamental shifts in global critical minerals procurement that extend far beyond traditional market dynamics. These patterns reflect deeper structural advantages embedded within institutional frameworks, processing capabilities, and strategic policy coordination that create persistent market asymmetries. Furthermore, understanding these dynamics becomes crucial as nations implement comprehensive approaches to their critical minerals strategy development.

Investment cycles in critical minerals markets rarely unfold predictably. Traditional supply and demand models assume rational market behaviour, steady procurement processes, and gradual capacity adjustments. However, the rare earth elements sector operates under fundamentally different dynamics where geopolitical constraints, regulatory asymmetries, and industrial policy gaps create persistent market distortions that favour certain regional buyers over others.

Understanding these structural advantages requires examining how procurement speed, financing mechanisms, and downstream integration capabilities influence competitive positioning in volatile supply chain environments. Consequently, the current landscape reveals pronounced differences in how North American and European buyers approach critical minerals acquisition, with implications extending far beyond immediate transaction outcomes.

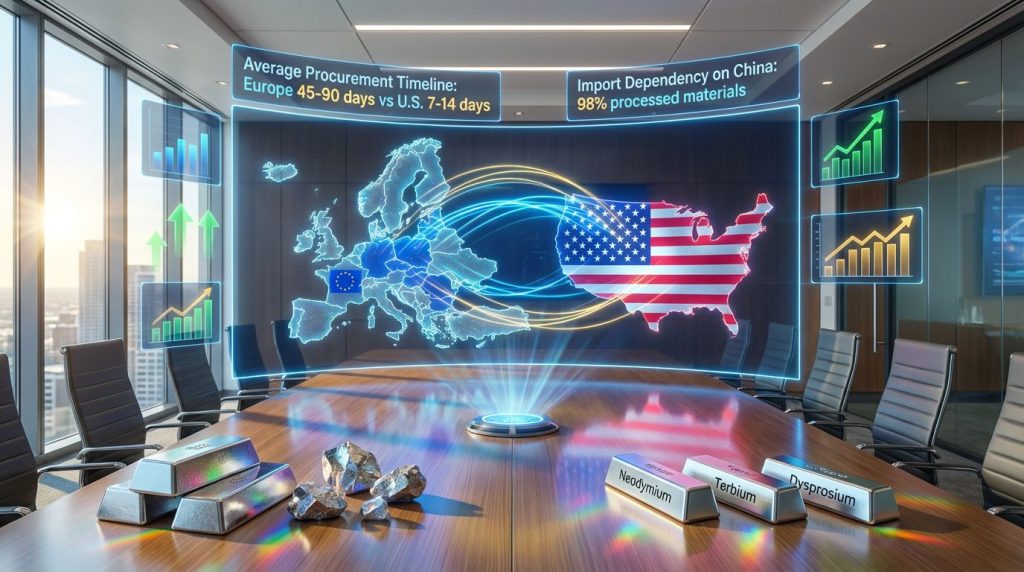

Regional Procurement Speed Differentials

The competitive gap between U.S. buyers securing European rare earths and their European counterparts stems from fundamental differences in institutional architecture. American defence contractors and industrials operate under multi-year appropriations frameworks that enable rapid capital deployment, while European entities navigate complex regulatory approval processes designed for transparency and competitive fairness. This disparity becomes particularly evident when examining recent U.S. production executive order implementations that streamline procurement pathways.

Procurement Timeline Comparison:

| Region | Initial Approval | Compliance Review | Contract Execution | Total Timeline |

|---|---|---|---|---|

| United States | 3-7 days | Concurrent process | 2-5 days | 7-14 days |

| European Union | 15-30 days | 20-45 days | 10-15 days | 45-90 days |

This speed differential becomes critical during supply chain disruptions when available inventory moves to the fastest bidders. U.S. entities leverage established relationships with European suppliers, pre-negotiated pricing mechanisms, and immediate cash availability to secure materials before European competitors complete their internal approval processes.

The Pentagon's Defence Production Act authority and Strategic National Stockpile replenishment programmes create additional competitive advantages. Defence contractors accessing multi-year funding cycles can commit to long-term supply agreements that European commercial buyers, operating under annual budget constraints, cannot match.

