How Tasmania Is Reshaping Australia's Critical Minerals Future

The global race for supply chain independence has created unprecedented opportunities across remote geological provinces where decades-old deposits suddenly command strategic importance. Australia's island state Tasmania emerges as rare earths hub through the convergence of exceptional geological endowments and advanced processing technologies, where heavy rare earth concentrations previously overlooked are now positioning the region as a cornerstone of Western critical minerals strategy.

Unlike conventional rare earth operations requiring extensive crushing and aggressive chemical processing, Tasmania's unique ionic adsorption clay deposits enable environmentally sustainable extraction methodologies through benign leaching processes. This fundamental geological advantage, combined with proximity to established shipping infrastructure and stable regulatory frameworks, creates operational cost benefits whilst reducing environmental impact compared to traditional hard rock rare earth developments.

The convergence of exceptional dysprosium and terbium concentrations with accelerated development timelines positions Tasmania as a critical component in reducing Western dependence on Chinese-controlled supply chains for permanent magnet manufacturing.

The Geological Advantages Behind Tasmania's Rare Earth Revolution

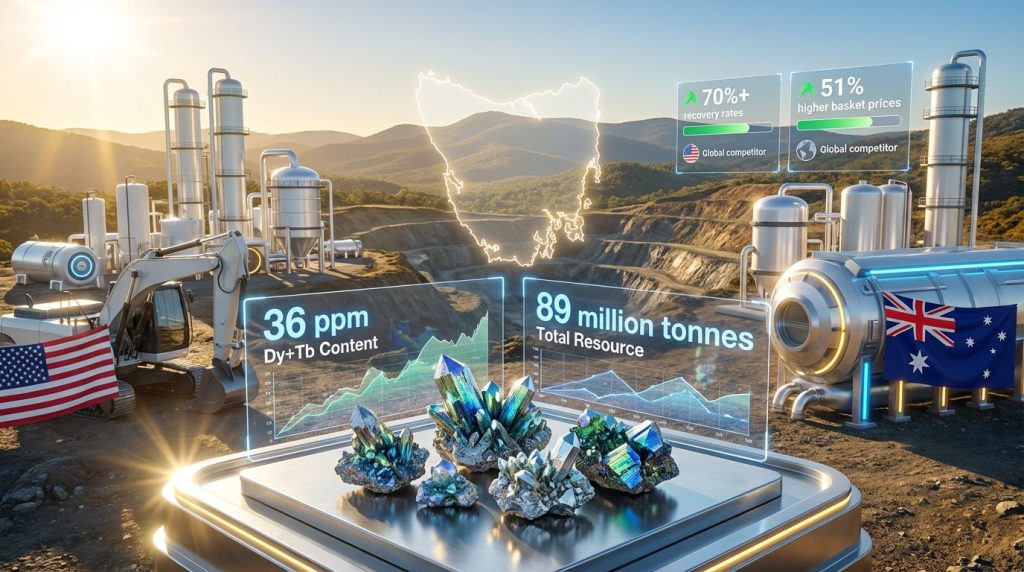

Recent geological assessments across Tasmanian prospects have revealed dysprosium and terbium concentrations reaching unprecedented levels within Australian ionic clay systems. ABx Group's Deep Leads project demonstrates this potential through maiden mixed rare earth carbonate (MREC) production containing 4% dysprosium and 0.7% terbium as percentages of total rare earth oxides.

These concentrations represent 2.8 to 4.7 times higher heavy rare earth content compared to peer operations outside China, according to analysis published in Australian Mining. The calculated basket price for Tasmania's MREC yields up to 51% premium over competitor products due to superior heavy rare earth ratios.

Resource Scale and Quality Metrics

| Parameter | Deep Leads Project | Global Average (Ionic Clay) |

|---|---|---|

| Total Resource Estimate | 89 million tonnes | 15-40 million tonnes |

| TREO Grade | 844 ppm | 500-700 ppm |

| Dysprosium + Terbium | High concentration | 8-15 ppm typical |

| Processing Recovery | 70%+ (Dy/Tb) | 45-60% standard |

The Deep Leads mineralisation extends across a 6.5-kilometre continuous channel system with thickness exceeding 20 metres, occurring within 50 metres of surface. This shallow, laterally extensive geometry enables low-cost open-pit extraction scenarios without deep mining infrastructure requirements.

