The Evolution of Mining Sector Portfolio Optimization Strategies

Mining companies face unprecedented pressure to maximize shareholder value through strategic asset allocation in an era of heightened geopolitical risk and capital market fragmentation. The recent trend toward corporate restructuring in the gold mining sector, exemplified by the Barrick Gold assets spin-off consideration, reflects broader institutional investor preferences for focused, jurisdiction-specific investment opportunities that offer clearer risk-adjusted return profiles.

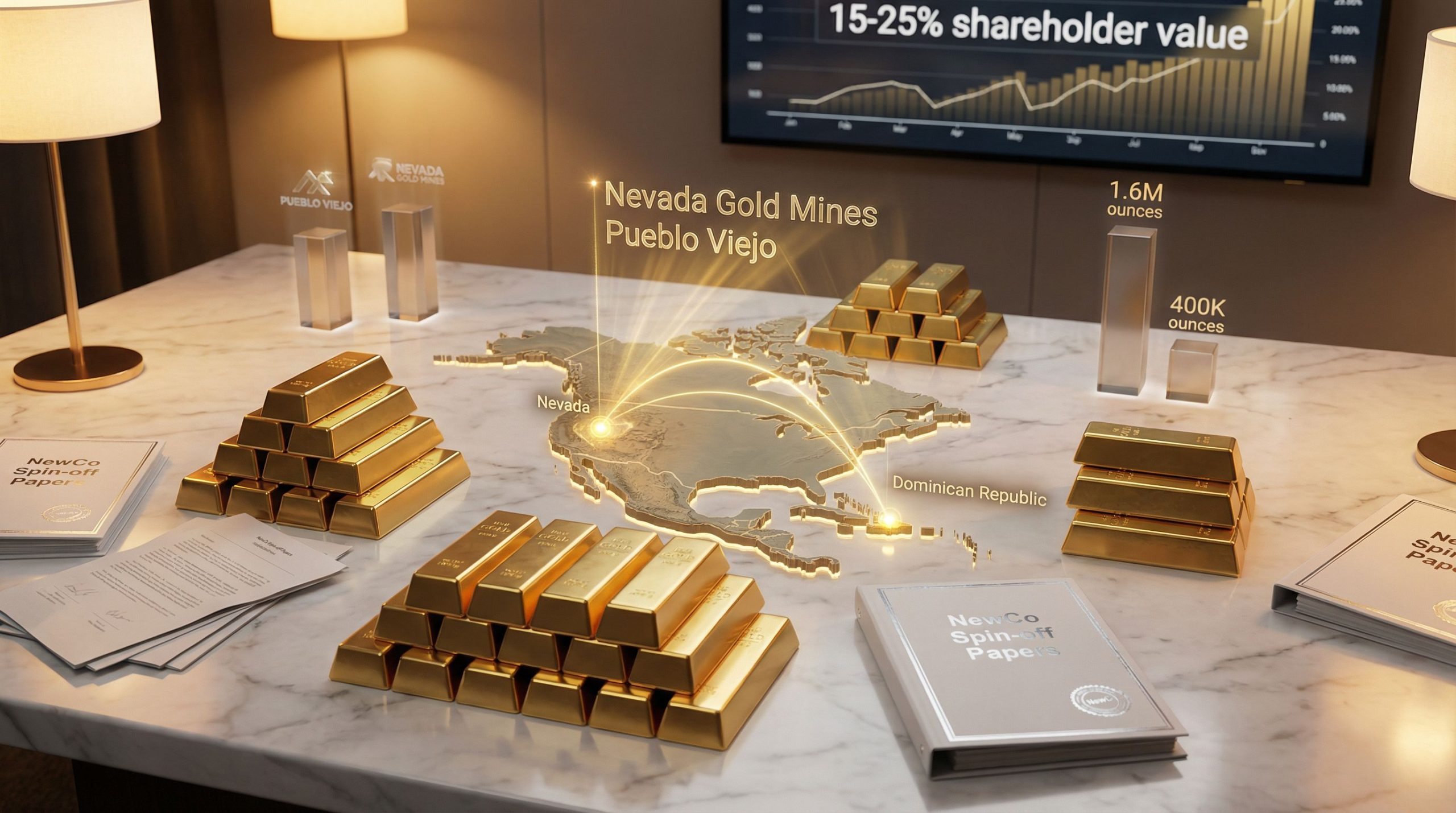

Portfolio theory suggests that conglomerate discounts in the mining sector often exceed 15-25% when companies operate across multiple jurisdictions with varying risk premiums. This valuation gap creates compelling incentives for management teams to pursue separation strategies that can unlock substantial shareholder value through improved market efficiency and enhanced capital allocation flexibility.