Key Strategic Advantages for U.S. Buyers:

- Immediate financing deployment through established credit facilities

- Streamlined approval processes under defence procurement authorities

- Long-term contract capability backed by multi-year appropriations

- Strategic reserve fulfilment creating baseline demand guarantees

European procurement operates under different constraints. EU Directive 2014/24/EU mandates transparency and competitive bidding for public sector purchases above specified thresholds. While these requirements ensure fair competition and prevent corruption, they inherently slow acquisition speed during time-sensitive supply shortages.

Industrial Capacity Asymmetries Drive Market Positioning

Europe's fundamental challenge extends beyond procurement speed to processing infrastructure gaps. The continent currently operates minimal commercial-scale rare earth separation capacity, forcing reliance on Asian processing facilities for value-added manufacturing inputs. Moreover, this capacity constraint directly impacts broader energy transition security objectives across the region.

Current European Rare Earth Processing Landscape:

| Facility | Operator | Annual Capacity | Development Stage |

|---|---|---|---|

| RES Orléans | Rare Earth Separations | ~150 tonnes | Pilot operations |

| Less Common Metals | REP Limited | ~800 tonnes | Limited commercial |

| REEtec Phase 2 | Consortium | Not operational | Development target 2027-2028 |

Total Current Capacity: <1,000 tonnes annually

European Market Demand: ~8,000-12,000 tonnes annually

This capacity constraint creates a structural disadvantage for European buyers. Without domestic separation capabilities, raw rare earth concentrates imported into Europe ultimately require export to Asian facilities for processing into usable oxides and metals. The processed materials then return as finished products, capturing minimal value-added manufacturing domestically.

The economic implications are substantial:

- Raw material import costs with limited domestic value addition

- Processing margin capture occurring in Asian facilities

- Finished product re-import at premium pricing

- Supply chain vulnerability to multiple geographic disruption points

U.S. industrial capacity development follows a different trajectory. MP Materials Corporation operates the Mountain Pass rare earth mine in California and has expanded downstream processing capabilities. Energy Fuels Inc. processes uranium and rare earth materials at White Mesa Mill in Utah. USA Rare Earth LLC is constructing magnet manufacturing facilities in Texas with planned operational capacity by 2026-2027.

U.S. Processing Capacity Development:

- Mountain Pass expansion: Target processing capacity 50,000+ tonnes annually

- Texas magnet manufacturing: Integrated supply chain from separation to finished magnets

- Strategic material stockpile: Government-backed inventory accumulation programmes

Export Control Disruptions Amplify Competitive Asymmetries

China's periodic restrictions on rare earth exports expose the structural vulnerabilities in global supply chains. Beijing's controls on specific elements including terbium, dysprosium, and samarium create immediate scarcity premiums that benefit buyers with rapid response capabilities. Additionally, understanding these China export controls patterns becomes essential for strategic planning.

According to a Bloomberg report, "American companies are outpacing European firms in securing critical rare earth supplies needed for defence applications, highlighting significant procurement speed advantages in competitive markets."

Supply Chain Vulnerability Assessment:

| Element | Global Supply Concentration | European Dependency | U.S. Response Strategy |

|---|---|---|---|

| Terbium | 95% China-controlled | Near-complete import reliance | Recycling capacity expansion |

| Dysprosium | 98% China-controlled | No domestic separation | Australian supply partnerships |

| Neodymium | 90% China-controlled | Limited stockpile capacity | Domestic processing scaling |

When Chinese export restrictions create supply gaps, U.S. buyers demonstrate superior market responsiveness. Defence contractors with established procurement authorities can execute transactions within days, while European entities require weeks or months to navigate regulatory approval processes.

The strategic implications extend beyond immediate material access. U.S. entities securing European inventory during supply disruptions often lock in pricing before market premiums fully develop. European buyers entering markets weeks later face higher acquisition costs and reduced availability.