Strategic Element Concentrations

Dysprosium and terbium command premium pricing between $400-1,000 per kilogram, representing 10-20 times the value of light rare earth elements such as cerium or lanthanum. These elements enhance magnet coercivity in neodymium-iron-boron permanent magnets, enabling operation at elevated temperatures required in electric vehicle powertrains, wind turbine generators, and advanced defence systems.

Mark Cooksey, ABx Group's Managing Director and CEO, emphasised the strategic significance of Tasmania's low radioactive element content, stating "the MREC product would be particularly sought after by customers seeking high dysprosium-terbium ratios and low uranium-thorium concentrations."

Advanced Processing Technologies Driving Competitive Advantages

Tasmania's ionic adsorption clay deposits enable processing methodologies fundamentally different from conventional hard rock rare earth operations. Partnership validation with the Australian Nuclear Science and Technology Organisation (ANSTO) has demonstrated extraction capabilities achieving in-situ leaching benefits through advanced methodologies:

- 70%+ recovery rates for dysprosium and terbium

- 50-75% overall rare earth extraction efficiency

- Minimal radioactive waste generation compared to hard rock operations

- Reduced chemical reagent consumption through benign leaching processes

Ionic Clay Processing Methodology

The high ionic proportion of Tasmanian deposits enables processing at elevated pH levels using ammonium sulfate or ammonium chloride solutions rather than aggressive acid leaching required by bastnaesite or monazite operations. This processing approach provides several advantages:

Environmental Benefits:

- Eliminates need for extensive crushing and flotation circuits

- Enables comprehensive water recycling systems

- Generates minimal solid tailings requiring disposal

- Reduces chemical waste through direct precipitation methodologies

Operational Advantages:

- Lower capital equipment costs by 30-40% compared to hard rock facilities

- Reduced energy consumption during ore preparation phases

- Simplified regulatory approval processes due to lower environmental impact

- Enhanced worker safety protocols with reduced acid handling requirements

Radioactive Element Management

Tasmania's rare earth deposits contain significantly lower uranium and thorium concentrations compared to global peers, creating strategic advantages for downstream customers. Furthermore, lower radioactive element burden reduces radiation safety monitoring requirements, waste classification costs, and worker exposure protocols during processing operations.

International Partnership Development and Supply Security

The strategic importance of heavy rare earth supply diversification has accelerated international partnership discussions as Western nations seek alternatives to Chinese-dominated supply chains. Current global rare earth supply concentrates 70% of mining and 85% of processing capacity in China, with 90-99% of heavy rare earth production under Chinese control.

ABx Group has established collaboration frameworks with Ucore Rare Metals to create direct supply channels to North American markets. Tasmania emerges as rare earths hub partly because the region's democratic governance structure and Five Eyes intelligence alliance membership provides supply security guarantees unavailable from alternative rare earth sources.

Premium Product Specifications

Tasmania's mixed rare earth carbonate products demonstrate superior heavy rare earth ratios compared to existing non-Chinese sources. The exceptional dysprosium and terbium content addresses critical supply vulnerabilities for:

Defence Applications:

- Guided weapons systems requiring high-temperature magnet operation

- Satellite systems demanding radiation-resistant permanent magnets

- Naval propulsion systems with extended operational requirements

Clean Energy Infrastructure:

- Electric vehicle motors requiring enhanced thermal stability

- Wind turbine generators operating in extreme environmental conditions

- Grid-scale energy storage systems with permanent magnet components

Development Timeline Analysis and Production Projections

Tasmania's shallow, surface-accessible mineralisation enables accelerated development schedules compared to conventional rare earth projects requiring deep mining infrastructure. In addition, the absence of significant radioactive elements streamlines environmental approval processes typically extending project timelines.

