Vulcan Energy Resources' groundbreaking €2.2 billion financing package for its Lionheart geothermal lithium project represents a watershed moment for European critical mineral security. The Vulcan Energy Germany lithium project financing demonstrates how strategic imperatives now drive investment decisions that extend far beyond traditional commercial evaluation criteria, particularly in lithium brine mining operations.

This landmark transaction signals coordinated policy alignment among allied nations to establish domestic supply chain sovereignty in an era where resource dependency translates directly into strategic vulnerability. Furthermore, the integrated approach combining renewable energy generation with lithium extraction reflects emerging trends in lithium industry innovations that prioritise environmental compliance alongside production capacity.

Understanding the Strategic Context Behind Europe's Largest Lithium Investment

European policymakers face a stark reality regarding critical mineral dependency. The continent currently relies on imports for approximately 90% of its lithium requirements, with supply chains dominated by Australian production and Chinese processing infrastructure. This dependency model exposes European battery manufacturers to both price volatility and geopolitical supply disruptions.

However, the emergence of domestic geothermal lithium projects offers pathways to reduce import reliance whilst simultaneously advancing renewable energy objectives. The Upper Rhine Valley's unique geological characteristics enable this dual-purpose approach, addressing multiple strategic priorities through a single integrated operation.

The Geopolitical Imperative Driving Massive Capital Allocation

Global lithium demand projections reveal the scale of the challenge facing European industry planners. The International Energy Agency forecasts lithium consumption will surge from roughly 500,000 tonnes in 2023 to between 1.3-1.5 million tonnes annually by 2035. European battery manufacturing capacity alone is expected to reach 3 TWh annually by 2030, requiring substantial upstream lithium supply chains independent of volatile international markets.

The timing of major lithium project financing reflects broader strategic concerns about resource security. Francis Wedin, Executive Chair of Vulcan Energy Resources, emphasized the urgency during recent financing announcements, stating that construction would begin immediately with strong backing from European and Australian government institutions. This represents alignment between commercial project economics and sovereign-level strategic priorities.

Consequently, the integration of critical minerals security considerations into mainstream investment frameworks reflects a fundamental shift in how strategic resources are evaluated and financed.

Government Policy Alignment with Private Sector Investment Thesis

The Upper Rhine Valley's geological characteristics offer unique advantages for integrated lithium extraction and renewable energy generation. Lithium-rich geothermal brines circulating at optimal temperatures enable simultaneous power production and mineral extraction, creating operational synergies unavailable in traditional hard-rock mining operations.

This integrated model addresses multiple European policy objectives simultaneously: domestic critical mineral production, renewable energy generation capacity, and carbon-neutral extraction methods aligned with EU climate targets. The convergence of these strategic imperatives explains why multiple national governments have committed financing resources typically reserved for infrastructure projects of national significance.

How Does Vulcan's Financing Structure Compare to Traditional Mining Project Funding?