Understanding Strategic Asset Separation in Large-Scale Mining Operations

The Mechanics of Corporate Restructuring in Gold Production

Large mining conglomerates increasingly recognise that their sum-of-parts valuations significantly exceed their current market capitalisations, particularly when tier-one jurisdictional assets trade alongside higher-risk international operations. Furthermore, the proposed separation structure involves creating a distinct entity housing North American gold production assets.

The Barrick Gold assets spin-off consideration represents a sophisticated approach to addressing this persistent valuation discount. This NewCo structure would maintain Barrick's majority control while offering public market access to a focused portfolio of premium jurisdictional assets, including the Nevada Gold Mines joint venture, Pueblo Viejo operations in the Dominican Republic, and the Fourmile development project.

Key operational considerations for such restructuring include:

- Joint venture partner consent requirements across existing partnerships

- Regulatory approval processes spanning multiple jurisdictions

- Complex debt allocation between separated entities

- Shared service arrangement transitions

- Management structure duplication costs

Timeline and Implementation Framework Analysis

Industry precedent suggests that major mining sector separations typically require 18-24 months for complete execution, with initial announcement-to-completion timelines extending through 2025-2026 implementation phases. The complexity increases significantly when joint venture assets require partner approval and regulatory clearance across international boundaries.

Market timing considerations become critical, as commodity price volatility can substantially impact valuation multiples during extended transaction periods. However, given the current historic gold surge, optimal market conditions exist for equity offerings and strategic transactions.

What Drives Mining Companies Toward Geographic Asset Segmentation?

Jurisdictional Risk Premium Valuation Models

Sophisticated institutional investors increasingly demand clear differentiation between mining assets based on political stability, regulatory predictability, and operational security factors. Consequently, these preferences translate directly into measurable valuation premiums that create powerful incentives for corporate restructuring.

| Geographic Region | Typical EBITDA Multiple | Risk Premium Factor | ESG Compliance Rating |

|---|---|---|---|

| North American Assets | 15-18x | Low (1.0-1.2x) | AAA to AA |

| African Operations | 8-12x | High (1.8-2.5x) | BB to B |

| Latin American Projects | 10-14x | Medium (1.4-1.8x) | A to BBB |

| Australian/Oceania | 14-17x | Low (1.1-1.4x) | AA to A |

Market Efficiency Theory in Resource Sector Applications

Pure-play investment strategies enable portfolio managers to construct precise geographic and commodity exposure allocations without accepting unwanted risk characteristics from diversified mining conglomerates. This specialisation demand particularly affects pension funds and sovereign wealth entities with specific ESG mandates.

The Barrick Gold assets spin-off strategy directly addresses these institutional preferences by creating focused investment vehicles that align with modern portfolio construction methodologies. In addition, pension funds managing $45+ trillion globally increasingly favour specialised exposure over diversified mining platforms.

Activist Investor Influence on Corporate Strategy Evolution

Sophisticated activist investors recognise the substantial value creation potential inherent in mining sector restructuring initiatives. For instance, Elliott Management's strategic positioning within major gold producers exemplifies how specialised investment firms drive corporate transformation through targeted engagement strategies.

Historical analysis demonstrates that activist-influenced mining restructurings generate average shareholder returns of 22-35% within 18 months of completion, significantly outperforming sector benchmarks during comparable periods. These returns primarily derive from multiple expansion rather than operational improvement initiatives.