Comparative Development Velocity

| Development Phase | Tasmania (Projected) | Global Hard Rock Average |

|---|---|---|

| Resource to Pilot Plant | 2-3 years | 3-5 years |

| Pilot to Commercial | 3-4 years | 5-7 years |

| Total Timeline | 5-7 years | 8-12 years |

Key Acceleration Factors:

- Shallow open-pit mining eliminates underground development requirements

- Benign processing chemistry simplifies environmental impact assessments

- Existing port infrastructure reduces capital expenditure for product transport

- Established mining service networks in Tasmania provide skilled workforce access

Near-Term Production Milestones

Current development progress indicates sample production capabilities achieved in Q4 2025, with resource expansion drilling planned across the 6.5-kilometre mineralised channel throughout 2026. Process optimisation through pilot plant construction and testing phases target 2026-2027 completion, positioning commercial production commencement for 2028-2029.

Economic Drivers and Investment Attractiveness

Heavy rare earth premium pricing creates substantial revenue advantages for Tasmania's development compared to light rare earth-dominated operations. Dysprosium and terbium historically trade at 10-20 times the value of light rare earth elements, with pricing ranges between $400-1,000 per kilogram driven by supply scarcity and defence applications demand.

Infrastructure Cost Advantages

Tasmania's established mining infrastructure provides capital expenditure advantages over remote rare earth developments. Existing port facilities at Burnie and Devonport enable direct shipping access to Asian processing hubs and North American markets without extensive transportation infrastructure development.

Operational Cost Comparisons:

- Hard rock rare earth operations: $400-600 USD per tonne TREO processing cost

- Ionic clay operations: $150-300 USD per tonne TREO processing cost

- Tasmania's enhanced recovery of premium elements further improves unit economics

Market Demand Projections

Electric vehicle production targets of 30 million units annually by 2030 require substantial increases in permanent magnet manufacturing capacity. Similarly, wind turbine installations targeting 1,000 GW of global capacity by 2030 create additional dysprosium and terbium demand pressure, with current supply sources insufficient to meet projected requirements.

Industry Players Advancing Tasmania's Rare Earth Development

ABx Group leads Tasmania's rare earth advancement through the Deep Leads project, with confirmed resource estimates and validated processing methodologies developed through ANSTO collaboration. The company's partnership with Ucore Rare Metals establishes direct supply channels to North American defence and technology markets.

Emerging Exploration Activity

Venture Minerals has identified rare earth mineralisation at the Reward Tin Deposit, expanding Tasmania's rare earth province beyond the Deep Leads discovery. Cobra Resources advances the 213-square-kilometre Deloraine project through systematic exploration programmes targeting similar ionic clay mineralisation.

University of Tasmania partnerships with nine industry participants accelerate research and development initiatives, including metallurgical testing, environmental assessment, and processing optimisation studies. This collaborative framework enhances technical validation whilst reducing individual company development risks.

Supply Chain Integration Strategies

Tasmania's rare earth developers are pursuing vertical integration strategies to capture downstream processing value whilst ensuring supply chain security. Moreover, processing facility development within Tasmania would eliminate dependence on Chinese rare earth separation infrastructure while creating regional employment opportunities.

Addressing Global Supply Chain Vulnerabilities Through Tasmania

Current rare earth supply chain concentration creates systemic vulnerabilities for Western technology manufacturing and defence procurement. China's control over 85% of global processing capacity enables supply disruption scenarios that could impact electric vehicle production, renewable energy infrastructure, and defence systems manufacturing.

Technology Security Implications

Electric vehicle manufacturers including Tesla, Ford, and General Motors require guaranteed access to dysprosium and terbium for permanent magnet motor production. Wind turbine producers such as Vestas, General Electric, and Siemens Gamesa similarly depend on secure heavy rare earth supplies for generator manufacturing.

Defence Contractor Dependencies:

- Lockheed Martin guided weapons systems requiring high-temperature magnets

- Raytheon satellite systems demanding radiation-resistant permanent magnets

- Boeing aerospace applications with extended operational requirements

- Naval propulsion systems requiring enhanced thermal stability

Geopolitical Risk Mitigation

Tasmania's development creates the first significant non-Chinese heavy rare earth source since the 1990s closure of alternative global operations. Democratic governance and allied nation status provide supply security guarantees essential for Western technology manufacturing and defence applications.