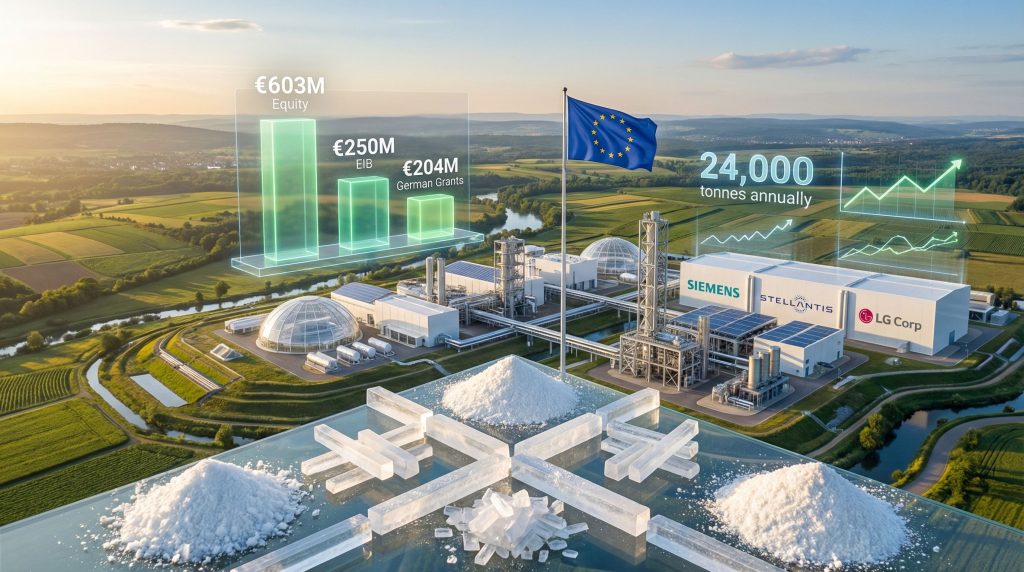

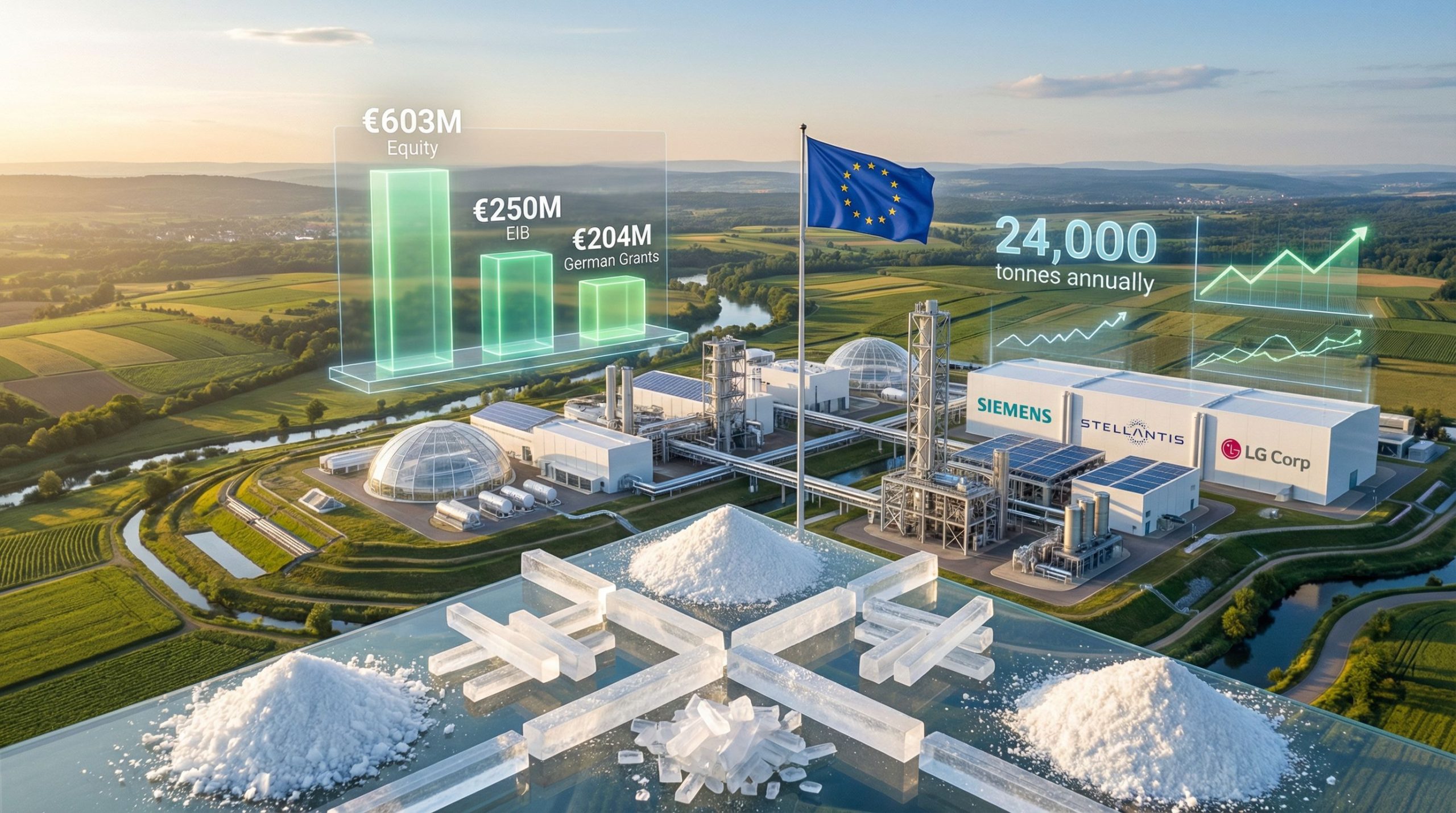

The €2.2 billion financing package secured for the Lionheart project represents a fundamental departure from conventional mining project capital structures. Traditional mineral developments typically rely on a combination of project debt, equity financing, and occasionally government loan guarantees. The Vulcan arrangement incorporates elements rarely seen together in commercial mining ventures.

In addition, this financing approach offers lessons for navigating current lithium market challenges through diversified funding sources and strategic partnerships that extend beyond purely commercial relationships.

Multi-layered Risk Mitigation Through Diverse Funding Sources

The financing architecture involves 13 distinct financial institutions, including the European Investment Bank, five export credit agencies, and seven commercial banks. This institutional diversity creates multiple layers of risk assessment and mitigation that extend beyond purely commercial evaluation criteria.

| Financing Component | Amount (€M) | Percentage | Risk Profile |

|---|---|---|---|

| Equity Raise | 603 | 27.4% | Highest |

| Government Grants | 104* | 4.7% | None |

| Commercial/ECA Debt | ~1,493 | 67.9% | Medium |

| TOTAL | €2.2 billion | 100% | Mixed public-private |

*Note: Sources indicate potential discrepancy with higher grant amounts; verification required through official announcements.

The equity component will be raised through institutional placement and entitlement offers at a fixed price of €2.24 per new share. This pricing mechanism provides certainty for both existing shareholders and institutional participants during a period of lithium price volatility.

Export Credit Agency Participation Signals Sovereign-Level Support

Export credit agencies from multiple allied nations have committed financing resources typically reserved for strategic infrastructure projects. These include institutions from France, Canada, Australia, Denmark, and Italy, representing coordinated policy alignment across NATO allies and strategic partners.