Market Response Patterns During Export Controls:

- Week 1-2: U.S. buyers activate pre-negotiated supply agreements

- Week 3-4: Spot market pricing increases 20-40% above baseline

- Week 5-8: European buyers complete approval processes and enter inflated markets

- Month 2-3: Supply chain adjustments and alternative sourcing develop

Investment Strategy Framework for Critical Minerals Positioning

The structural advantages favouring U.S. buyers securing European rare earths create specific investment opportunities across the supply chain spectrum. Portfolio positioning requires understanding both direct beneficiaries and companies developing technologies to address current market inefficiencies. Furthermore, these developments align with broader trends in mining industry evolution that reshape competitive landscapes.

Primary Investment Categories:

Tier 1: Direct Processing and Manufacturing

- Companies with operational rare earth separation facilities

- Integrated magnet manufacturers with secured feedstock supplies

- Mining operations with offtake agreements to U.S. processors

Tier 2: Infrastructure and Technology Development

- European companies developing alternative separation technologies

- Recycling operations processing end-of-life permanent magnets

- Transportation and logistics serving critical minerals supply chains

Tier 3: Policy-Dependent Opportunities

- Facilities dependent on government funding for capacity expansion

- Companies requiring regulatory approval for operational permits

- Entities relying on international trade agreement stability

Risk Assessment Considerations:

Research from the Institute for Security Studies Europe indicates that "European complacency regarding rare earth supply chain independence creates false security whilst U.S. firms systematically build competitive advantages through faster procurement and processing capabilities."

Timeline Analysis for Investment Positioning:

2025-2027: Capacity Building Phase

- U.S. processing facility expansions reach operational capacity

- European policy implementation begins showing measurable results

- Chinese export control policies potentially intensify

2028-2030: Market Rebalancing Phase

- European industrial capacity additions reduce import dependency

- Alternative supply chain routes establish operational reliability

- Market pricing volatility potentially decreases

2031-2035: Structural Equilibrium Phase

- Regional supply chain blocs achieve greater self-sufficiency

- Technology substitution impacts become more apparent

- Investment returns reflect new competitive landscape

Why Are U.S. Buyers More Successful in European Markets?

The pattern of U.S. buyers securing European rare earths reflects systematic advantages rather than temporary market conditions. These advantages stem from institutional design differences that create persistent competitive gaps between American and European procurement capabilities.

Institutional Framework Differences:

- Multi-year funding authorisation enables U.S. entities to make immediate commitments

- Defence procurement integration streamlines approval processes for strategic materials

- Credit facility pre-approval eliminates financing delays during acquisition windows

- Strategic reserve mandates create baseline demand supporting supplier relationships

European entities operate under fundamentally different constraints that prioritise transparency and competitive fairness over procurement speed. While these principles serve important democratic governance functions, they create systematic disadvantages during time-sensitive supply chain disruptions.

How Do Processing Capacity Gaps Affect Competitive Positioning?

Europe's minimal rare earth processing capacity creates structural dependence on external separation facilities, fundamentally altering competitive dynamics for material acquisition. Companies securing raw concentrates must factor in additional processing costs, transportation expenses, and timeline delays that integrated competitors avoid.

Processing Value Chain Analysis:

- Raw concentrate value: $2-4 per kilogram rare earth oxide equivalent

- Separated oxide value: $15-50 per kilogram depending on element purity

- Finished magnet value: $200-800 per kilogram for high-performance applications

European buyers securing raw concentrates capture minimal value compared to integrated competitors who control separation through finished product manufacturing. This value capture differential explains why U.S. entities with processing integration can afford premium pricing for European raw materials.

Long-Term Supply Chain Architecture Evolution

The current pattern of U.S. buyers securing European rare earths represents more than temporary market dynamics. These transactions indicate fundamental shifts toward regional supply chain bloc formation, with strategic implications extending through the next decade.

