Zimbabwe's mining sector faces a significant recalibration as new fiscal policies prepare to reshape investment dynamics across the country's gold production landscape. The Southern African nation's decision to implement a progressive royalty structure represents more than a simple tax adjustment, signaling a fundamental shift in how resource extraction revenues will be captured during varying commodity price cycles. Furthermore, this Zimbabwe tax hike on Bilboes project specifically demonstrates the broader challenges facing development-stage mining initiatives in the region.

The implications extend far beyond immediate fiscal calculations, touching on broader questions of investment climate stability, capital allocation efficiency, and the delicate balance between government revenue optimisation and maintaining attractiveness for international mining capital. For development-stage projects requiring substantial upfront investment, these changes introduce new variables that could materially alter project economics and financing structures.

Understanding Zimbabwe's 2026 Mining Fiscal Overhaul

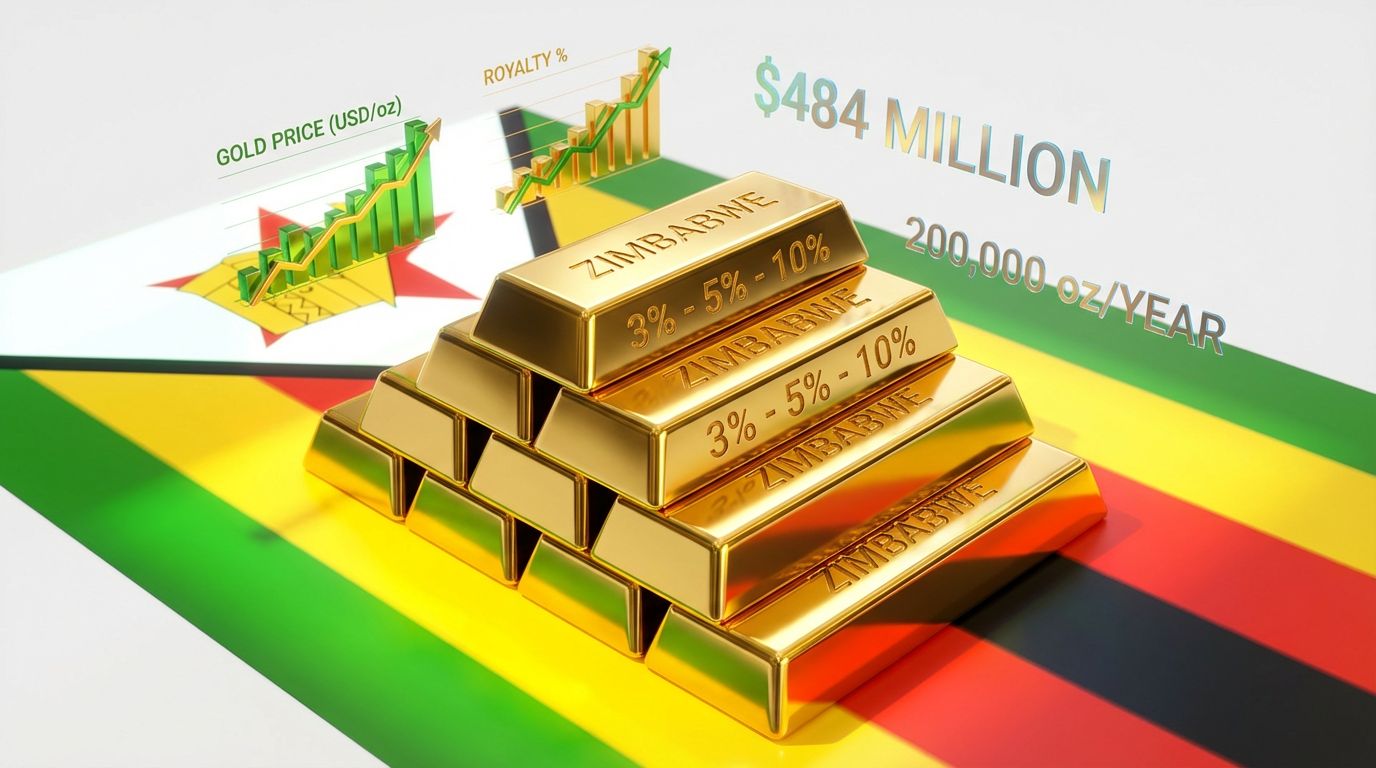

Zimbabwe's Finance Minister Mthuli Ncube announced a comprehensive restructuring of gold mining royalties on November 27, 2025, introducing a tiered system that links tax obligations directly to prevailing gold prices. This departure from traditional flat-rate structures aims to capture enhanced government revenue during commodity boom periods while theoretically maintaining investment viability during lower-price environments. Moreover, understanding this gold price surge context becomes essential when evaluating the policy's timing and potential impact.