How Mining Spin-Offs Create Measurable Shareholder Value

Valuation Gap Analysis Through Sum-of-Parts Methodology

Mining companies trading below their theoretical sum-of-parts valuations create systematic opportunities for value realisation through strategic separation initiatives. The magnitude of these valuation gaps often exceeds the transaction costs and ongoing operational complexity associated with maintaining separate corporate entities.

Furthermore, the current record-high gold prices environment provides an optimal backdrop for unlocking these valuations.

"Mining companies executing successful jurisdictional separations typically unlock 15-25% shareholder value premiums, particularly when isolating tier-one assets from higher-risk international operations across multiple regulatory environments."

Capital Allocation Efficiency Enhancement Models

Focused management attention on geographically concentrated assets enables more sophisticated operational optimisation and strategic decision-making processes. This specialisation particularly benefits complex joint venture arrangements where partner coordination requires extensive management bandwidth.

The Nevada Gold Mines joint venture structure exemplifies how focused management attention can optimise production efficiency across multiple mine sites within a concentrated geographic region. Operational synergies become more achievable when management teams concentrate exclusively on specific jurisdictional frameworks.

Key efficiency improvements include:

- Streamlined regulatory compliance across unified jurisdictions

- Enhanced supply chain optimisation within geographic clusters

- Improved labour relations through regional specialisation

- Accelerated permitting processes via focused government relations

- Optimised capital deployment across proximate operations

Market Multiple Expansion Scenarios and Benchmark Effects

S&P 500 inclusion benefits create substantial passive fund flows for companies achieving sufficient market capitalisation thresholds through strategic combinations or focused growth strategies. These index inclusion effects generate measurable alpha beyond fundamental operational improvements.

Benchmark weighting adjustments across major mining indices can redirect billions in passive fund flows, particularly when restructured entities achieve enhanced ESG ratings or jurisdictional risk profiles. The Barrick Gold assets spin-off could position resulting entities for favourable index treatment across multiple benchmark categories.

Strategic Acquirer Positioning Analysis for Premium Mining Assets

Newmont Corporation's Natural Strategic Advantages

Newmont Corporation represents the most logical strategic acquirer for separated North American gold assets due to existing operational relationships and proven integration capabilities across similar jurisdictional profiles. The company's Nevada Gold Mines partnership already demonstrates successful joint venture management.

Operational synergy potential includes:

- Shared processing infrastructure optimisation across Nevada operations

- Combined exploration programmes leveraging geological expertise

- Integrated supply chain management reducing operational costs

- Unified environmental and safety protocol implementation

- Consolidated government and community relations programmes

Scale economics become particularly compelling when considering that Newmont's current production profile of approximately 6 million ounces annually could expand by 33-50% through strategic acquisition of separated Barrick Gold assets. This growth magnitude cannot be achieved through organic development or smaller acquisition opportunities.

Alternative Strategic Acquirer Assessment

Agnico Eagle Mines maintains a complementary risk profile focused on tier-one jurisdictions, making separated North American assets strategically attractive despite potential integration complexity. The company's proven track record in Canadian and U.S. operations provides relevant operational expertise.

Kinross Gold represents another potential acquirer, though their current portfolio concentration in Russia and West Africa creates strategic misalignment with premium North American asset acquisition strategies. Their financial capacity remains constrained relative to transaction scale requirements.

Private Equity and Sovereign Wealth Fund Interest Assessment

Infrastructure-focused private equity funds increasingly target stable cash-generating mining assets in tier-one jurisdictions, particularly when operations demonstrate predictable production profiles and limited expansion capital requirements. The Pueblo Viejo mine's consistent production history aligns with these investment criteria.

Government pension funds managing $2+ trillion in assets actively seek direct exposure to strategic mineral production, especially within allied nation jurisdictions. Canadian and Australian sovereign wealth entities have demonstrated particular interest in North American gold production assets.