The involvement of multiple sovereign-backed financing agencies indicates government assessment that European lithium supply chain security qualifies as critical infrastructure worthy of concessional financing terms. Export credit agencies typically accept lower returns and longer tenors than commercial banks, while requiring alignment with national strategic objectives as primary evaluation criteria.

Furthermore, this coordinated approach reflects growing recognition that resource security requires multilateral cooperation, particularly in regions where geological resources align with strategic partnership opportunities.

Corporate Strategic Investor Integration

Beyond financial institutions, the project has secured 10-year supply commitments from 2028 with major industrial partners including Stellantis, LG Corp, Umicore, and Glencore. These offtake agreements provide revenue certainty while creating industrial partnership structures that extend beyond typical customer-supplier relationships.

Approximately 72% of contracted volumes are protected by floor or fixed pricing mechanisms for the first decade of operations. This pricing structure provides downside protection for project economics while offering offtakers supply security and cost predictability during the critical early phase of European battery manufacturing scale-up.

What Economic Scenarios Justify This Scale of Investment in Geothermal Lithium?

The fundamental economic thesis underlying the Lionheart project financing centres on structural supply deficits emerging in global lithium markets. Francis Wedin articulated this perspective directly, noting that there has been a deficit of new projects achieving final investment decision approval, creating conditions where supply constraints will eventually drive pricing power for projects reaching production.

The project's economics benefit from insights gained through analysis of similar developments, including lithium brine market insights from established producing regions that demonstrate the viability of brine-based operations under various market conditions.