The Three-Tier Royalty Framework Explained

The new structure implements a progressive taxation model with three distinct tiers, where royalty rates escalate based on gold price thresholds. The framework applies a 3% rate at the lower tier, increases to 5% at the middle threshold, and reaches a maximum 10% when gold prices exceed $2,501 per ounce.

This threshold-based mechanism differs fundamentally from incremental taxation models commonly used in income tax systems. Rather than applying different rates to price bands incrementally, Zimbabwe's structure applies the full rate to all ounces produced within each price category, creating what economists term "cliff effects" at threshold transitions.

| Price Threshold | Royalty Rate | Application Method |

|---|---|---|

| Lower tier | 3% | Full rate on all production |

| Middle tier | 5% | Full rate on all production |

| $2,501+/oz | 10% | Full rate on all production |

The government's stated objective centres on ensuring mining sector contributions remain proportional to commodity price performance. According to the Finance Minister's budget speech, the policy seeks to eliminate arbitrage opportunities between different categories of miners while harmonising royalty structures across all gold producers. Additionally, this approach aligns with broader gold market performance trends observed throughout 2025.

Capital Expenditure Treatment Changes

Alongside royalty restructuring, the fiscal overhaul introduces modifications to capital expenditure treatment, shifting from immediate 100% deduction allowances toward depreciation schedules. This change affects cash flow timing for mining companies, potentially extending the period required to recover initial investment costs through tax relief mechanisms.

The timing adjustment creates particular significance for capital-intensive projects, where large upfront expenditures traditionally provided immediate tax shields against early production revenues. Under revised treatment, these deductions spread across multiple years, affecting internal rate of return calculations and debt service coverage ratios.

Key Consideration: The distinction between tax liability and cash flow impact becomes critical when evaluating project economics, as depreciation timing affects actual cash available for debt service and dividend distributions.

What Makes the Bilboes Project Economically Vulnerable?

Caledonia Mining Corp's Bilboes Gold Project exemplifies the challenges facing large-scale development initiatives under Zimbabwe's new tax hike framework. The project's $484 million capital requirement and dependence on cross-asset financing creates multiple vulnerability points that the revised royalty structure directly impacts.

Project Scale and Investment Requirements

The Bilboes development represents one of Zimbabwe's most significant recent gold mining investments, designed to produce 200,000 ounces annually over a projected 10.8-year mine life. With total reserves estimated at 1.55 million ounces, the project requires substantial initial capital commitment before generating revenue streams.

This scale creates inherent sensitivity to fiscal policy changes, as modifications to tax rates directly affect net present value calculations and internal rate of return projections used in capital allocation decisions. The project's economics were initially modelled under previous royalty assumptions, necessitating comprehensive reassessment under the new tiered structure.

| Project Metrics | Specifications |

|---|---|

| Capital Investment | $484 million |

| Annual Production Target | 200,000 oz/year |

| Mine Life | 10.8 years |

| Total Reserve Base | 1.55 million ounces |

Financing Structure Dependencies

CEO Mark Learmonth acknowledged in December 2025 that Caledonia's financing strategy relies on cash flow contributions from their existing Blanket Mine operation, which currently produces 80,000 ounces annually. This cross-subsidisation model creates cascading financial dependency where royalty increases at the operating asset directly constrain development capital available for Bilboes.

The financing architecture vulnerability becomes apparent when considering that Blanket Mine must maintain sufficient cash generation to service both its own operational requirements and contribute to Bilboes development financing. Learmonth specifically warned of lower profitability and cash generation relative to current market expectations at Blanket, directly attributing this concern to the proposed royalty changes. Furthermore, this demonstrates how the Zimbabwe tax hike on Bilboes project affects not only the development asset but the entire portfolio structure.

The company committed to providing further updates once clarity becomes available on implementation details, suggesting ongoing internal modelling of various scenarios and potential negotiations with Zimbabwean authorities regarding transition arrangements.

Revenue Stream Dependencies:

• Blanket Mine: 80,000 oz/year primary cash contributor

• Bilboes Project: 200,000 oz/year target requiring external financing bridge

• Cross-asset financing: Blanket cash flows supporting Bilboes debt service

• Government royalty increase: Direct reduction in available development capital

How Do Tiered Royalty Systems Affect Mining Economics?