Financial Implications and Production Analysis for Market Participants

Production Volume and Revenue Projection Framework

Nevada Gold Mines contributes approximately 1.6 million ounces annually to Barrick's attributable production, representing nearly 40% of the company's total gold output. This production scale provides substantial standalone viability for separated entity operations.

| Asset Portfolio | Annual Gold Production | Estimated Life of Mine | All-in Sustaining Costs |

|---|---|---|---|

| Nevada Gold Mines (Barrick portion) | 1.6M ounces | 15+ years | $950-1,050/oz |

| Pueblo Viejo Operations | 400K ounces | 8-10 years | $750-850/oz |

| Fourmile Development Potential | 300-500K ounces | 12-15 years | $800-900/oz |

| Combined Portfolio Total | 2.3-2.5M ounces | Various | $875-975/oz |

Enterprise Value Distribution and Transaction Metrics

Current market conditions suggest North American gold mining assets command enterprise value multiples of $20,000-25,000 per annual ounce of production, significantly exceeding African or South American comparable transactions. This premium reflects jurisdictional stability, regulatory predictability, and operational security factors.

Barrick Gold assets spin-off valuation estimates range from $45-60 billion for the complete North American portfolio, representing approximately 50-60% of current combined entity enterprise value. This concentration reflects the substantial premium assigned to tier-one jurisdictional assets.

Debt allocation strategies become critical for maintaining optimal capital structures across separated entities. Industry practice suggests allocating debt based on cash flow generation capacity rather than asset book values, ensuring sustainable leverage ratios for both entities.

Dividend Policy Restructuring and Cash Flow Optimisation

Separated entities typically implement dividend policies reflecting their specific cash flow characteristics and growth capital requirements. North American operations generally support higher payout ratios due to lower reinvestment needs and more predictable cash flows.

The Fourmile development project requires substantial capital investment over 3-5 years, potentially constraining initial dividend distributions until production stabilises. This development timeline influences optimal transaction structuring and investor communication strategies.

Historical Precedent Analysis for Mining Sector Restructurings

Major Mining Separation Case Studies

BHP Billiton's petroleum asset separation in 2021 provides relevant precedent for large-scale resource sector restructuring, demonstrating how focused entities can achieve superior market valuations compared to diversified predecessors. The separation created Woodside Petroleum with enhanced strategic flexibility.

Rio Tinto's aluminium business divestiture patterns illustrate systematic approaches to portfolio optimisation, focusing management attention on higher-return iron ore and copper operations while enabling specialised aluminium operators to optimise asset performance.

Anglo American's recent portfolio optimisation initiatives demonstrate how activist investor pressure catalyses strategic transformation, resulting in improved operational focus and enhanced shareholder returns through systematic asset portfolio refinement.

Success Metrics for Mining Industry Spin-Offs

Successful mining sector separations typically achieve the following performance benchmarks within 12-18 months of completion:

- 20%+ valuation premium relative to pre-separation trading multiples

- Improved operational focus resulting in 5-10% cost reduction achievements

- Enhanced capital market access through specialised investor base development

- Clearer investment thesis enabling premium institutional investor participation

Companies failing to achieve these benchmarks often face pressure for additional strategic alternatives, including complete acquisition by specialised operators or further portfolio rationalisation initiatives.

Execution Risk Assessment and Potential Transaction Impediments

Regulatory Approval Complexity Analysis

Multi-jurisdictional regulatory frameworks create substantial execution complexity for large-scale mining sector restructurings, particularly when joint venture assets require partner consent across international boundaries. The Nevada Gold Mines structure involves both U.S. federal and Nevada state regulatory oversight.

Dominican Republic mining regulations require government approval for significant ownership changes in major mining operations, potentially extending transaction timelines beyond initial projections. These requirements can create material execution risk for complex separation strategies.

Joint Venture Partner Dynamics and Consent Requirements

Newmont Corporation's existing partnership in Nevada Gold Mines creates both opportunity and complexity for potential separation transactions. Their consent requirements could either facilitate strategic acquisition opportunities or constrain alternative transaction structures.

The Pueblo Viejo joint venture with Goldcorp (now part of Newmont) similarly requires partner approval for significant structural changes, creating additional coordination complexity for separation execution.

Market Timing and Commodity Price Volatility Considerations

Given the current gold market outlook, gold price volatility during extended transaction periods can substantially impact final valuation multiples and transaction attractiveness for all parties. Historical analysis suggests optimal execution windows during periods of stable or rising gold prices.