Regional Bloc Development Indicators:

North American Integration:

- USMCA rare earth cooperation frameworks

- Canadian critical minerals development partnerships

- Mexican manufacturing capacity integration

European Autonomy Development:

- EU Critical Raw Materials Act implementation

- Member state strategic reserve coordination

- African mining partnership expansion

Asian Supply Chain Consolidation:

- China-Japan-South Korea technology cooperation

- ASEAN rare earth processing development

- India domestic capacity expansion programmes

The timeline for achieving regional supply chain independence varies significantly across blocs. North American integration benefits from existing industrial capacity and established financing mechanisms. European autonomy development faces longer implementation timelines due to regulatory complexity and required infrastructure investment.

Competitive Positioning Analysis:

U.S. Structural Advantages:

- Defence procurement integration providing stable demand

- Financial system responsiveness enabling rapid transactions

- Technological innovation capacity supporting alternative development

European Development Challenges:

- Regulatory framework complexity slowing implementation

- Capital allocation inefficiencies across member states

- Industrial capacity gaps requiring substantial investment

Market Equilibrium Timeline:

- 2025-2028: Continued U.S. competitive advantages in European procurement

- 2028-2032: European capacity additions beginning to impact market dynamics

- 2032-2035: Regional supply chain blocs approaching greater balance

Strategic Risk Management for Market Participants

Companies and investors positioning for the evolving critical minerals landscape must account for multiple risk factors that could alter competitive dynamics over medium-term investment horizons.

Primary Risk Categories:

Supply Chain Disruption Risk:

- Geopolitical tensions affecting trade relationships

- Transportation bottlenecks during demand surges

- Natural disasters impacting mining and processing operations

Technology Substitution Risk:

- Alternative permanent magnet technologies reducing rare earth demand

- Recycling efficiency improvements decreasing primary material requirements

- Electric vehicle motor design evolution changing element demand profiles

Regulatory and Policy Risk:

- Export control policy changes affecting material availability

- Environmental regulations impacting processing facility operations

- Trade agreement modifications altering competitive positioning

Market Structure Evolution Risk:

- New entrants developing processing capacity faster than anticipated

- Demand patterns shifting due to technology adoption changes

- Pricing volatility affecting long-term contract economics

Risk Mitigation Strategies:

- Diversified exposure across multiple supply chain segments and geographic regions

- Technology agnostic positioning avoiding dependence on specific rare earth applications

- Policy scenario planning accounting for various regulatory development pathways

- Timeline flexibility maintaining investment liquidity for market timing adjustments

Market Psychology and Behavioural Dynamics

The psychological factors driving current procurement patterns reveal important insights about market participant behaviour during supply chain stress periods. U.S. buyers securing European rare earths demonstrate consistent behavioural patterns that create predictable competitive advantages.

Behavioural Pattern Analysis:

Crisis Response Speed:

- U.S. entities activate contingency procurement within 24-48 hours of supply disruption announcements

- European entities require 2-4 weeks to assess impact and develop response strategies

- Asian entities often wait for market price stabilisation before major procurement decisions

Risk Tolerance Differences:

- U.S. defence contractors accept premium pricing to ensure supply continuity

- European commercial buyers seek competitive pricing even during shortages

- Private investors often delay decisions until market direction becomes clearer

Information Processing Advantages:

- Pentagon supply chain monitoring provides early warning systems

- European procurement operates on quarterly reporting cycles

- Market intelligence gaps create timing advantages for better-informed participants

These behavioural differences create opportunity windows that experienced market participants can exploit for competitive advantage.

Technical Specifications and Processing Requirements

Understanding the technical complexity of rare earth processing helps explain why Europe's capacity gap persists despite policy commitments to supply chain independence.

Rare Earth Separation Technical Requirements:

Primary Processing Stages:

- Concentrate preparation requiring specialised grinding and flotation equipment

- Acid leaching operations using high-purity hydrochloric or sulfuric acid systems

- Solvent extraction cascades employing multiple separation stages

- Precipitation and purification producing individual rare earth oxides

Infrastructure Investment Requirements:

- Processing facility construction: €200-400 million per 5,000 tonne annual capacity

- Environmental compliance systems: €50-100 million for waste management

- Specialised equipment procurement: €100-200 million for separation technology

- Working capital requirements: €30-50 million for feedstock and chemical inventories

Quality Specifications for Magnet Manufacturing:

- Neodymium oxide purity: >99.5% for permanent magnet applications

- Dysprosium oxide purity: >99.9% for high-temperature motor applications

- Terbium oxide purity: >99.99% for specialised defence applications

These technical requirements explain why European capacity development requires multi-year development timelines and substantial capital commitments that private investors often find challenging to justify given market volatility.