Progressive royalty structures introduce non-linear relationships between commodity prices and after-tax cash flows, fundamentally altering traditional mining project evaluation methodologies. The threshold-based approach creates scenarios where small price movements near transition points generate disproportionate impacts on total tax liabilities.

Break-Even Analysis Under New Tax Regime

Mining companies must now incorporate price threshold analysis into their economic modelling, recognising that royalty obligations can increase dramatically at specific price points. For a 200,000 ounce annual producer like Bilboes, moving from the 5% to 10% royalty tier represents an additional $10 million in annual tax payments at $2,501 per ounce. This scenario becomes more likely given recent record high gold prices experienced throughout 2025.

Step-by-Step Royalty Impact Calculation:

-

Determine applicable price tier based on prevailing gold prices

-

Apply full royalty rate to entire production volume (not incremental)

-

Calculate annual royalty obligation (Production × Price × Royalty Rate)

-

Assess cash flow impact on debt service and dividend capacity

-

Adjust NPV and IRR calculations for threshold sensitivity analysis

The cliff effect mechanism means that projects operating near threshold levels face heightened volatility in after-tax returns, requiring sophisticated hedging strategies or operational flexibility to manage tax liability fluctuations.

Regional Competitive Positioning

Zimbabwe's new royalty structure positions the country at the higher end of Southern African mining tax regimes, particularly when gold prices exceed $2,501 per ounce. The 10% maximum rate compares unfavourably to neighbouring jurisdictions where royalty rates typically range from 3-7% regardless of commodity price levels.

| Country | Gold Royalty Rate | Structure Type |

|---|---|---|

| Zimbabwe (New) | 3%-10% tiered | Price-linked progressive |

| South Africa | 0.5%-7% | Revenue-based formula |

| Botswana | 5%-10% | Profit-based sliding |

| Zambia | 6% flat | Fixed rate |

This competitive disadvantage becomes particularly pronounced during high gold price environments, when Zimbabwe's 10% rate substantially exceeds alternatives available in the region. Mining companies with multiple development opportunities may redirect capital toward jurisdictions offering more favourable or stable fiscal terms. Consequently, this policy illustrates broader trends in government intervention insights affecting global mining investment decisions.

Investment Impact: Maximum royalty rates often influence capital allocation decisions more significantly than average rates, as investors focus on worst-case scenario planning for long-term mining investments.

What Are the Broader Investment Climate Implications?

The introduction of tiered royalty rates signals broader shifts in Zimbabwe's approach to mining sector taxation, with implications extending beyond immediate project economics to encompass investor confidence, capital market access, and long-term sector development trajectories.

Revenue Optimisation vs. Investment Deterrence

Government revenue projections anticipate enhanced fiscal capture during elevated gold price periods, potentially generating significant additional income for national development priorities. However, this immediate revenue optimisation must be balanced against potential longer-term impacts on foreign direct investment flows and mining sector expansion.

The policy creates inherent tension between short-term fiscal gains and maintaining Zimbabwe's attractiveness as a mining investment destination. Historical precedents from other resource-dependent economies suggest that unilateral tax increases can trigger capital flight and reduced exploration activity, ultimately constraining long-term revenue growth. This tax policy case study demonstrates similar challenges in other jurisdictions.

Trade-offs Between Immediate Gains and Long-term Investment:

• Government Revenue: Enhanced capture during commodity booms

• Investment Deterrence: Higher maximum rates may redirect capital flows

• Exploration Impact: Reduced early-stage investment in prospective areas

• Employment Effects: Delayed or cancelled projects affect job creation

• Technology Transfer: Reduced international mining company presence

Sector-Wide Adaptation Strategies

Mining companies operating in Zimbabwe face multiple strategic responses to the new fiscal framework, ranging from operational adjustments to fundamental portfolio restructuring. The industry's adaptation will largely determine whether the policy achieves its intended revenue objectives without undermining sector vitality.

Caledonia's constructive engagement approach, emphasising long-standing operational presence and continued dialogue with authorities, represents one response model focused on negotiation and clarification rather than immediate divestment. This strategy suggests companies may seek transitional arrangements or implementation modifications rather than abandoning Zimbabwean operations entirely.