Trade tensions between Western nations and China could accelerate demand for alternative rare earth sources, with Tasmania emerges as rare earths hub through strategic positioning enabling rapid scaling to meet emergency supply requirements through accelerated development timelines.

Environmental Sustainability and Regulatory Advantages

Ionic adsorption clay processing eliminates environmental challenges associated with hard rock rare earth operations, including extensive crushing, grinding, and flotation requirements. The benign chemical extraction process generates minimal solid waste whilst enabling comprehensive water recycling systems.

Sustainable Extraction Methodologies

The mining sustainability transformation in Tasmania demonstrates several key advantages:

Water Management:

- Comprehensive recycling capability reduces freshwater consumption to 1-2 cubic metres per tonne TREO

- Closed-loop processing systems minimise environmental discharge requirements

- Reduced chemical waste generation through direct precipitation processes

Waste Minimisation:

- Spent clay materials suitable for return to extraction areas without extensive treatment

- Elimination of flotation reagents reduces chemical waste streams

- Lower tailings storage infrastructure requirements compared to hard rock operations

Radioactive Impact Reduction

Tasmania's rare earth deposits contain significantly lower uranium and thorium concentrations compared to global peers including Mountain Pass (USA), Lynas Mount Weld (Australia), and various Chinese operations. Consequently, this reduces radioactive waste management requirements and environmental monitoring obligations throughout the operational lifecycle.

Future Scenarios Accelerating Tasmania's Strategic Importance

Multiple demand scenarios could accelerate Tasmania's development timeline through enhanced financing availability and customer commitment to long-term supply agreements. Government-backed financing initiatives, including the Australian Critical Minerals Facility and international development bank participation, could reduce capital costs whilst enhancing project financing accessibility.

Technology Demand Growth Trajectories

Electric Vehicle Expansion:

- Global EV sales targeting 30% of total vehicle production by 2030

- Each electric vehicle requires 2-5 kilograms of permanent magnet materials

- Dysprosium and terbium comprise 5-15% of magnet weight depending on performance specifications

Renewable Energy Infrastructure:

- Offshore wind capacity targeting 500 GW globally by 2030

- Each MW of wind capacity requires 150-600 kilograms of permanent magnet materials

- Heavy rare earth content varies by generator design and operational requirements

Supply Disruption Risk Scenarios

Potential trade restrictions or export quotas from Chinese rare earth producers could create immediate supply shortages for Western manufacturers. Tasmania's rapid development capability positions the region to address emergency supply requirements through accelerated production timelines.

Critical Supply Points:

- Defence contractor stockpile requirements for strategic materials

- Automotive manufacturer production continuity during supply disruptions

- Renewable energy project completion schedules dependent on component availability

Investment Capital Mobilisation

International recognition of rare earth supply security importance has mobilised government and institutional capital toward alternative source development. Australia's Critical Minerals Facility, combined with US Defense Production Act authorities and European Union strategic autonomy initiatives, creates financing frameworks supporting accelerated development timelines.

The critical minerals energy transition requires substantial investment in alternative supply sources to ensure Western technological sovereignty. Furthermore, mining industry innovation continues to drive cost reductions and processing efficiency improvements across Tasmania's developing rare earth operations.

Tasmania emerges as rare earths hub through the convergence of exceptional geological endowments, advanced processing technologies, and strategic geopolitical positioning. The island state's ionic clay deposits provide Western nations with their first significant alternative to Chinese-controlled heavy rare earth supplies, supporting clean energy infrastructure and defence technology manufacturing requirements essential for technological sovereignty.

Looking to Capitalise on Critical Minerals Opportunities?

Discovery Alert's proprietary Discovery IQ model delivers real-time alerts on significant ASX mineral discoveries, instantly empowering subscribers to identify actionable opportunities ahead of the broader market. Understand why major mineral discoveries can lead to substantial market returns by exploring Discovery Alert's dedicated discoveries page, showcasing historic examples of exceptional outcomes, and begin your 30-day free trial today to position yourself ahead of the market.