Current market conditions with gold trading above $2,000/ounce provide favourable backdrop for mining asset valuations, though potential Federal Reserve policy changes could impact precious metals pricing during transaction execution periods. The gold price forecast suggests continued upward momentum supports strategic transaction timing.

Investment Strategy Framework for Portfolio Managers

Risk-Adjusted Return Optimisation Through Geographic Specialisation

Portfolio managers increasingly recognise that geographic concentration in tier-one mining jurisdictions provides superior risk-adjusted returns compared to diversified international exposure across varying political and regulatory environments. This preference drives demand for specialised mining investment opportunities.

Currency exposure management becomes simplified when mining operations concentrate within single currency zones, reducing hedging complexity and improving cash flow predictability for institutional investors with specific currency mandates.

Sector Rotation Timing and Federal Reserve Policy Impact

Gold mining equities typically outperform during periods of monetary policy accommodation, creating strategic opportunities for tactical allocation increases during Federal Reserve easing cycles. The Barrick Gold assets spin-off timing coincides with potential policy pivot points.

For instance, understanding the gold-stock market guide reveals seasonal patterns in precious metals markets that suggest optimal entry points during Q4 and Q1 periods, when physical demand typically increases and speculative positioning creates favourable technical momentum for mining equity performance.

ESG Integration and Modern Portfolio Construction

Environmental, Social, and Governance considerations increasingly influence institutional investment decisions, particularly for pension funds and sovereign wealth entities with specific sustainability mandates. Tier-one jurisdictional assets typically demonstrate superior ESG compliance profiles.

Governance structure improvements through corporate separation can enhance ESG ratings and expand eligible investor universe, particularly among European pension funds with strict sustainability investment criteria requiring board independence and operational transparency.

Technology Integration and Mining Sector Transformation Trends

Automation Adoption Rates Across Different Jurisdictions

North American mining operations demonstrate accelerated automation implementation compared to international operations, reflecting regulatory support, skilled labour availability, and capital investment capacity. This technological advantage supports premium valuation multiples for separated assets.

Digital twin technology deployment enables sophisticated operational optimisation across proximate mine sites, creating synergistic benefits when management focuses exclusively on geographically concentrated assets rather than globally dispersed operations.

Sustainability Technology and Operational Efficiency Enhancement

Carbon reduction initiatives become more achievable when mining companies concentrate operations within unified regulatory frameworks supporting renewable energy adoption and emissions reduction technologies. Nevada's renewable energy infrastructure provides strategic advantages for mining operations.

Water management systems require jurisdiction-specific expertise and regulatory compliance capabilities that benefit from focused management attention and specialised operational teams concentrated on regional environmental challenges.

Supply Chain Resilience and Strategic Resource Security

Near-Shoring Preferences in Critical Mineral Production

Government policy initiatives increasingly favour domestic and allied nation mineral production capabilities, creating structural demand for North American mining operations independent of traditional commodity market dynamics. This trend supports premium valuations for separated jurisdictional assets.

Strategic stockpile policies implemented by major economies create additional demand sources for tier-one jurisdictional production, providing revenue stability and reduced market volatility compared to international operations subject to trade relationship fluctuations.

Trade Relationship Stability and Long-Term Investment Security

Political risk assessment becomes increasingly important for international mining operations, while North American assets benefit from stable regulatory frameworks and predictable trade relationships that support long-term capital investment planning and strategic development initiatives.

However, recent reports suggest that specific claims regarding current Barrick Gold management statements require official company filings and independent financial analysis for investment decisions.

The evolving landscape of mining sector portfolio optimisation reflects broader institutional investor preferences for focused, specialised investment opportunities that offer clear risk-return profiles and enhanced operational efficiency through geographic concentration and regulatory specialisation.

What Opportunities Await in Mining Discovery Alerts?

Discovery Alert delivers instant notifications on significant ASX mineral discoveries using its proprietary Discovery IQ model, transforming complex mining announcements into actionable investment insights for both short-term traders and long-term investors. Explore how major mineral discoveries have historically generated substantial returns by visiting Discovery Alert's discoveries page and begin your 30-day free trial today to position yourself ahead of the market.