Supply Deficit Projections Through 2035

Current global lithium production capacity of approximately 500,000 tonnes annually falls significantly short of projected 2030 demand exceeding 800,000 tonnes, with the gap widening through 2035. European battery manufacturing alone will require 120,000-160,000 tonnes of lithium annually by 2030 based on projected gigafactory capacity expansion.

The 24,000 tonnes annual production capacity targeted by the Lionheart project represents roughly 3-3.5% of projected 2030 global demand, but its strategic value extends beyond absolute volume contribution. Domestic European production reduces import dependency risks while providing supply chain resilience during geopolitical or trade disruptions.

Technology Risk vs. Market Risk Assessment

Geothermal lithium extraction offers operational advantages over traditional hard-rock mining that improve project economics across multiple dimensions:

- Energy Cost Integration: Simultaneous power generation reduces operational energy expenses

- Environmental Compliance: Zero mining waste tailings and renewable energy alignment

- Scalability Potential: Brine reprocessing through cascading thermal systems

- Regulatory Advantages: Streamlined permitting in European environmental frameworks

The integrated renewable energy component creates additional revenue streams while reducing carbon intensity, aligning with EU taxonomy requirements for sustainable finance classification.

Why Are Export Credit Agencies Treating This as Critical Infrastructure?

The participation of export credit agencies from five separate allied nations represents unprecedented coordination around a single lithium project. These institutions typically extend financing only for projects meeting national strategic interest criteria, suggesting government assessment that European lithium independence qualifies as alliance-level infrastructure.

According to Vulcan Energy's announcement, the project has secured backing from major institutional investors alongside government support, demonstrating the convergence of commercial and strategic interests in critical mineral development.

Multi-National Export Credit Agency Participation

Export credit agencies operate under fundamentally different risk assessment frameworks than commercial banks. Their mandate extends beyond purely financial returns to encompass national security, industrial policy, and strategic positioning considerations.

Strategic Financing Criteria:

- National energy security enhancement

- Supply chain resilience for critical industries

- Geopolitical positioning against strategic competitors

- Long-term alliance coordination objectives

The combination of Bpifrance, Export Development Canada, Export Finance Australia, Denmark's EIFO, and Italy's SACE creates a multilateral government backing structure typically reserved for major infrastructure projects with cross-border strategic implications.

Industrial Policy Convergence Across Allied Nations

The coordinated government support reflects broader policy alignment around critical mineral security among allied nations. Recent legislative frameworks including the US CHIPS and Science Act, EU Critical Raw Materials Act, and similar initiatives in Canada and Australia demonstrate convergent recognition that resource dependency creates strategic vulnerabilities requiring government intervention.

This financing structure establishes precedent for future critical mineral projects where commercial viability intersects with strategic necessity, potentially creating a new category of government-backed resource development initiatives.

How Will This Project Reshape European Battery Manufacturing Economics?

The Lionheart project's 2028 production timeline aligns precisely with the critical phase of European battery manufacturing scale-up. Major automotive manufacturers including Stellantis have committed to aggressive electrification timelines requiring secure lithium supply chains independent of geopolitically volatile regions.

Moreover, European Investment Bank funding of €250 million demonstrates institutional confidence in the project's strategic importance for European industrial competitiveness.

Local Supply Chain Integration Benefits

Domestic European lithium production eliminates several cost and risk factors inherent in current import-dependent supply chains:

- Transportation Cost Reduction: Elimination of intercontinental shipping expenses from Australian or South American sources

- Currency Hedging Advantages: Euro-denominated transactions reduce foreign exchange risk for European battery manufacturers

- Just-in-Time Delivery: Reduced logistics complexity enables more efficient inventory management

- Quality Assurance: Enhanced traceability and compliance with EU battery regulations

Competitive Positioning Against Asian Battery Manufacturers

European battery cell producers face intense competition from established Asian manufacturers with integrated supply chains and scale advantages. Secure, competitively-priced lithium supply represents a critical factor in achieving cost parity while maintaining environmental and social compliance standards required in European markets.