Geological Considerations Affecting Long-Term Supply

The geological distribution of rare earth deposits influences long-term supply chain development strategies and regional competitive positioning.

Global Rare Earth Resource Distribution:

| Region | Resource Base | Processing Capacity | Strategic Significance |

|---|---|---|---|

| China | 40% of reserves | 85% of processing | Dominant market position |

| United States | 12% of reserves | 15% of processing | Expanding domestic capacity |

| Australia | 8% of reserves | 5% of processing | Key Western alliance partner |

| Europe | 3% of reserves | <1% of processing | Import dependency challenge |

Geological Quality Considerations:

- Heavy rare earth concentration: Higher in South China clay deposits

- Light rare earth abundance: Mountain Pass, Lynas, and other deposits

- Processing complexity: Ion-absorption clays vs. hard rock deposits

- Environmental impact: Radioactive element co-occurrence in many deposits

These geological realities constrain long-term supply chain independence options for regions without substantial domestic resources, creating persistent competitive advantages for countries with both resources and processing capacity.

Financial Market Implications and Valuation Considerations

The structural dynamics favouring U.S. buyers securing European rare earths create specific financial market implications for publicly traded companies across the supply chain.

Valuation Premium Factors:

- Companies with operational processing capacity trading at 2-3x revenue multiples above development-stage entities

- Integrated supply chain companies receiving ESG premium valuations

- Strategic material stockpile operators benefiting from asset appreciation during supply disruptions

Cash Flow Predictability Analysis:

- Long-term offtake agreements providing revenue visibility supporting higher valuation multiples

- Spot market exposure creating earnings volatility and lower multiple assignments

- Government contract relationships improving cash flow quality assessments

Investment Timeline Considerations:

- Development-stage projects requiring 3-5 year investment horizons before operational cash flows

- Operational facilities generating immediate cash flows but requiring expansion capital for growth

- Market timing sensitivity affecting optimal entry and exit points for different asset classes

Investment Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Critical minerals markets involve substantial risk including price volatility, regulatory changes, and geopolitical disruptions that may result in significant losses. Investors should conduct independent due diligence and consult qualified financial advisors before making investment decisions.

Strategic Implications for Global Market Architecture

The competitive dynamics enabling U.S. buyers to secure European rare earths more effectively than domestic European entities reflect deeper structural changes in global critical minerals markets. These changes extend beyond immediate transaction patterns to influence long-term supply chain architecture, industrial policy effectiveness, and regional economic competitiveness.

The timeline for addressing these structural imbalances extends well beyond current market cycles. European industrial capacity development requires sustained political commitment, substantial capital deployment, and technical expertise acquisition that cannot be achieved through policy declarations alone. Meanwhile, U.S. competitive advantages continue expanding through operational facility scaling and strategic partnership development.

For market participants, this dynamic creates clear directional opportunities over medium-term investment horizons. Companies with operational processing capacity and established supply relationships maintain structural advantages that policy changes and new capacity additions will require years to challenge effectively.

The evolution toward regional supply chain blocs appears increasingly inevitable, driven by national security considerations, industrial policy coordination, and supply chain resilience requirements. Understanding these structural forces and their timeline implications provides essential context for strategic positioning in critical minerals markets throughout the remainder of this decade.

Want to Stay Ahead of Critical Minerals Market Shifts?

Discovery Alert's proprietary Discovery IQ model delivers real-time notifications on significant ASX mineral discoveries, transforming complex market data into actionable insights for both short-term traders and long-term investors. With European rare earths procurement highlighting the importance of rapid market response, subscribers gain the speed advantage needed to identify emerging opportunities before they become mainstream knowledge—start your 30-day free trial today to position yourself ahead of critical minerals market developments.