Five Key Negotiation Points for Mining Companies:

-

Grandfathering provisions for projects under development

-

Phase-in schedules for existing operations

-

Price calculation methodologies and averaging periods

-

Capital expenditure treatment during transition

-

Dispute resolution mechanisms for implementation disagreements

The success of these negotiations will significantly influence whether Zimbabwe's tax policy achieves optimal balance between revenue enhancement and investment climate preservation.

Which Gold Price Scenarios Create the Greatest Impact?

The price-threshold structure of Zimbabwe's royalty system creates asymmetric impacts across different gold price environments, with the greatest policy effects occurring during transitions between royalty tiers and sustained periods above the $2,501 per ounce threshold.

Threshold Analysis and Market Volatility

Gold price volatility introduces strategic complexity for mining companies operating under threshold-based taxation, as royalty obligations can shift dramatically based on relatively small price movements. This volatility requires sophisticated financial modelling and risk management approaches not typically necessary under flat-rate royalty systems.

Historical gold price analysis reveals significant time periods when prices exceeded the $2,501 threshold, particularly during economic uncertainty periods when gold serves as a safe-haven asset. Mining companies must now evaluate the probability and duration of high-price scenarios when assessing project viability under the new framework.

| Gold Price Scenario | Royalty Rate | Annual Royalty (200k oz) | vs. Baseline Impact |

|---|---|---|---|

| $1,800/oz | 3% tier | $10.8 million | Baseline |

| $2,200/oz | 5% tier | $22.0 million | +103.7% |

| $2,600/oz | 10% tier | $52.0 million | +381.5% |

The analysis demonstrates that royalty burden increases nearly five-fold between moderate and high-price scenarios, creating substantial cash flow sensitivity to commodity price movements. This volatility requires mining companies to incorporate scenario analysis and stress testing into their financial planning processes.

Hedging and Price Risk Management

Traditional hedging strategies become complicated under threshold-based royalty systems, as companies must consider both commodity price risk and tax liability volatility when designing risk management programs. The cliff effect at $2,501 per ounce creates particular challenges for hedging decisions.

Mining companies might adjust their hedging strategies to account for royalty threshold effects, potentially using options strategies or collar arrangements that provide protection against adverse price movements while maintaining upside participation during favourable pricing environments. Indeed, the Zimbabwe tax hike on Bilboes project necessitates such sophisticated risk management approaches.

Strategic Challenge: The all-or-nothing nature of threshold-based taxation creates scenarios where companies may prefer price stability near tier boundaries rather than maximum price appreciation that triggers higher royalty obligations.

Long-term supply contracts and streaming arrangements may also require renegotiation to account for variable royalty costs, as counterparties adjust pricing mechanisms to reflect the mining company's altered cost structure under different gold price scenarios.

How Should Investors Evaluate Mining Projects Under New Tax Regimes?

Investment analysis methodologies require fundamental adjustments when evaluating mining projects subject to progressive or threshold-based royalty systems, as traditional discounted cash flow models may inadequately capture the non-linear relationship between commodity prices and after-tax returns.

Due Diligence Framework Adjustments

Sophisticated investors must now incorporate multiple price scenarios and probability-weighted outcomes into their project evaluation processes, recognising that royalty volatility introduces additional layers of risk beyond traditional commodity price exposure and operational variables.

Six Critical Factors for Investment Analysis:

-

Scenario Modelling: Multiple price environments and royalty tier impacts

-

Threshold Sensitivity: Break-even analysis near tier transition points

-

Cash Flow Volatility: Quarterly and annual variability under different price assumptions

-

Financing Implications: Debt service coverage ratios across scenarios

-

Hedging Strategy: Risk management costs and effectiveness

-

Political Risk Assessment: Probability of further fiscal policy changes

Due diligence processes must also evaluate management's understanding of the new fiscal framework and their strategic response capabilities, as companies with sophisticated modelling and risk management capabilities may better navigate threshold-based taxation systems. Additionally, accessing detailed analysis from mining industry publications provides valuable context for investment decisions.

Stress testing methodologies should incorporate not only traditional sensitivity analysis but also monte carlo simulations that capture the probability distribution of outcomes under volatile royalty rate environments.

Portfolio Diversification Considerations

Geographic concentration in jurisdictions with volatile fiscal policies amplifies portfolio risk for mining-focused investors, particularly when multiple assets face similar regulatory environments and policy uncertainty.

The Zimbabwe tax hike on Bilboes project demonstrates the importance of diversification across multiple jurisdictions with different regulatory frameworks and fiscal stability profiles. Single-country exposure to mining assets increases vulnerability to unilateral policy changes that can materially affect portfolio returns.