The floor pricing mechanisms covering 72% of contracted volumes provide European manufacturers with cost predictability during the critical market penetration phase, while supply security reduces operational risks associated with international supply chain disruptions.

Key Performance Indicators for Success

| Phase | Timeline | Key Deliverables | Funding Deployment |

|---|---|---|---|

| Construction Start | Q4 2024 | Ground breaking, permits | €200M |

| Phase 1 Completion | Mid-2026 | Pilot production | €800M |

| Commercial Operations | 2028 | Full-scale production | €1.2B |

| Expansion Phase | 2030+ | Capacity optimisation | TBD |

What Are the Primary Risk Scenarios That Could Impact Project Delivery?

Despite comprehensive financing and government backing, the Lionheart project faces technical and market risks inherent in first-of-kind integrated geothermal lithium operations. The 2.5-year construction timeline represents aggressive scheduling for complex industrial infrastructure requiring precise coordination between lithium extraction and power generation systems.

Geothermal Extraction Technology Risks

Upper Rhine Valley geological conditions provide favourable fundamentals for geothermal lithium extraction, but reservoir performance can exhibit variability affecting both power generation and lithium yield rates. Scaling and corrosion management in brine processing systems requires ongoing technical optimisation throughout operational life.

Integration challenges between lithium extraction equipment and geothermal power generation systems represent operational complexity not present in traditional mining operations. Simultaneous optimisation of both revenue streams requires sophisticated process control and maintenance protocols.

Market Volatility and Pricing Protection Analysis

Lithium markets have demonstrated extreme price volatility, with lithium carbonate equivalent prices fluctuating from peaks exceeding $60,000 per tonne in 2022 to troughs below $12,000 per tonne in 2023. Recovery patterns through 2024 suggest $25,000-40,000 per tonne trading ranges, but long-term price discovery remains subject to supply-demand balancing and technological disruption.

The floor pricing mechanisms negotiated with major offtakers provide downside protection, but specific price levels have not been disclosed publicly. Long-term contract renegotiation scenarios during market stress periods could test the durability of current pricing arrangements.

How Does This Investment Signal Broader Trends in Critical Mineral Financing?

The Vulcan Energy Germany lithium project financing establishes new precedents for government-industry partnerships in strategic resource development. The blended finance model combining grants, export credit agency participation, multilateral bank financing, and commercial debt creates a template for future critical mineral projects where commercial viability intersects with strategic necessity.

Government-Industry Partnership Evolution

Traditional mineral project financing relied primarily on commercial banks and equity investors evaluating projects based on purely financial criteria. The Lionheart financing demonstrates evolution toward integrated evaluation frameworks incorporating strategic value alongside commercial returns.

Export credit agencies are expanding their mandate beyond traditional trade finance toward supply chain security financing, while sovereign wealth funds and government-backed institutions increasingly participate directly in critical mineral project equity.

ESG Integration in Mining Project Evaluation

The integrated renewable energy generation component addresses environmental, social, and governance criteria increasingly required for institutional investment participation. Carbon-neutral extraction methods provide competitive advantages in European regulatory environments while enhancing social licence for operations.

Circular economy integration through renewable energy systems creates additional strategic value beyond traditional mining project economics, potentially influencing evaluation criteria for future resource development initiatives.

In conclusion, the Vulcan Energy Germany lithium project financing represents more than a single project milestone—it establishes a new paradigm for critical mineral development where strategic imperatives drive investment structures previously reserved for national infrastructure projects.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Lithium market projections involve significant uncertainty, and actual outcomes may differ materially from current expectations. Government policy changes, technological developments, and market conditions could substantially impact project economics and strategic value assessments.

Looking to Capitalise on Critical Mineral Investment Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understand why major mineral discoveries can lead to significant market returns by exploring historic examples of exceptional outcomes, then begin your 30-day free trial today to position yourself ahead of the market.