Indicators of Stable vs. Volatile Fiscal Environments:

• Historical Precedent: Frequency of mining tax policy changes

• Government Stability: Political continuity and policy predictability

• Industry Dialogue: Formal consultation processes for policy development

• International Treaties: Investment protection agreements and dispute resolution mechanisms

• Fiscal Transparency: Clear communication of policy objectives and implementation timelines

Portfolio Risk Management: Single-country mining exposure amplifies policy risk, particularly in jurisdictions with history of unilateral fiscal changes affecting the mining sector.

What Does This Signal for Zimbabwe's Mining Investment Future?

Zimbabwe's implementation of progressive gold royalties represents a broader trend toward resource nationalism and enhanced government revenue capture from mining operations, with implications extending beyond immediate project economics to encompass long-term sector development patterns. Furthermore, comprehensive analysis from financial research platforms suggests these changes reflect global trends in mining sector governance.

Government Revenue Strategy Assessment

The tiered royalty structure reflects Zimbabwe's strategic approach to balancing immediate fiscal needs with longer-term mining sector development objectives, though the ultimate success depends on implementation details and industry response patterns that remain unclear.

Government revenue projections likely anticipate significant additional income during elevated gold price periods, potentially providing enhanced funding for national development priorities and economic diversification initiatives. However, these projections depend on maintaining production levels and avoiding capital flight to alternative jurisdictions.

How much additional revenue will Zimbabwe generate from gold royalty increases?

Revenue enhancement depends on multiple variables including gold price environments, production volume responses, and compliance levels across the mining sector. While exact projections remain undisclosed, the potential for doubling royalty rates from previous levels suggests substantial fiscal impact during high-price periods.

The policy's effectiveness requires careful balance between revenue optimisation and maintaining sufficient investment attractiveness to sustain mining sector growth and employment generation.

Industry Response and Negotiation Dynamics

The mining industry's response to Zimbabwe's fiscal changes will largely determine whether the policy achieves its intended objectives without undermining sector competitiveness and long-term development potential.

| Response Type | Likely Industry Action | Government Consideration |

|---|---|---|

| Negotiation | Seek transitional arrangements | Implementation flexibility |

| Operational Adjustment | Modify production timing | Revenue impact assessment |

| Capital Redeployment | Redirect investment to other jurisdictions | Lost opportunity costs |

| Technology Integration | Enhance efficiency to offset costs | Productivity improvements |

| Financial Restructuring | Adjust financing and hedging strategies | Market stability |

Companies like Caledonia, with established operations and long-term commitments, are more likely to pursue negotiated solutions rather than immediate divestment. This provides opportunities for policy refinement and implementation modifications that could optimise outcomes for both government revenue and private sector participation.

The timeline for policy implementation and potential modifications will significantly influence investor confidence and capital allocation decisions across Zimbabwe's mining sector during the critical 2026 transition period.

Frequently Asked Questions

When Do the New Royalty Rates Take Effect?

The revised royalty structure is scheduled for implementation in 2026, though specific effective dates within the year remain undefined in available public communications. Mining companies are currently assessing implications and may seek clarification on transitional arrangements for existing operations and projects under development.

How Does the 10% Rate Compare Globally?

Zimbabwe's 10% maximum royalty rate positions the country among the higher-taxation mining jurisdictions globally, particularly when compared to other gold-producing regions. Most established mining jurisdictions maintain royalty rates between 2-7%, making Zimbabwe's threshold-triggered 10% rate relatively aggressive in international comparison.

Can Existing Projects Negotiate Grandfathering Provisions?

Grandfathering arrangements remain subject to negotiation between mining companies and Zimbabwean authorities. Companies with long-standing operations and substantial prior investments may seek transitional provisions, though no official policy regarding exemptions or phase-in schedules has been announced.

What Happens to Projects Already Under Development?

Development-stage projects face the greatest uncertainty, as they lack existing production cash flows to absorb increased royalty obligations. Projects like Bilboes require comprehensive economic reassessment under the new fiscal framework, potentially affecting financing structures, development timelines, and ultimate investment decisions.

Ready to Discover the Next Major Mining Investment Opportunity?

Discovery Alert's proprietary Discovery IQ model delivers instant notifications on significant ASX mineral discoveries, helping investors identify actionable opportunities before broader market awareness. With historic discoveries like De Grey Mining and WA1 Resources generating substantial returns, explore Discovery Alert's dedicated discoveries page to understand why timing matters in mining investments, then begin your 30-day free trial today to gain a market-leading edge.